- ETH bulls attempted to push for a recovery rally but were faced with resistance near the $2,700 price level.

- As a result, investors are beginning to hesitate, increasing the risk of capitulation.

It’s been a week since Ethereum (ETH) began its recovery journey after its crash earlier this month. This has given the market ample time to test the waters and gauge momentum and demand.

So far, the cryptocurrency has struggled to break much above $2,700, indicating little demand above that price level.

Will ETH Capitulate in the Face of Price Drop?

ETH was priced at $2,649 at press time, down 2.61% in the last 24 hours. This result further reinforced the observed lack of demand, supported by market uncertainty.

Source: TradingView

The RSI remained below its 50% level, once again confirming the weakness of the bullish momentum. This trend was confirmed by reports earlier today, indicating that some institutions were now dumping some of their ETH.

For example, private venture capital firm BlockTower reportedly sold 9,232 ETH worth around $24.8 million in the past few hours.

While these results may suggest that the market is still hesitant and undecided, some offer some confidence.

For example, the percentage of ETH in smart contracts has been increasing and, at press time, was approaching 40%.

Source: Glassnode

The chart indicates that DeFi utility has gained traction, which should bode well for ETH demand.

In other words, organic demand has increased, but ETH’s suppressed price action appears to be a reflection of market sentiment rather than on-chain performance.

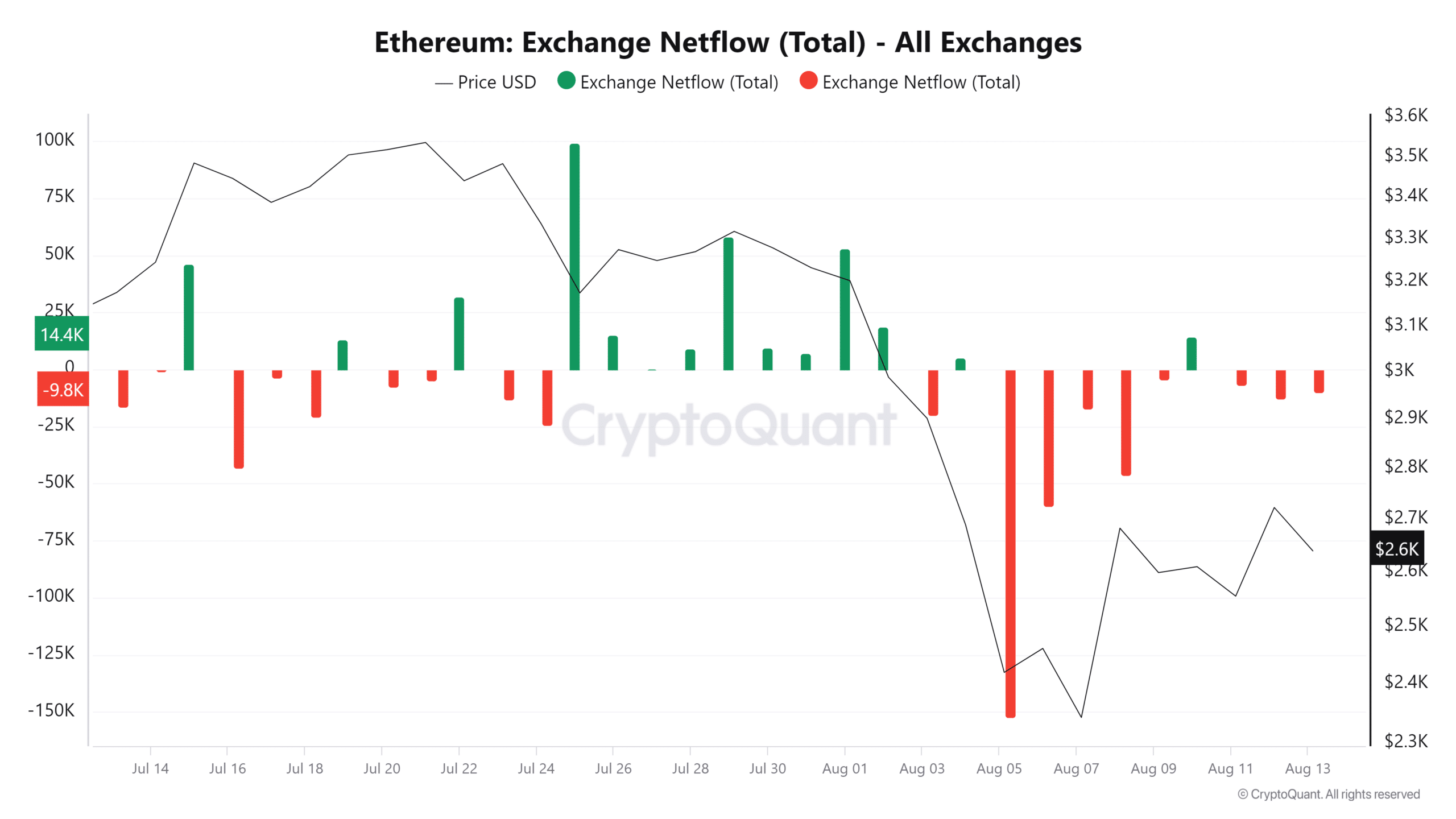

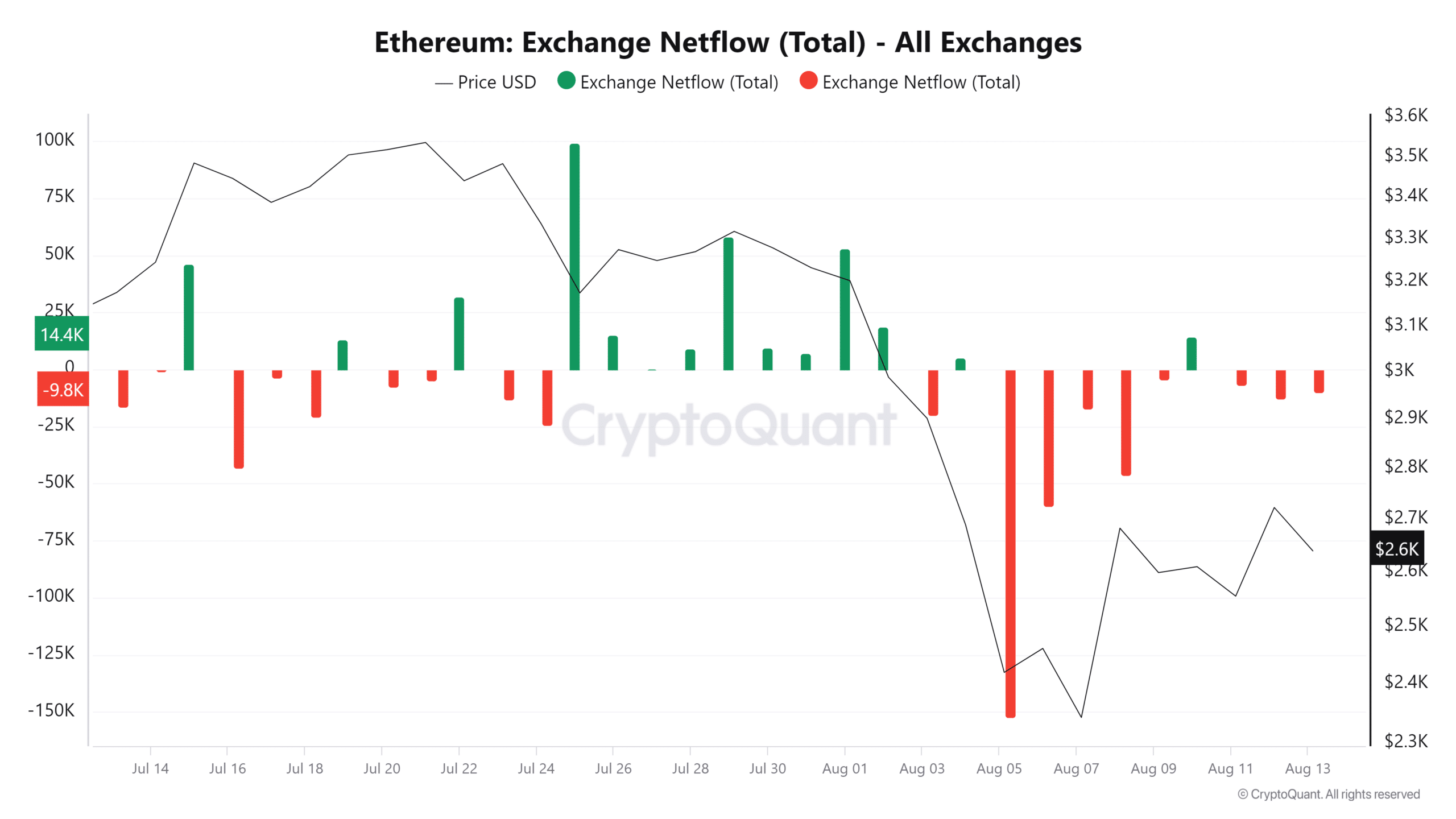

The impact of market sentiment is evident in ETH’s inflow data. The cryptocurrency’s net inflows have been mostly negative since the peak of the decline.

This means that the outflows were slightly higher than the inflows.

Source: CryptoQuant

Despite these observations, trade flows remain low, which corresponds to the state of uncertainty in the market. There is therefore always a risk that the market can be easily influenced in one direction or the other.

A decrease in fear in the market could trigger higher demand for ETH. However, the opposite will be true if the market remains fearful, perhaps paving the way for further capitulations in the days to come.

Read Ethereum (ETH) Price Prediction 2024-25

The Fear and Greed Index indicated a slight recovery from extreme fear over the past 48 hours.

If this rally continues, ETH bulls might finally have a chance to break above the current resistance and possibly reach 3,000 later this week.