Reason to trust

Strict editorial policy which focuses on precision, relevance and impartiality

Created by industry experts and meticulously revised

The highest standards in the declaration and publishing

Strict editorial policy which focuses on precision, relevance and impartiality

Morbi Pretium Leo and Nisl Aliquam Mollis. Quisque Arcu Lorem, quis pellentesque nec, ultlamcorper eu odio.

Este Artículo También is respondable in Español.

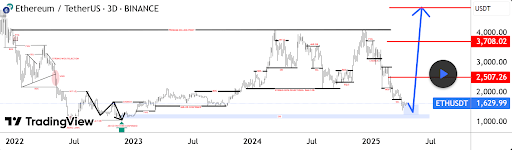

The action of Ethereum prices seems to prepare the ground for a major decision which could redefine its market trajectory by the end of 2025. Although the last months have seen the price of the cryptocurrency lose its base, a technical analysis shows that this phase could end. In particular, Ethereum is now negotiated near a level of support that could cause a rebound upwards Around $ 4,000 by the end of 2025.

A strong demand zone shows an Ethereum background

The action of Ethereum prices throughout 2025 has been down, marked by a series of structural breakdowns which have erased a large part of the bullish momentum postponed from the fourth quarter of 2024. Since December 2024, the cryptocurrency has slipped through a series of levels of key technical support, starting with the breakdown of a gap of fair value (FVG) near $ 3,700 at the start of the $ 3,700 January.

Related reading

This was followed by a critical choch (change of character) around $ 3,100 in February, signaling a final passage of the bullish feeling to the lowering feeling. The situation worsened in March, with Ethereum losing its structural support of $ 2,000 Nivel in the first week of the month, then passing a major liquidity pool at $ 1,700 by the end of March, which sparked a new accident until it has a background at $ 1,415 on April 9.

According to a TradingView analysisAll these movements pushed the Ethereum price to its lowest level of support, which could lead to a rebound. This level of support is around $ 1,629 on the 3 -day candlestick graph.

Looking at the 3 -day ETH / USDT graph, Ethereum found itself in this area with high demand marked by multiple liquidity scales and confirmations of previous control blocks in 2023. This area sparked a significant optimistic reversal in 2023, which finally led to a wave in the following year.

Three main targets on the path of $ 4,500

Now that Ethereum has rebounded around this block of orders, the following prospects are a rebound greater than $ 2,000 and beyond, the tradingView analyst particularly predicting a overvoltage at $ 4,500. According to TradingView’s analysis, there are three key levels of the price that Ethereum should reach its way to a new summit of all time around $ 4,500.

Related reading

The first target is around $ 2,507, a level which corresponds to a lowering control block which led to the rupture of the structure on March 2. The second level, at $ 3,708, marks a more prominent resistance and is seated around the difference of fair value which appeared in January. Finally, the ultimate goal is just for $ 4,500.

At the time of writing this document, Ethereum is negotiated at $ 1,795, up 10.7% in the last 24 hours and Piggybacking off bitcoin’s break Above $ 90,000.

Pixabay star image, tradingView.com graphic