German state-owned bank KfW has taken a major step by planning to launch blockchain-based digital bonds. This development is significant because it shows how traditional finance is starting to embrace cryptocurrency and blockchain technology.

This bold move could redefine the way we think about investments, safety and efficiency in financial markets.

Here’s more information about this exciting development.

KfW takes next step with blockchain

KfW has already issued a digital bond under the German Electronic Securities Act (eWpG). It is now going one step further by introducing a bond using blockchain technology. The move is part of the European Central Bank’s (ECB) trials to test the effectiveness of blockchain with central bank money. Gaetano Panno, who manages transactions at KfW, underlined the bank’s commitment to exploring new technologies and shaping the future of finance.

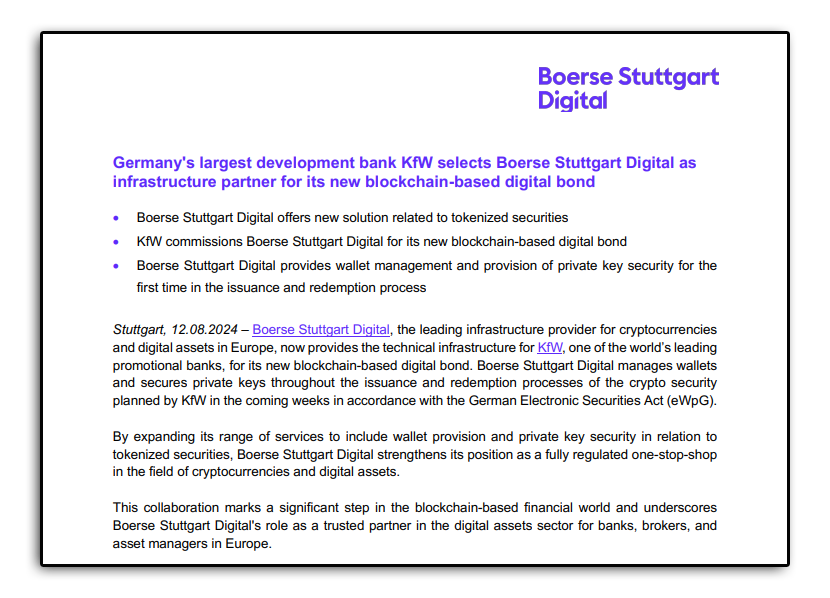

Teaming up with the right partners

To make this project a reality, KfW has partnered with Boerse Stuttgart Digital (BSD), a leader in the field of digital assets. BSD is responsible for managing the crypto wallets and securing the private keys throughout the process. Ulli Spankowski, CEO of BSD, sees this partnership as a major step in the digital transformation of finance.

KfW is not working alone. It has brought in major institutions such as DZ Bank, Deutsche Bank, LBBW and Bankhaus Metzler as co-lead managers. In addition, the Frankfurt-based fintech company Cashlink Technologies is responsible for registering the crypto assets. This collaboration underlines the importance of this project in the financial world.

What comes next?

The bond is expected to be worth at least €100 million ($108 million) and mature in December 2025. KfW isn’t the only bank experimenting with blockchain; big names like JPMorgan are also exploring the technology for bond issuance. If KfW’s initiative is successful, it could lead to broader adoption of blockchain in banking, making transactions faster, cheaper and easier to track.

A new era for finance

The financial industry as a whole is paying close attention to KfW’s progress. This project could mark the beginning of a new era in which blockchain will become an integral part of traditional finance, bringing significant changes to the sector.

Also read: Lost $93,494 in ETH because of a single mistake? It happened, and it could happen to you too!

With blockchain as its backbone, could it be the future of bond issuance? The whole world is watching.