The data on the chain show that the Bitcoin balance held by short -term holders has recently jumped. Here is what it could mean for the BTC price.

Bitcoin’s short -term holder’s offer recorded an increase

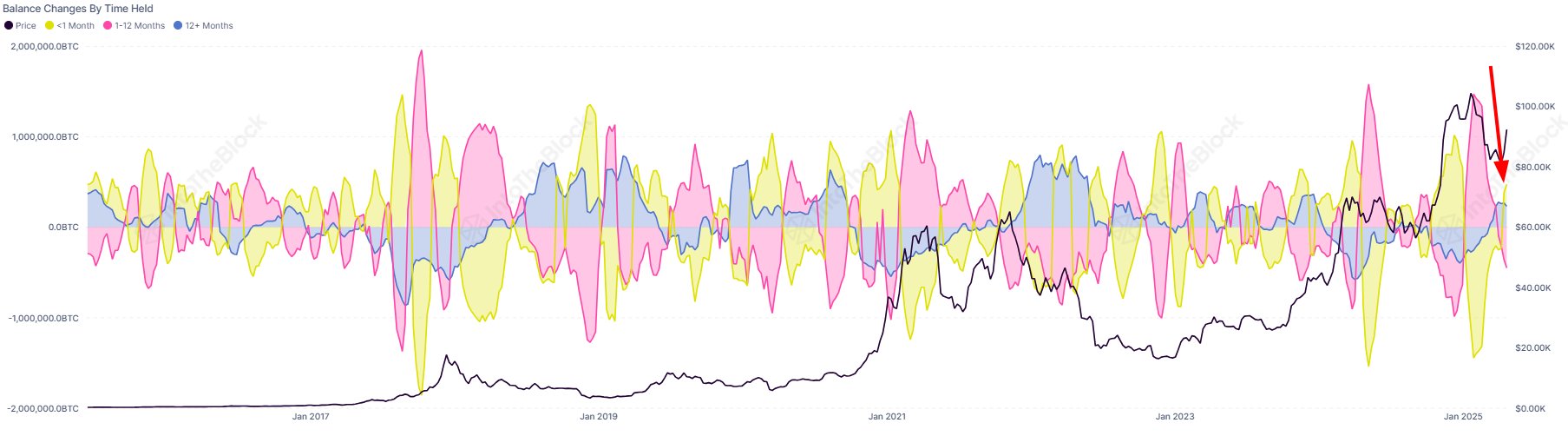

In a new article on X, the intelligence platform of the Intotheblock market explained how the different Bitcoin cohorts saw their diet recently changed. The groups in question were divided on the basis of the maintenance time.

The analysis company classifies investors in these groups: “traders” who bought their pieces in the past month, “cruisers” who did it between one and twelve months, and “hodlers” who have been holding for more than a year.

Generally, the more an investor keeps its parts, the less it is likely to sell them in the future. Thus, the resolution of the holder becomes stronger as merchants are passed to the Hodlers.

Now here is the graph shared by Intotheblock which shows the trend in the net change of balance held by each of these groups in the last decade:

Looks like the traders have seen a positive change in recent days | Source: IntoTheBlock on X

As displayed in the above graph, Bitcoin traders recently recorded a positive value on this metric, suggesting that the balance held by the group has increased. This increase in this cohort came while the BTC witnessed a price rally.

Whenever the offer of traders observes an increase, this means that members of one or two older cohorts broke their dormancy. Since the last wave coincided with an increase in the price of assets, it is possible that it is an indication of taking advantage of the market.

According to the graph, it is visible that the Hodlers have also seen a positive change recently, which implies that these diamond hands continue to hold firmly. This leaves the cruisers as the only group that can be responsible for the sale, and indeed, the change of negative balance would confirm this.

Cruisers are more resolved than merchants, but even they can be subject to the sale of panic because they have not entirely made the same trace as the Hodlers, so the last distribution of them may not be too surprising.

Although taking profits is not a positive sign for Bitcoin, the increase in trader’s supply could be examined from a more optimistic point of view: this could imply that there is a new demand that flows in the sector.

This was apparently the case during the rally which occurred in the last two months of 2024, where the change of offer of merchant increased high in the positive territory.

“If this influx persists, he supports the idea that the current movement is more than a rescue rally and could be the first step in a wider rise trend,” notes the analytical company.

BTC price

Bitcoin saw a decline less than $ 93,000 yesterday, but it seems that the play found an upward momentum because its price has now increased to $ 95,200.

The price of the coin seems to have shot up during the past day | Source: BTCUSDT on TradingView

Dall-E star image, intotheblock.com, tradingView.com graphic

Editorial process Because the bitcoinist is centered on the supply of in -depth, precise and impartial content. We confirm strict supply standards, and each page undergoes a diligent review by our team of high -level technology experts and experienced editors. This process guarantees the integrity, relevance and value of our content for our readers.