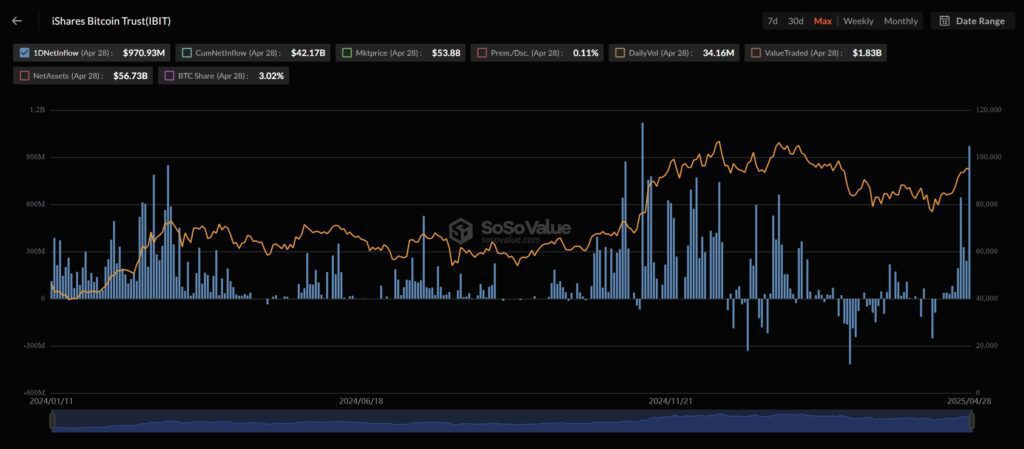

Blackrock has just reminded all those who are the boss in the Bitcoin ETF space. On April 28, 2025, his Ishares Bitcoin Trust (Ibit) quietly picked up a huge 970 million dollars in Bitcoin in one day.

This is the second influx for the fund, only behind the monster $ 1.12 billion he made last November. This also relates to the domination of BlackRock market share at more than 50% for Bitcoin ETF.

With this purchase, Ibit now has more than $ 56 billion in assets. To put this in perspective, this represents more than 3% of the total bitcoin offer. A fund, managed by the largest asset manager in the world, is sitting on enough BTC for even OG Crypto to increase an eyebrow.

Blackrock Bitcoin ETF: market dynamics and institutional interest

While BlackRock was busy taking care, most of the other FNB Bitcoin FNB of the US SPOT had flat flows or even outings on the same day. This contrast is difficult to ignore and raises the question: what do Blackrock see that others could miss?

Some analysts say everything comes down to timing and strategy. Large purchases like this are considered to provide structural support for Bitcoin. When someone like Blackrock makes a movement, it helps to put a floor under the price. This type of stability is gold to investors in a space known for wild oscillations.

The BlackRock FNB Bitcoin saw $ 970.9 million in yesterday’s entries

It is their greatest day of entries in the last 173 days. pic.twitter.com/kuqo2uzk1h

– Master of wealth by Lark Davis (@wealthmaster_) April 29, 2025

Samara Cohen, CIO DES ETF and index Investments in Blackrock, has recently sounded to say that most institutional customers are focused on Bitcoin laser right now. It makes sense. With uncertain markets of rates, inflation and global tension, Bitcoin begins to look more like a long -term game than a bet on the moon.

Bitcoin prices stability in the midst of market movements

Surprisingly, despite the billion dollars of Blackrock dollars, Bitcoin did not jump overnight. Instead, he remained stable at around $ 95,000. This kind of calm after a big purchase is a sign of the amount of market that the market has matured.

DISCOVER: The best new cryptocurrencies to invest in 2025

At the same time, other upper tokens like Ethereum and Cardano have also seen green. The wider market shows signs of confidence, even if no one is still organizing a party.

Look forward to

The latest BlackRock movement is not just a flex. It is a signal that institutional investors are there to stay and double the bitcoin even though others hesitate. The fact that this happened while the rivals were sitting motionless or saw outings say a lot.

Whether you are a long -term holder or just look at the touch, one thing is clear: Bitcoin ETF races heats up and BlackRock leads. The question is now who follows then and how speed the game changes.

DISCOVER: 20+ Next Crypto to explode in 2025

Join the 99Bitcoins News Discord here for the latest market updates

Key dishes to remember

-

Ishares Bitcoin Trust of Blackrock (IBIT) added $ 970 million in BTC on April 28, bringing its total assets to more than $ 56 billion, or more than 3% of the total Bitcoin offer.

-

This day’s influx was the second largest ever for Ibit, reporting continuous institutional trust in Bitcoin.

-

While most of the other American FNB Bitcoin FNB have seen flat or negative flows, the purchase of Blackrock stood out as a vote of trust in the middle of the uncertainty of the market.

-

Despite the massive purchase, the price of bitcoin remained stable around $ 95,000, reflecting the growing maturity of the market.

-

Blackrock’s aggressive accumulation positions him as a dominant force in Bitcoin ETF, giving the tone to other institutional players.

The post BlackRock now holds more than 3% of the Bitcoin via ETF power appeared first on 99Bitcoins.