The Glassnode chain analysis company has revealed in a report on how the sale pressure can see an increase in long -term Bitcoin holders around this price level.

The profit of the long -term holder Bitcoin will reach 350% at 99,900

In his latest weekly report, Glassnode spoke of the latest trend linked to long -term Bitcoin holders. “Long -term holders” (LTH) refer to Bitcoin investors who keep their parts more than 155 days ago.

The LTH compensates for one of the two cohorts of the main BTC support divided on the basis of the maintenance time, the other side being known as “short -term holders” (STHS).

Statistically, the more an investor keeps its coins, the less it is likely to sell them at any time, so LTH with their long maintenance time can be considered more resolved than STH.

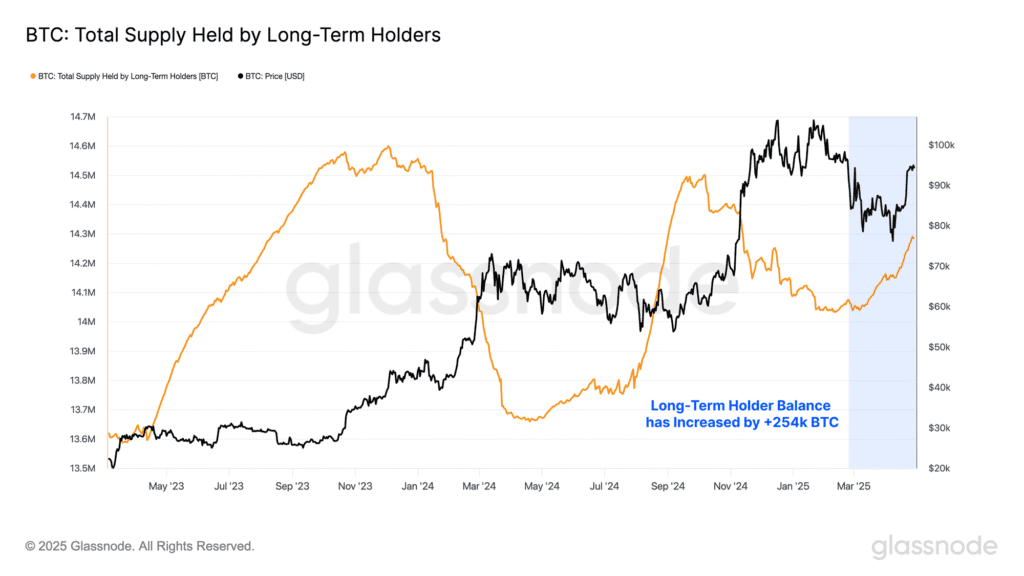

Below is the graph shared by the analysis company which shows how the total offer held by these Hodlers has changed in the past two years.

As it is visible in the graph, Bitcoin LTH diet has increased in the past two months, a sign that some STH has maturity in the cohort. In total, metrics increased by 254,000 BTC during this period.

Although LTH tends to be resolved entities, it is not as if they never sold at all. From the table, it is obvious that these diamond hands made profits during the two major rallies of last year.

Recently, BTC has again tried to create an upward momentum, but the continuous rise in the LTH Supply implies that these Hodlers have not yet decided to sell.

As for what this cohort would be sufficiently invented to sell, perhaps history can provide an index or two.

In the graph, Glassnode attached the data for the base of the average cost or the price made of LTHs and certain price lines which correspond to a specific degree of profit / loss for this cohort.

Currently, the price of the BTC is well above the LTH produced the price, so that the members of this group would lead to significant benefit. Despite this fact, these Hodlers do not yet seem ready to separate from their pieces.

As for the moment when their melody could change, the report explained:

Historically speaking, the long -term holder’s cohort generally increases its expenditure pressure when the average member holds an unrealized profit margin of + 350%.

Based on their current cost base, LTH should reach this 350% profit threshold when Bitcoin reaches the $ 99,900 mark. Thus, if the BTC recovery race continues so far, it is possible that the cryptocurrency can find problems due to the sale of Hodler.

BTC price

At the time of writing the editorial staff, Bitcoin is negotiated about $ 96,500, up around 4% in the last seven days.