The first exchange of Crypto Kraken declared $ 472 million in revenues for the first quarter of 2025. Surprisingly, it is up 19% compared to the previous year despite a first quarter which saw BTC drop below $ 65,000.

In a positive sign for the expected bullish market, Kraken’s trading volume on the platform increased 29% in annual sliding, and funded accounts increased by 26%. However, active platforms dropped 2% to 34.9 billion dollars. Kraken attributed the drop to the market accident which saw many tokens drop by 70%, then some.

Q1 results are for @krakenfx!

$ 472 million in gross income

Adjusted Ebitda of $ 187 million (+ 19% in annual shift)

Accounts financed under 26% in annual shiftDiscover the rest here –

And much more on the T2 path! pic.twitter.com/th7m3dq0j0

– Dave Ripley (@davidlriple) May 1, 2025

The growing commercial volume for a major exchange is a promising sign for the bull

A revealing panel to look for when trying to speculate on the Haussier market calendar in crypto is liquidity and volume. A main platform such as Kraken Exchange reporting an increase in volume of almost 30% in annual shift is extremely optimistic.

Especially taking into account this crypto, the crypto had a mainly horrible Q1, which saw BTC tank at around 30%, going from $ 106,000 to briefly less than $ 78,700 on March 11.

All previous bull races have started once “retail” enters the market. The retail trade being non -crypto individuals who normally enter when Bitcoin has just struck an important landmarks. To make it happen, the BTC will probably have to go up over $ 110,000, marking a new summit of all time while analysts will start asking $ 200,000 afterwards.

Discover: 20+ Next Crypto to explode in 2025

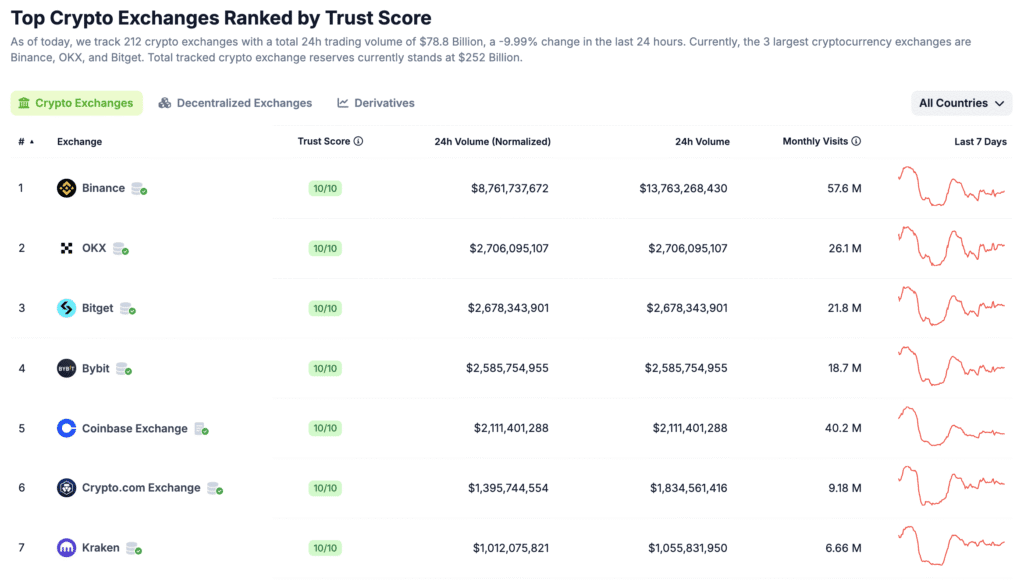

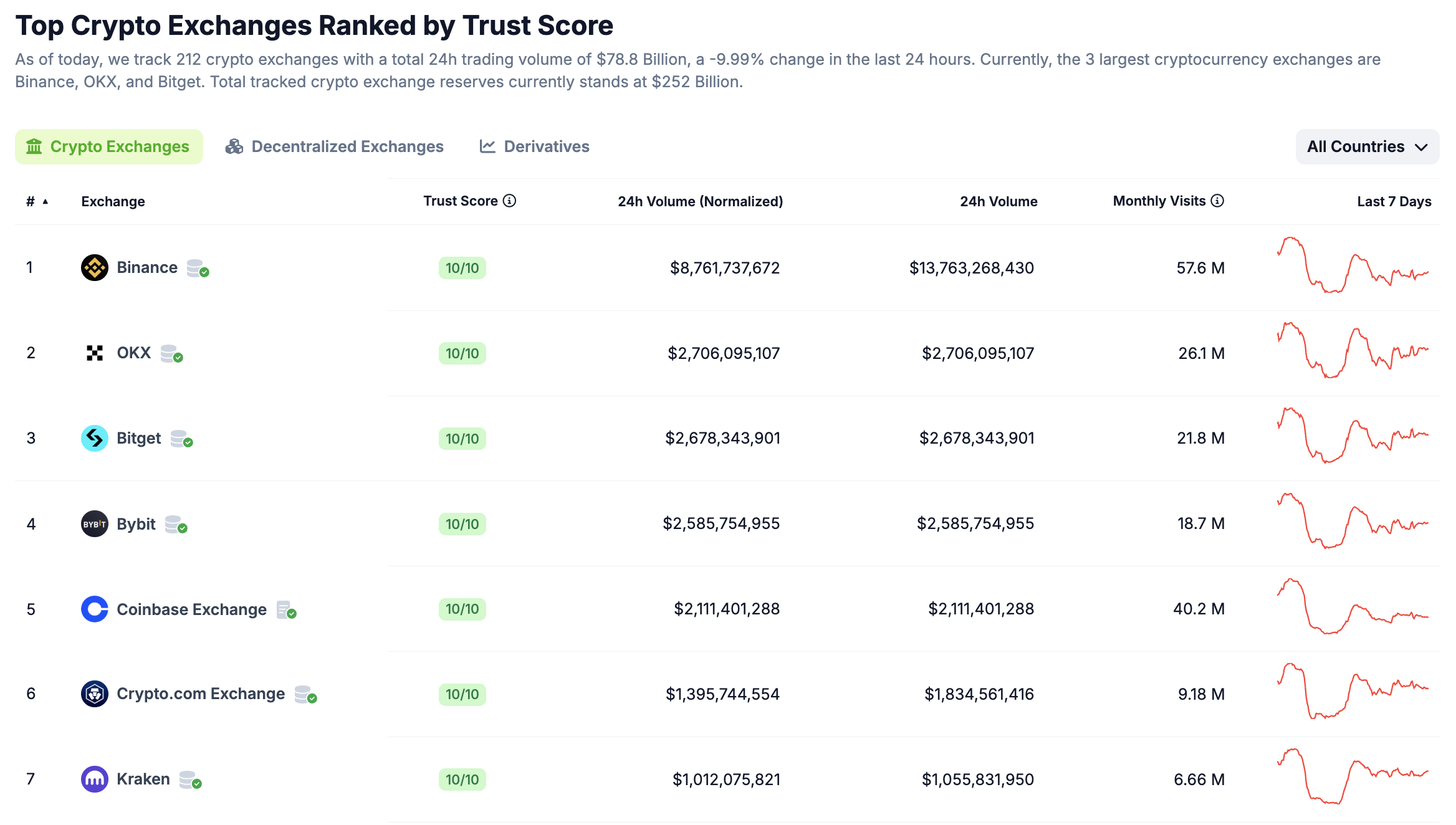

Coingecko data show that the 24 -hour negotiation volume for all the main centralized scholarships amounts to $ 78 billion. Kraken himself represents $ 1 billion in this figure while Binance opens the way with $ 13.7 billion.

No other major exchange has yet published its quarterly reports, but it will be interesting to see if the tastes of Binance and Coinbase have experienced similar increases in activity and volume.

(Flirtatious))

The biggest news for Kraken Exchange in the first quarter was its acquisition of Ninjatrader

The title of the quarter, however, was the acquisition ended by Kraken de Ninjatrader, a long-term trading platform and derivatives focused on retail.

“This transaction concludes the most important agreement combining traditional finance (tradfi) and crypto. More than an expansion of our business, this strategic acquisition strengthens our position in derivatives for tradfi and crypto services,” wrote the scholarship in a report.

The agreement positions the platform to serve merchants who seek to access the two asset classes in one place. It will allow crypto traders to access traditional term contracts, while the 800,000 Ninjatrader users reported will have access to the cryptography market.

This is an exciting day in the trip of Ninjatrader to redefine trade in term contracts, because we have concluded an agreement to unite their forces with @krakenfx.

We will continue to operate as an autonomous platform while we are working with Kraken to unlock new opportunities for all our … pic.twitter.com/58kalj5kot

– Ninjatrader (@ninjatrader) March 20, 2025

This decision brings Kraken closer to achieve his ambition to become a multi-assembly platform. The purchase of Ninjatrader occurred during the same quarter Kraken launched a functionality allowing cross -border payments, Kraken Pay. It will be stimulated with the introduction of Crypto debit cards, in partnership with Mastercard.

Kraken also completed proof of certificate reserves for the Crypto-Monnaies goalkeeper with the exchange on March 31. The firm, which allows users to check their assets independently on the chain through a Merkle tree test, said it was planning to publish these evidence every quarter.

Discover: Best ICO of the same corner in which invest today

Join the 99Bitcoins News Discord here for the latest market updates

Kraken Exchange publishes his report on the first quarter results, shows an increase in income and volume

-

The centralized exchange of exchange and the volume are a key sign that a Bull Run is getting closer

-

As a rule, bull races begin when Bitcoin takes a new important step, attracting generalized attention

-

BTC must exceed $ 110,000 for “commercial” investors to be paid in the markets

-

Kraken had a solid Q1, supplemented by its acquisition of Ninjatrader, a derivative trading platform focused on retail

The post-rate signs of the market as the quarterly ratio of Kraken Exchange show that 29% of volume peak appeared first on 99Bitcoins.