International Forex and CFD Broker XTB declared $ 155 million in total revenue for the first quarter of 2025. Based on recent XTB financial results, this is the highest income from the Polish brokerage since its launch in 2004.

Despite the record profit of XTB Q1 2025, the high operational costs of the Polish negotiation platform, composed mainly of costs linked to global expansion, the acquisition of customers and technological investment, slowed down its net income. While XTB aims to extend its services more, investors will monitor how the company manages global demand while managing its growing expenses.

XTB reaches a record of $ 155 million in revenue at T1 2025

Decompos the causes of revenues of $ 155 million from XTB X1 2025.

The overvoltage of trading volumes leads to growth in the head line

One of the reasons why XTB’s revenues in 2025 have skyrocketed were a significant increase in the volume of trading. In particular, the brokerage house experienced a 25% increase in CFD lots exchanged (1.91 million lots), against 1.53 million CFD lots in T1 2024.

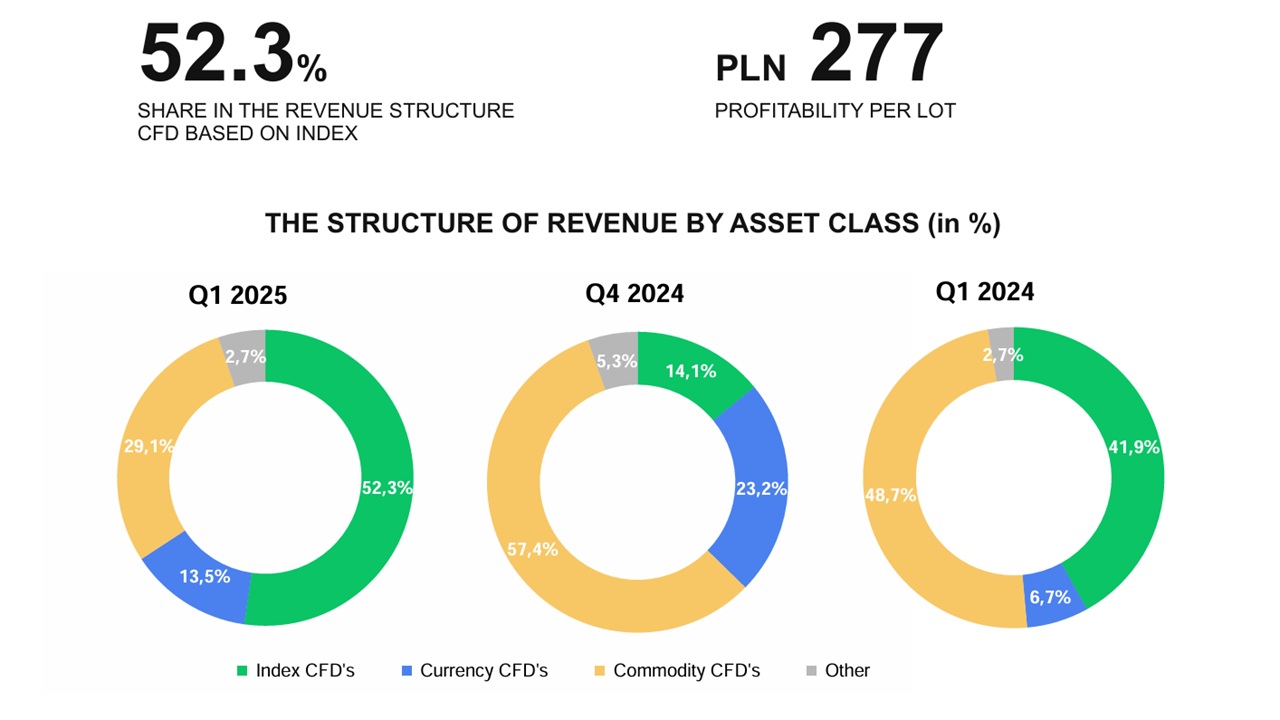

Distribution of income by asset class

According to the company’s latest financial reportCFD trading returned had most of its profits by class of instruments.

- CFDS based on the indices had the largest share of revenues at 52.3%, with the German DAX index CFD and the American profitability of American CFD being important factors.

- CFDs based on raw materials were the second more profitable, representing 29.1% of global income.

- The Forex CFD trading volume in 2025 represented 13.5% of income, compared to 6.7% At T1 2024.

Visit XTB

Beneficiary margins flat because XTB is cluster with the increase in operating costs

Although income has improved, XTB’s net profit has remained stable due to a significant increase in operational expenses. These costs reached $ 83.6 million in the first quarter of 2025, compared to $ 70 million in the fourth quarter of 2024 and $ 54 million in the first quarter of 2024.

Marketing and endowment of fuel expenditure hiking

XTB’s marketing budget reached $ 37 million, an increase of 74% from one year to the next. A Forex focusing on growth and marketing expenses of the CFD broker should be much higher compared to other expenses.

An increase in the number of employees has also added to overall costs, increasing salary and benefits by 30% compared to the first quarter of 2024. The increase in user deposits also led to higher payments processing costs.

Strategic investment in the global brand and technological infrastructure

The XTB management committee has priority increasing its customers And build its global brand to develop towards non -European markets. As a result, marketing costs are expected to increase by around 80% compared to the previous year.

In addition, XTB launched various product innovations in 2025 with the launch of its Ewallet service for users in Poland. Other significant supply changes include long -term savings products such as ISA (individual savings account) for British customers and the PEA account for French merchants.

Customer acquisition at all high times

Regarding the acquisition of XTB client, the trading platform added more users to T1 2025 than in any other quarter. With more than 194,000 new registrations, customers now exceed 1.54 million.

194K + new customers added in the first quarter

XTB recorded 19,304 new customers between January and March 2025, an increase of 49.8% in annual sliding. The main marketing campaigns, with a wide range through digital, television and display internships, were the main engines of this growth.

Active customers jump 76% in annual shift

The number of active customers reached 735,389, which represents an increase of 76.5% compared to the first quarter of 2024. During the quarter, these customers exchanged positions, occupied positions or maintained account sales. In total, XTB added more than half a million new customers from the same time last year.

Why XTB is popular among British merchants and investors

Regulated by the UK Financial Conduct Authority, XTB continues to attract British retail investors with its safe and practical negotiation features. Zero-commission stock trading, low CFD deviations and a friendly interface make it a competitive brokerage platform.

In accordance with online trading trends in 2025, XTB seeks to take care of CFD Crypto Trading And ISA compatible investment products to attract more British customers. In addition, merchant funds are protected by the financial services remuneration regime (FSCS), which gives up to £ 85,000 per person if XTB becomes insolvent.

Beginning with XTB in 2025

Here’s how British residents can start discussing XTB:

- Create an account: Visit the XTB home page and click “Open the account”.

- Check your identity: Download proof of identity and address to complete the KYC verification process (know your customer).

- Deposit fund: Transfer money via bank, debit or credit card. Most deposits are treated instantly.

- Start exchanging: Open a position on actions, ETFs, currencies or basic products via the XStation platform. You can also open your account via the mobile application to easily manage positions.

Depending on your deposit method, you may need to pay additional costs outside the XTB platform.

Our verdict on XTB

XTB’s profits from X1 2025 reflect the acquisition strategy and the expansion of the negotiation platform for the negotiation platform in other regions. Although higher operational costs have lowered the XTB beneficiary margins, the management committee remains confident in the development of its global brand and its marketing initiatives.

Open an account with XTB today and find new investment opportunities with a regulated regulation broker in the United Kingdom!

Visit XTB

Faq

Is XTB legal in the United Kingdom?

XTB is a regulated trading platform authorized by the UK Financial Conduct Authority, allowing the site to legally offer trading services to British merchants.

Is my money safe in XTB?

XTB user funds are well protected, following the UK Financial Duct Authority directives. This includes storage of customer retail holdings in separate bank accounts and up to £ 85,000 per person of protection by the financial services plan (FSCS).

Can we trust XTB?

As a leading Forex and CFD trading platform with international licenses, XTB is considered a safe and practical broker with more than 1.5 million users.

Which broker is the best for trading uk?

XTB is one of the main trading platforms in the United Kingdom, thanks to its user-friendly design, competitive costs and multi-active offers.

Is trading forex prohibited in the United Kingdom?

Trading Forex is an entirely legal activity in the United Kingdom, with brokers regulated by the FCA such as the XTB offering various pairs of currency for trading.

How to withdraw from XTB money?

From your XTB account, open the withdrawal tab and enter the amount you want to withdraw. Select your favorite method and click on “Removal” to start the process.

{“@Context”: “” @Type “:” Faqpage “,” mainentithy “: ({” @type “:” question “,” name “:” Is XTB legal in the United Kingdom? “,” Accepteddanswer “: {” @type “:” Answer “,” Text “:” XTB is a regulated negotiation platform UK legally. of users “.” Question “,” Name “:” What broker is the best for trading uk? “,” Accept in “: {” @type “:” Answer “,” text “:” XTB is one of the main trading platforms in the United Kingdom, thanks to its friendly design, competitive costs and multi-ai-style offers. “In the United Kingdom?” Accepted in “: {” @type “:” Answer “,” text “:” Forex Trading is an entirely legal activity in the United Kingdom, with brokers regulated by the FCA as XTB offering various pairs of currency for trading. “}}, {” @Type “:” Question “:” How do I get money from XTB? “” “” @Type “:” Answer “,” text “:” From your XTB account, open the withdrawal tab and enter the amount you want to withdraw. Select your favorite method and click on “withdraw” to initiate the process. »}})}

References:

- XTB – Relacje inwestorskie »XTB published Q1 2025 Preliminary financial results. Save the operating profit and increased investor activity (XTB Q1 2025)

- XTB – Relacje inwestorskie »XTB financial results for the 1st quarter of 2024 (XTB Q1 2024)

- RB-17-2025-WSSEPNE-WYNIKI-FINANSOWE-I-OPEACYJNE-ZA-I-KWARTAL-2025-ENG-ALL-1-3.PDF (XTB Q1 2025 report)

The Post XTB reports register $ 155 million in income from the first quarter of 2025; The profits remain stable in the increase in marketing and staff costs appeared first on 99Bitcoins.