- Helium, Aave, and THORChain were the biggest gainers last week.

- Dogwifhat, Brett and Mantra suffered the biggest losses last week.

Helium (HNT) once again secured a spot among the top two gainers for the second time this month, demonstrating its strong performance.

On the other hand, dogwifhat (WIF) ended the week as the biggest loser, highlighting the market volatility.

Interestingly, no memecoins appear among the top gainers over the past week, marking a notable shift in market dynamics.

The biggest winners

Helium (HNT)

HNT became last week’s biggest gainer, after finishing second the previous week.

According to data from CoinMarketCap, HNT has seen an impressive 19.5% increase over the past week, marking a solid performance.

AMBCrypto’s analysis of Helium’s daily trend showed that the week started with a significant 8% drop, bringing its price down from around $6.6 to $6.0.

However, helium rebounded the next day with a substantial 14% increase, pushing its price to around $6.9.

Although the token saw some fluctuations throughout the week, it ended on a positive note with a further 14% increase, closing the week at around $7.6.

Source: TradingView

Further analysis noted that HNT was in a strong uptrend at the time of the recall, with its Relative Strength Index (RSI) around 70.

The trend also suggested that the asset was in overbought territory.

This strong buying momentum has pushed Helium’s market cap to over $1.2 billion, with trading volume exceeding $24.5 million at the time of writing.

Aave (AAVE)

Aave (AAVE), among last week’s losers, made a significant comeback, ending last week as the second-biggest gainer.

According to data from CoinMarketCap, AAVE has gained nearly 18% over the past week.

AMBCrypto’s analysis of AAVE’s price trend revealed that it started the week trading at around $94.

The token saw strong upward momentum throughout the week, pushing its price to around $111 by the end of the week.

Notably, AAVE reached as high as $115 during the week before falling back to around $111.

At the time of writing, AAVE’s market cap stands at over $1.6 billion, with trading volume exceeding $131 million.

It should be noted, however, that both market cap and volume have decreased over the past 24 hours. This could indicate profit taking or a temporary slowdown after the sharp rally.

Overall, AAVE’s impressive gains underscore its resilience and renewed investor interest after a difficult period.

Thor’s Chain (Rune)

THORChain (RUNE) became the third-biggest gainer of the week, with its price rising more than 17.8%, according to data from CoinMarketCap.

Price analysis shows that RUNE started the week at around $3.4 but saw early declines. However, the token price recovered during the week and it was trading near $4 by the end of the week.

At the time of writing, RUNE has dropped slightly to around $3.9. Despite this slight decline, its market cap has seen a notable increase of over 7% in the last 24 hours, bringing it to over $1.3 billion.

However, trading volume has declined by more than 10% over the same period, currently standing at over $150 million.

This drop in volume may suggest that while there was strong buying activity earlier in the week, it has since subsided, potentially leading to a period of consolidation for RUNE.

The overall positive movement in its market capitalization indicates continued interest in the token, even as trading activity slows.

The biggest losers

Dog Hat (WIF)

Dogwifhat (WIF) faced a tough week, finishing as the biggest loser with a drop of over 23.8%, according to data from CoinMarketCap.

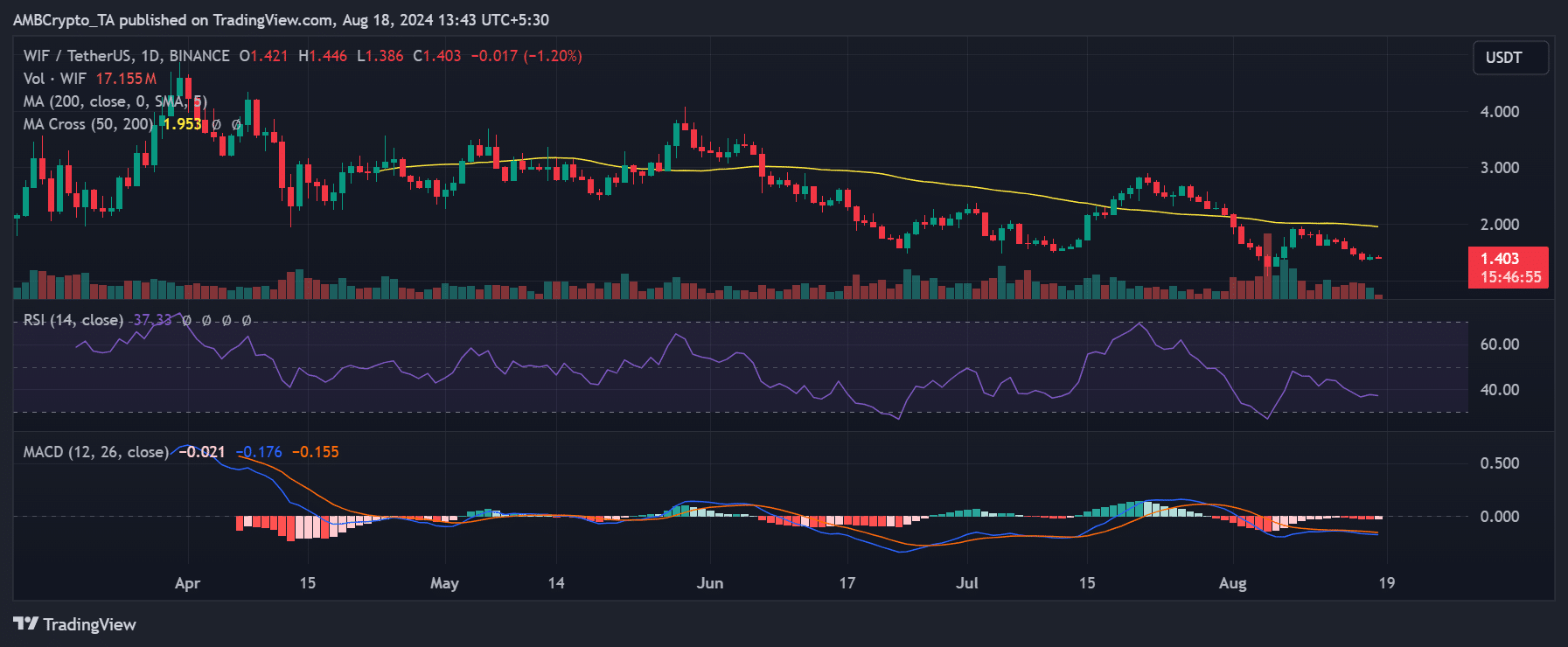

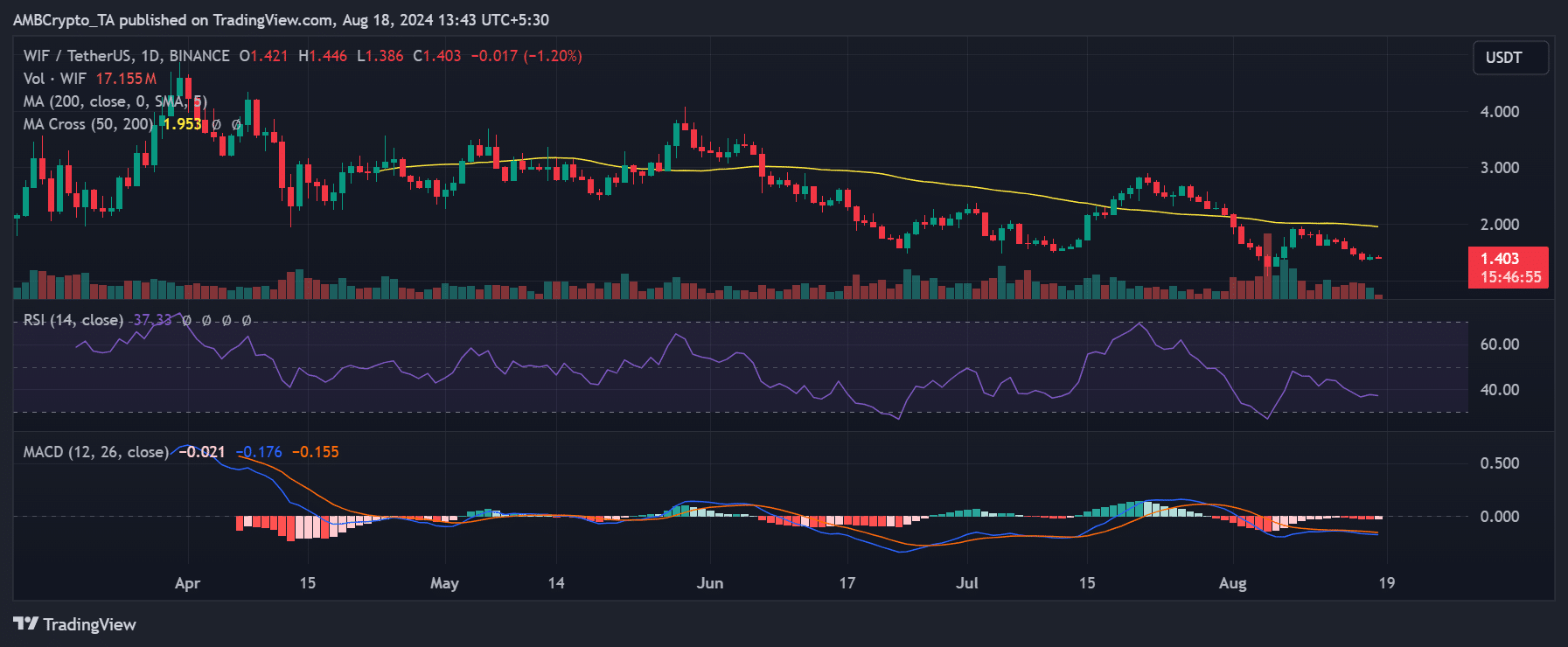

AMBCrypto’s analysis of WIF on a daily time frame revealed that it has seen steady declines for most of the past week.

The week started with a sharp drop of 10.25%, bringing its price down to around $1.62.

Although WIF saw a brief recovery the next day, with a 5% increase pushing its price to around $1.7, this uptrend was short-lived.

The token then entered a downward spiral, experiencing four consecutive days of decline. By the end of the week, WIF was trading at around $1.4, despite a slight increase of 1.94% in the last session.

Source: TradingView

A closer look at its Relative Strength Index (RSI) shows that WIF is below 40, indicating that it is in a downtrend and in the oversold zone.

This reflects strong selling pressure and a lack of buying momentum, contributing to its significant weekly loss.

At the time of writing, dogwifhat’s market cap is around $1.4 billion, with a trading volume of over $226 million.

Brett (BRETT)

Brett (BRETT) has seen a significant decline of over 20.6% over the past week, making it the second-biggest loser, according to data from CoinMarketCap.

AMBCrypto’s analysis of BRETT’s price movement shows that it started the week at around $0.099 but faced a downtrend throughout the week.

The token started the week with a decline and continued to lose value, ending the week with a price of around $0.079. This steady decline highlights the bearish sentiment surrounding BRETT.

Additionally, BRETT’s market cap and trading volume have declined over the past 24 hours, with its market cap now sitting at over $786 million and its volume at around $18 million.

MANTRA (OM)

MANTRA (OM) ranked third among the biggest losers last week, dropping more than 16%, according to data from CoinMarketCap.

The token started the week trading at around $1, but it steadily fell throughout the week, ending at around $0.9.

This downward price trend was accompanied by a decline in market capitalization and trading volume.

At the time of writing, MANTRA’s market cap stands at over $753 million, which is down over 1% in the last 24 hours. Its trading volume has dropped significantly by over 20%, and now stands at over $15 million.

Conclusion

Here is the weekly recap of the biggest gainers and losers. It is essential to keep in mind the volatile nature of the market, where prices can move quickly.

So it is best to do your own research (DYOR) before making any investment decisions.