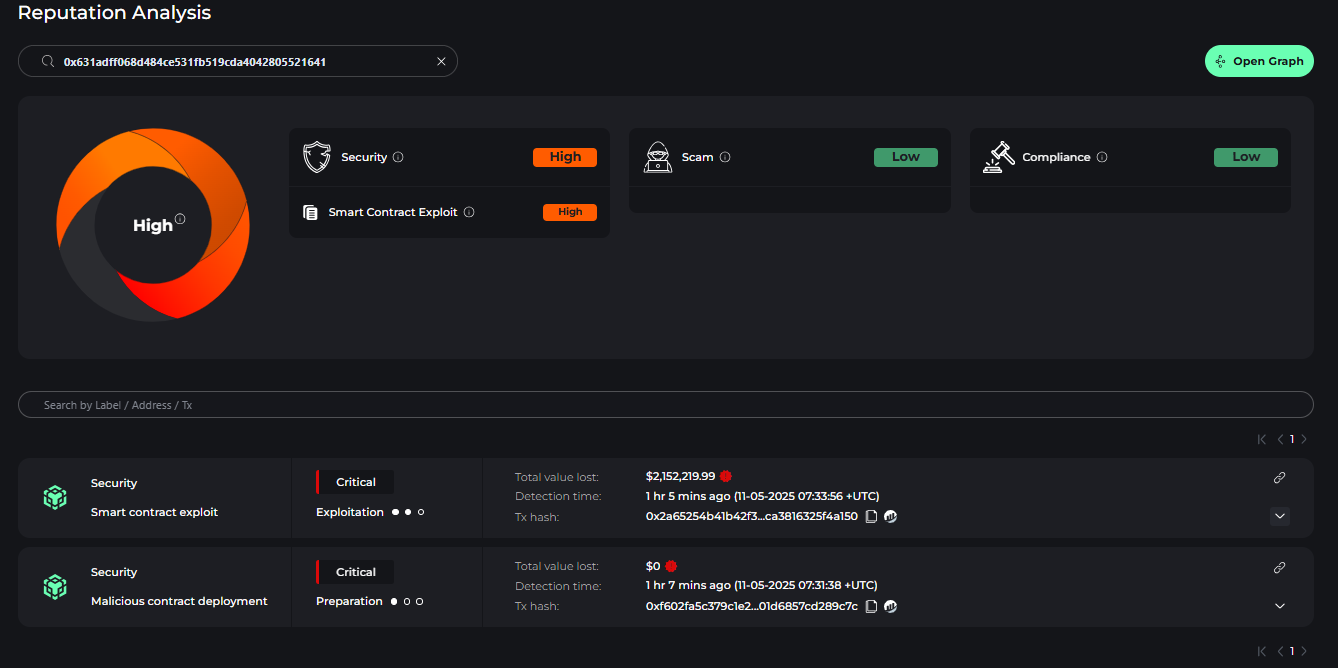

A critical vulnerability in the intelligent Mobius token (MBU) toy contract on the BNB intelligent channel led to a loss of $ 2.15 million, adding to the growing list of crypto exploits in 2025. Mobius is a less known project in the BNB ecosystem.

The attack, confirmed by the web security company CYVER on May 11, involved a malicious pirate who took advantage of a flaw in the MBU race mechanism.

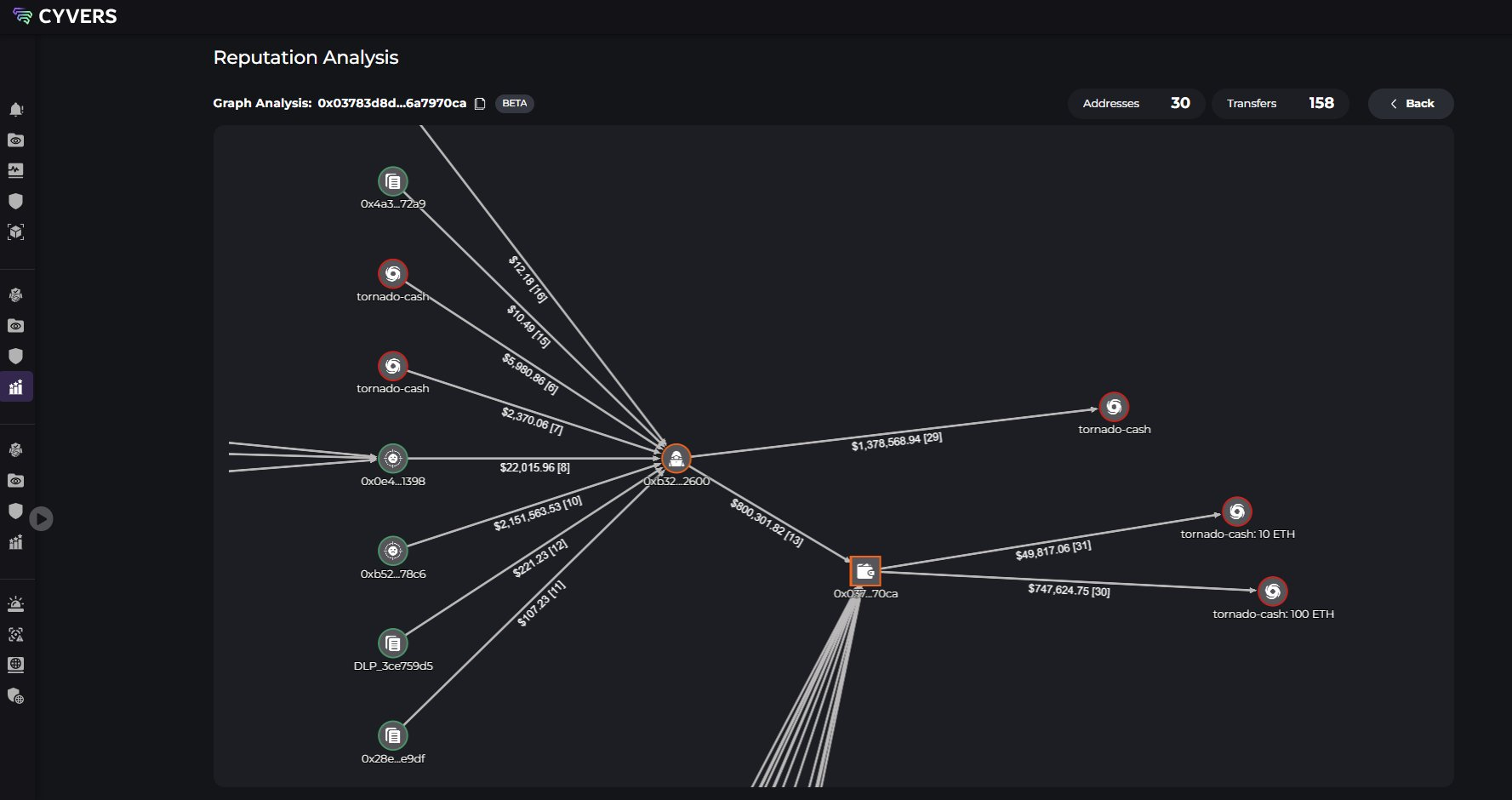

Mobius Attacker Moves Fund via Tornado Cash

According to Cyvers, the incident started at 07:31 UTC when a portfolio (0xB32A5) deployed a thug contract. Two minutes later, another address (0x631adf) launched a series of suspicious transactions.

Using only 0.001 BNB, the attacker struck 9.73 MBU quadrillion tokens by 9.73 and quickly exchanged them for stablescoins, which reported $ 2.15 million. In the same process, the attacker also won 28.5 million additional MBU tokens.

After the feat, stolen assets were transferred to Tornado Cash, a popular protocol that anonymously anonymous.

The exploit method and speed point towards a calculated movement to escape the follow -up and recovery of assets. This incident also highlights the persistent vulnerabilities facing intelligent contracts based on contracts.

Meanwhile, this hacking of Mobius makes it the last victim of a wave of blockchain exploits which led to a loss of around $ 2 billion on various platforms, including Bebit.

BNB Chain Activity Surcs

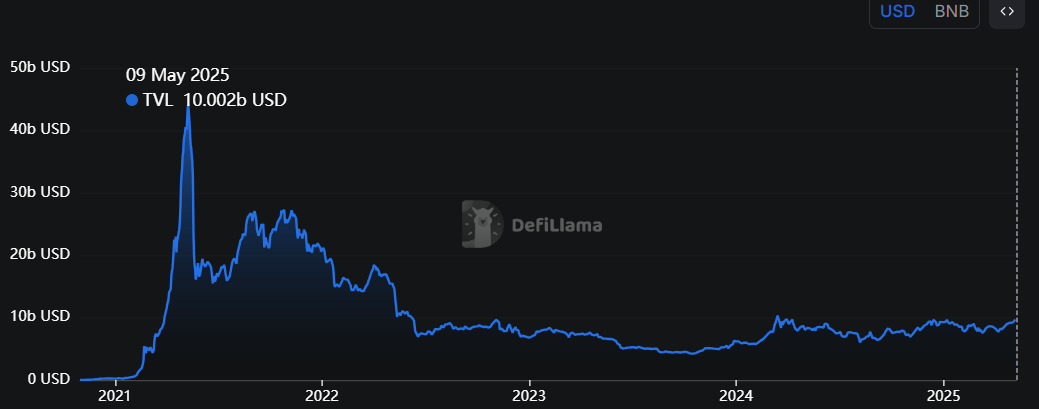

Despite isolated incidents such as Mobius violation, the BNB channel attends a significant resurgence of user and developers’ activity. In recent months, the network has reappeared as a superior contender in the DEFI space.

Defillama’s data show that the total locked value (TVL) on the BNB channel exceeded $ 10 billion, reaching a three -year summit. However, it is still significantly lower than the highest in 2021 more than $ 40 billion.

The BNB chain also recently claimed the first place in the decentralized trade sector (DEX), exceeding Ethereum and Solana.

Market observers have noted that network growth is fueled by new institutional interests, an increase in the participation of the challenge and a high demand for chain assets.

In addition, the momentum can also be partly attributed to the continuous influence of Binance and the renewed concentration of Changpeng Zhao on the blockchain network.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.