The Aave and Uniswap protocols have recently created new records in the midst of signs of a recovery on the cryptocurrency market.

The records recorded by Aave and Uniswap in the midst of a crypto market in Sose Savoir the question: sitting at the start of a new Boom Defi, or is it just a short-term wave?

Whale activity reports confidence in Aave

With Ethereum (ETH) exceeding $ 2,500, a key step on a volatile cryptography market, a whale activity on Aave and the United Stateswap milestones comb a picture of the decentralized finance ecosystem (DEFI).

A portfolio linked to WLFI recently deposited 50 WBTC in Aave V3 and borrowed USDC 400 million to buy 1,590 weth at an average price of $ 2,515. This portfolio now has assets worth $ 15.11 million, including $ 3,924 ($ 9.91 million) and 50 WBTC ($ 5.19 million). It has a healthy position on Aave (health rate of 2.0), reflecting confidence in the potential for rising ETH.

On the same day, a whale named Nemorino.eth bought 3,088 Weth at an average price of $ 2,488, obtaining an unabled profit of around $ 124,000. This strengthens the bullish feeling around ETH as large investors accumulate nearly $ 2,500. However, not all whales are optimistic.

On May 12, 2025, Embercn reported that a whale borrowed 5,000 ETH in Aave in 50 minutes and abbreviated it at $ 2,491, highlighting divergent investment strategies.

Is Defi ready for a boom?

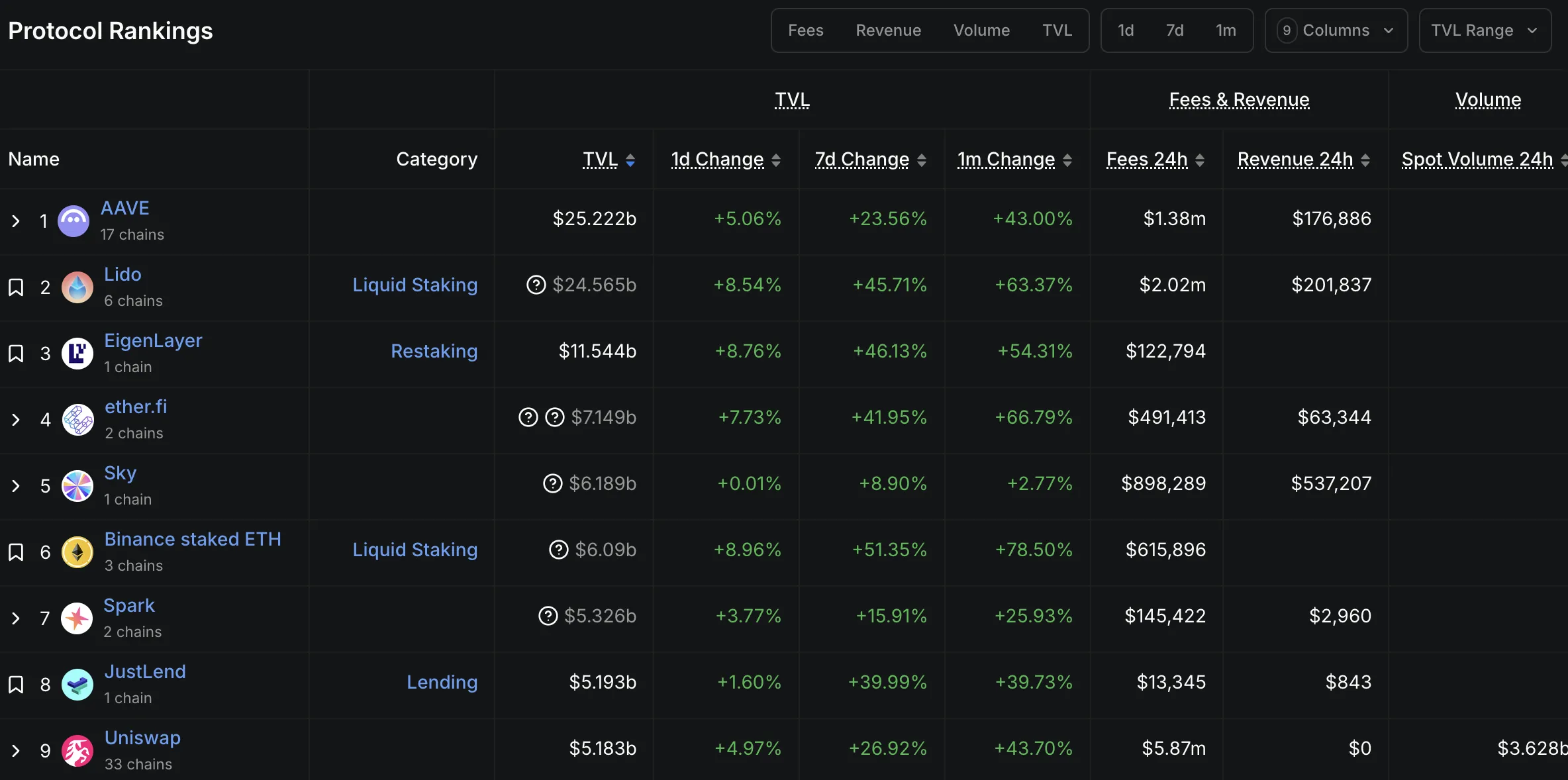

The push of the activity of whales on Aave aligns with remarkable challenge milestones. The founder of Aave, Stani Kulechov, announced on May 11, 2025, that Aave reached a total locked value (TVL) of 25 billion dollars, making it one of the largest protocols DEFI.

According to Defilma data of May 14, 2025, Aave represents more than 21% of the TVL of the DEFI market, exceeding competitors like Lido (LDO) and Eigenlayer (Eigen). This growth is widely directed by large investors depositing substantial assets in the protocol.

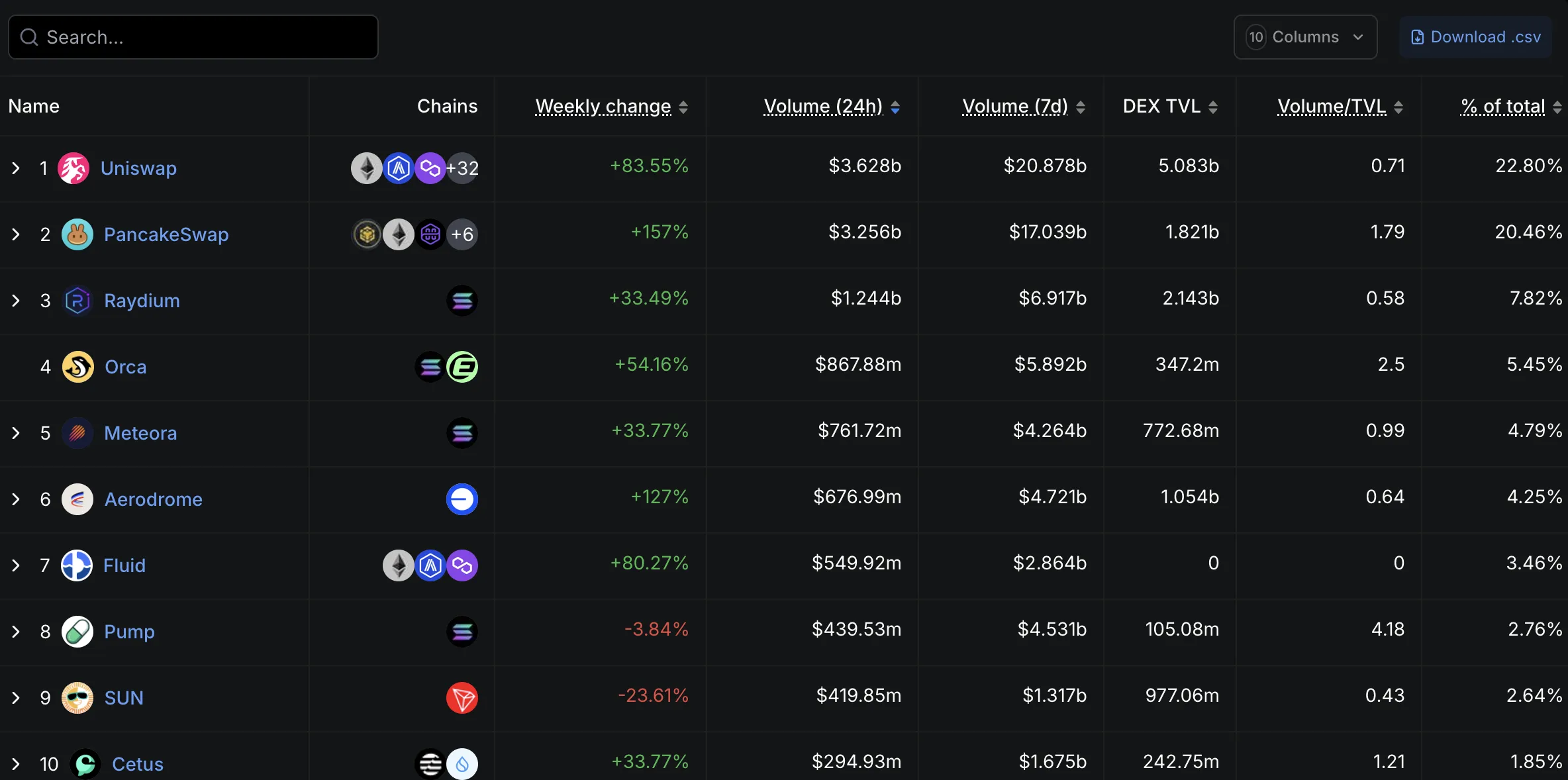

Meanwhile, Uniswap, a leading decentralized exchange (DEX), has reached a historic stage. On May 12, 2025, Uniswap indicated that its volume of trading of all time had exceeded 3 billions of dollars, showing the call of Defi.

The DEFILLAMA data of May 14, 2025 show that UNISWAP processes more than $ 3.6 billion in 24 hours, capturing 24% of the global volume of negotiation and solidifying its domination.

These milestones of Aave and Uniswap reflect the growth of Defi and a passage from the capital of traditional finance to decentralized protocols.

Implications of whale movements and growth

These developments have important implications for ETH and the DEFI ecosystem. The active participation of the whale on Aave signals a strong belief in ETH, especially since its price exceeds $ 2,500. This optimism supports the broader challenge story.

The TVL of $ 25 billion in Aave highlights its role in the supply of liquidity and the support of complex investment strategies. Likewise, the volume of trading of 3 billions of UNISWAP dollars shows the popularity of the DEX, allowing direct and without intermediary exchanges which reduce costs and improves transparency.

The Boom DEFI could propel ETH long -term growth. The price exceeding $ 2,500, associated with the activity of the whales, indicates that DEFI becomes the cornerstone of the Ethereum ecosystem.

The rise of Aave and UNISWAP, fueled by TVL and trading volumes, alongside major whale activities, suggests that DEFI has entered a new growth phase. Although short -term market fluctuations remain possible, the growing institutional interests of these protocols and solid fundamentals indicate a boom of sustained challenge, with Ethereum to his heart. However, investors should monitor market movement and whale strategies, as divergent approaches signal the volatility of potential.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.