Moo Deng fell almost 40% of its recent summits, but the current correction could prepare the ground for the next leg. A critical support area is emerging.

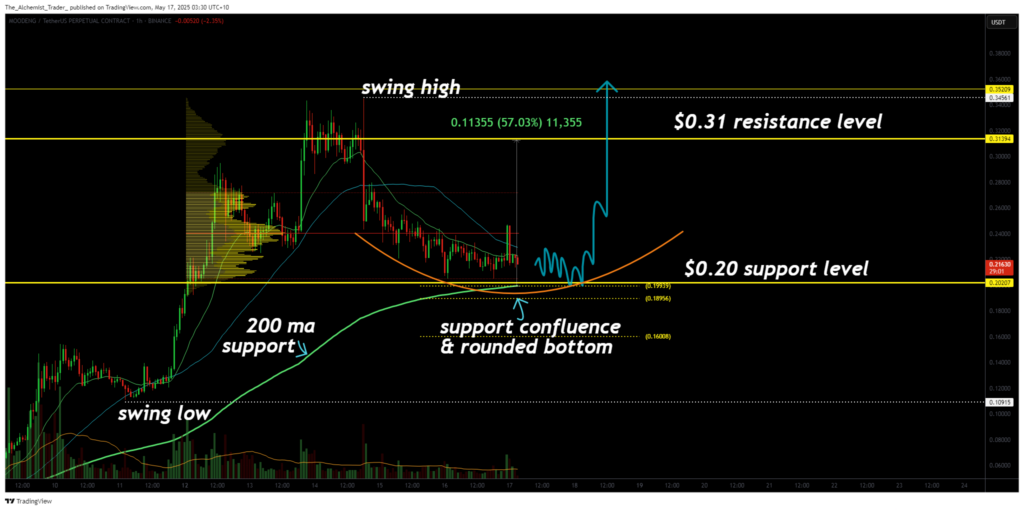

After an explosive movement higher, Moo-Deng (Moodeng) entered a corrective phase, but it seems to be healthy in the wider increased structure. The price action ended up towards the $ 0.20 zone, which aligns with several technical indicators of high trust, suggesting that this level could act as a springboard for a renewed rally.

Despite the sharp drop compared to the $ 0.35 swing, the trend remains intact. The structure of the market shows signs of formation of a lower small potential, while the upward confluence continue to build at the current levels. Merchants should closely monitor signs of a return to support.

Key technical points,

- Major support at $ 0.20: 200 mA, 0.618 fibonacci, low value area and SR daily

- Round background formation: A potential rounding base is formed on the daily graphic

- Target up at $ 0.31: A 50% decision could follow if the support is maintained and the structure confirms

Moo Deng’s correction started after a strong swing almost $ 0.35, triggering an aggressive withdrawal. However, this retrace is not unusual, it follows a stiff and volatile rally. The current movement has returned to $ 0.20, which has a significant technical weight. This zone coincides with the retrace of fibonacci of 0.618 of the most recent leg, the 200 -day mobile average, a daily area of support resistance and the low value area on the volume profile.

In particular, prices’ action begins to form a round background motif. Although it is still in development, this type of structure generally indicates accumulation and often precedes rupture movements. The longer Moo Deng is consolidated and holds more than $ 0.20, the more credible Bothing training.

From the point of view of the structure of the market, the maintenance of this support would confirm a low lower in the wider trend, a bull signal. The confluence of technical levels makes it a high probability area for a reversal if buyers regain control.

What to expect in the action of upcoming prices

If the support region of $ 0.20 continues to hold and the structure of the round background matures, Moo Deng could stage a rally around $ 0.31, which represents a movement of almost 50% of the current levels.

The upward trend remains intact, and this decline can prove to be a necessary reset before the next impulsive leg. Traders should closely monitor the behavior of the volume and prices around support for the first signs of a reversal.