- EOS slides on Monday, extending losses to short -term EMA support of 50 days.

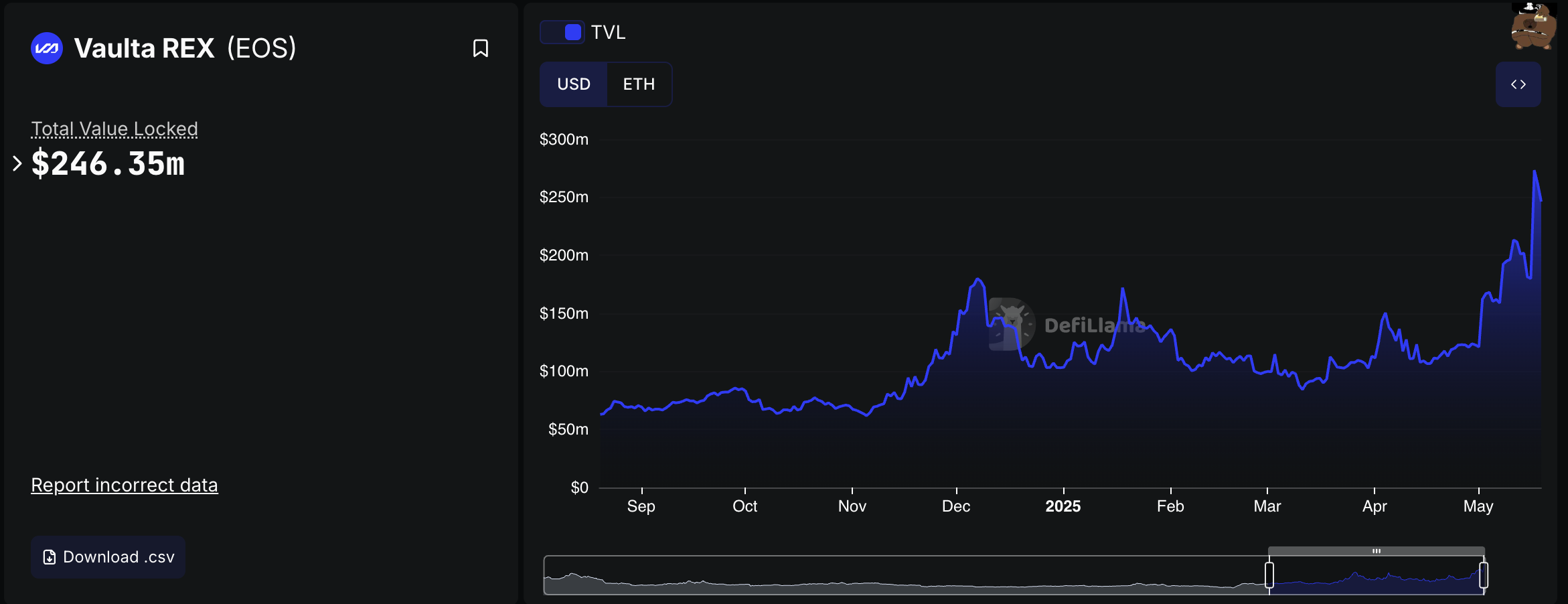

- The Vaulta d’Eos Defil TVL volume reached $ 273 million on Saturday before going to $ 246 million.

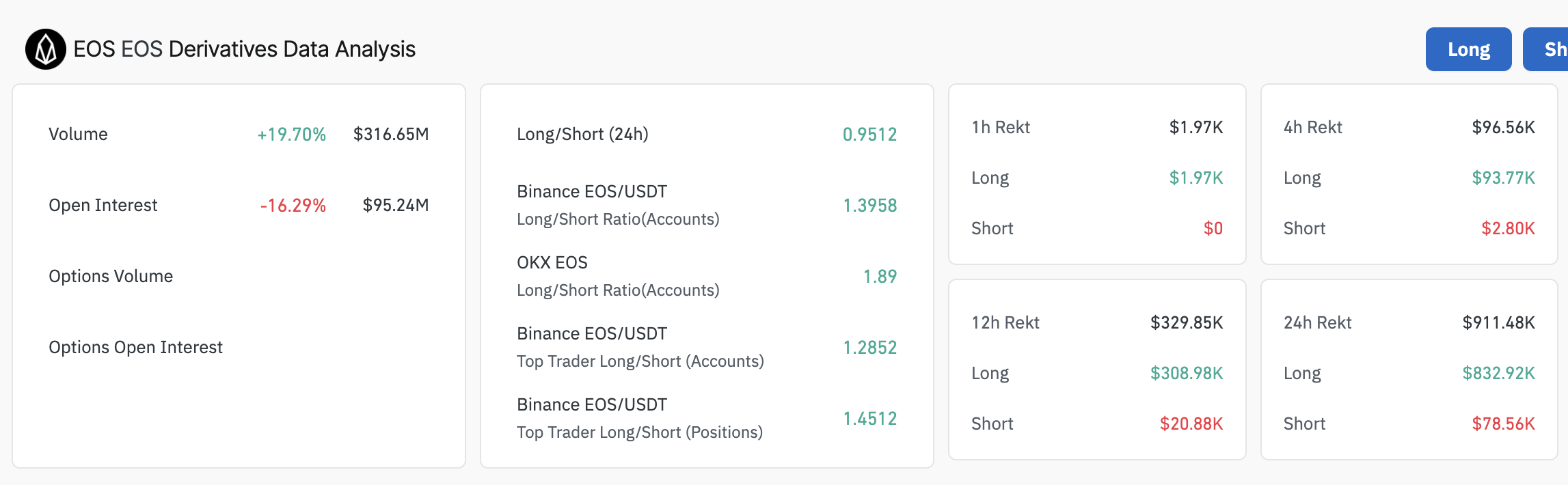

- A 16% drop in the open interest of derivatives to $ 95 million, with an increase in long -position liquidations signaling the interest of the decolining trader.

EOS prices slide about $ 0.75 on Monday, erasing a minor increase on Sunday, while extending the withdrawal of the May 10 summit at around $ 0.99. THE EOS Network is renowned in Vaulta In the first quarter, open the way to a web3 banking platform. Investors and cryptocurrency exchanges are preparing for the exchange of EOS token in Vaulta (A), which should start on May 26.

The exchange of EOS tokens in Vaulta aims to align the asset with its new web ban3 vision.

DFI TVL de Vaulta is forward on Eos Token Swap

The decentralized financing ecosystem (DEFI) of Vaulta Value Locanté (TVL) has experienced considerable growth since early March, culminating at around 273 million dollars on Saturday, compared to almost $ 100 million recorded on March 1.

This wave highlights an increase in users’ activity, stimulus and supply of liquidity, encouraging investors to lock assets in Vaulta DEFI protocols.

Investors often prefer to pay their assets in intelligent contracts, engage in loan, borrowing and yield protocols when confident in the long -term value of the ecosystem and the price of assessment of prices.

Vaulta’s Defi TVL | Defillama

A minor drop to 246 million dollars compared to the weekend summit of $ 273 million highlights the opposite winds and the evolution of dynamics on the wider market of cryptocurrencies.

Co -quais derivative data shows a significant collapse of 16% in open interest (OI) to around 95 million dollars, reflecting the drop in traffic interests. OI is the total number of term contracts or active circulation options that have not been closed or set.

The drop in OI as the negotiation volume increases by almost 20% to 316 million dollars implies that more merchants generally firmly position positions instead of opening new ones. This could indicate potential benefits or even holding positions.

EOS derivative market data | Rinsing

There have been more liquidations in a long position in the last 24 hours, with around $ 833,000 destroyed compared to around $ 79,000 in shorts. The increase in long -term liquidations as the OI drops into a potential decrease tendency and increased volatility because fewer traders make up bruises.

EOS withdrawal, looking for stability above short-term support

The correction of EOS prices from May 10, slightly less than $ 1.00, searches for the superior support for the exponential mobile average of 50 days (EMA) at around $ 0.73.

The bears take control, because the relative resistance index (RSI) stretches downwards, falling below the midfield line 50 after having culminated at 76.11 on May 10.

The current technical prospects indicate a weakening of the bullish momentum, accentuated by the monetary flow index (MFI) falling strongly to 57.74 of an exaggerated peak of around 82.93.

Note that the MFI follows the flow of money in and outside the EOS, with persistent samples likely to trigger a prolonged downward trend in the price of EOS.

EOS / USDT daily graphics

The 50 -day EMA provides immediate support at $ 0.73, which could absorb potential sales pressure. Marginally below this level, the EMA of 100 days and 200 days are online to provide additional support at $ 0.70 and $ 0.69, respectively, against an increased sale.