- Spot Ether ETF outflows totaled $433 million after three consecutive days of outflows.

- The decline in demand for ETH, alongside the increase in supply, has hampered Ethereum’s efforts to gain traction.

The cryptocurrency market saw a strong rebound on Tuesday during the Asian trading session. Ethereum (ETH) gained about 2% to trade at $2,678 at the time of writing.

However, despite the recent gains, the largest altcoin has lost 23% of its value since the launch of spot Ether exchange-traded funds (ETFs) in the United States last month.

So what’s weighing on the price of Ethereum?

Ethereum ETF outflows hit $433 million

Cumulative net outflows from Ethereum spot ETFs stood at $433 million at press time.

The Grayscale Ethereum Trust ETF (ETHE), which launched with $10 billion in assets, has seen consistent negative flows since its launch. The ETF still holds $4.84 billion in net assets, further increasing downside risk.

Source: SoSoValue

Last week, Framework Ventures co-founder Vance Spencer predicted that investors could potentially split their portfolios with a 50-50 split between Bitcoin and Ether ETFs.

However, over the last three trading days, Bitcoin ETFs have seen consecutive inflows while Ethereum ETFs have seen consecutive outflows.

Decrease in network activity increases ETH supply

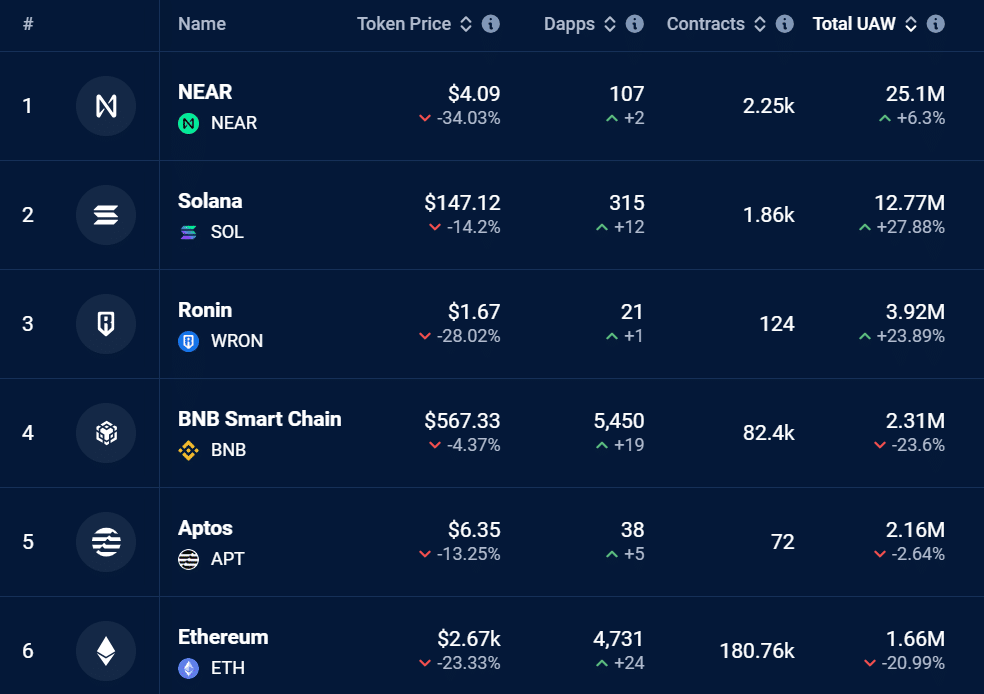

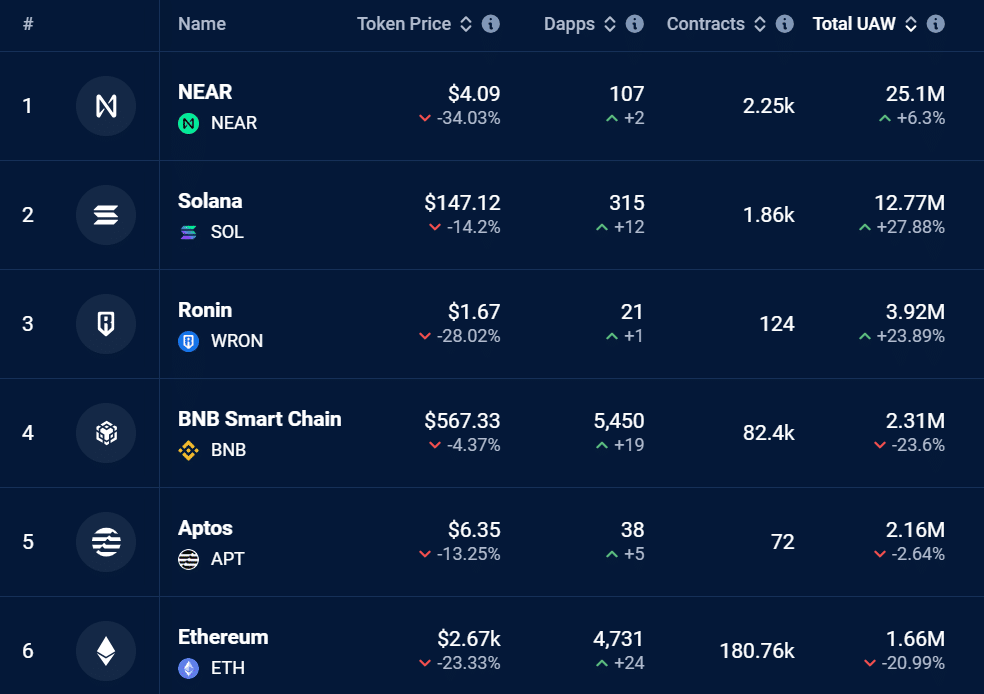

The Ethereum network has also seen a drop in usage, as shown by DappRadar.

The number of unique active wallets (UAW) on the Ethereum network has dropped by 20% over the past 30 days. The 30-day user count on Ethereum stands at 1.66 million, ranking it sixth by this metric.

Source: DappRadar

The drop in network usage also affected the amount of ETH tokens burned, which in turn increased the supply, making Ethereum inflationary.

Data from Ultrasound money showed that over the past seven days, around 18,000 ETH tokens were issued, while only 1,500 were burned.

This means that the supply of ETH has increased by more than 16,000 tokens in seven days. Increasing supply amid reduced demand has put downward pressure on ETH.

Indicators point to weak demand

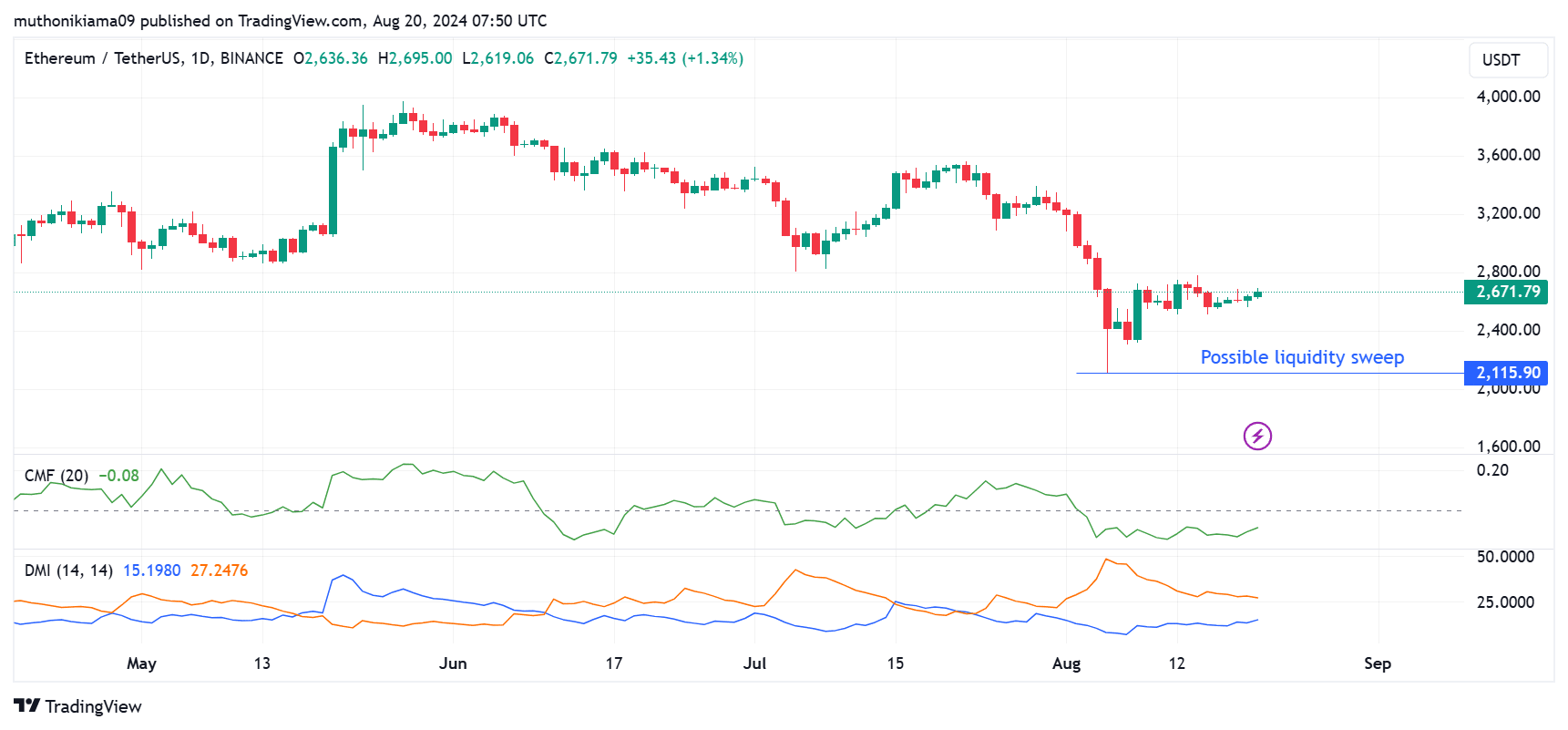

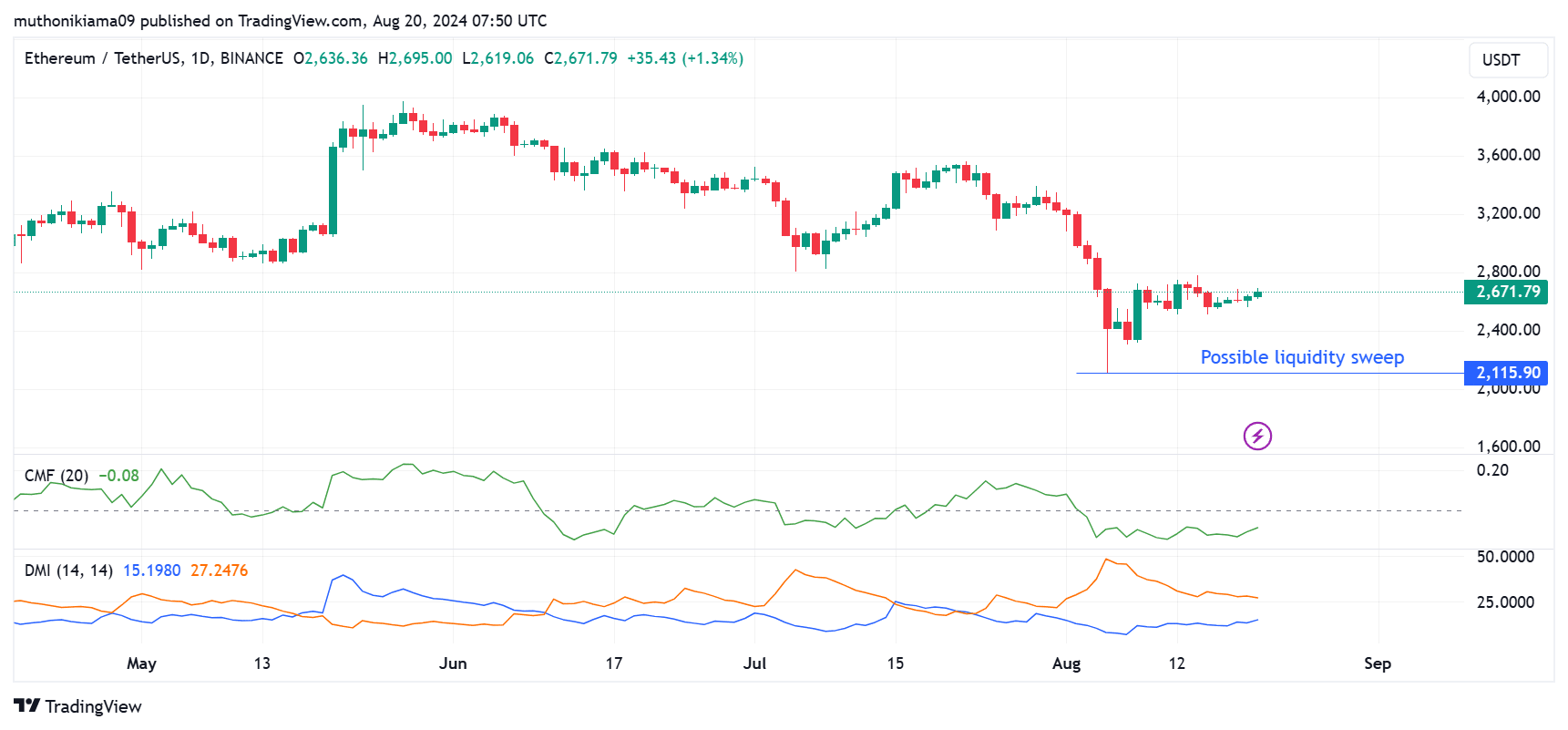

At the time of publication, ETH was facing low demand, which could potentially weigh on prices. Chaikin Money Flow, which measures accumulation and distribution, was negative at the time.

Thus, selling pressure has exceeded buying pressure since the beginning of August.

Source: TradingView

The positive Directional Movement Index (DMI) has also shown a downward trend as the positive directional indicator has been below the negative directional indicator since July.

However, the distance between the two lines is narrowing, hinting at a potential reversal. Traders should also watch for a possible surge in liquidity to $2,115 as price stages a strong rebound.

Realistic or not, here is the market capitalization of ETH in terms of BTC

According to AMBCrypto’s take on CryptoQuantETH needs leveraged traders to come back for an upward correction.

Additionally, according to Coinglass, Ethereum open interest has fallen from a peak of $17 billion in May to $10 billion currently.