ChainLink positioned himself at the center of a potential market opportunity of 260 billions of dollars while the Oracle Network blockchain accelerates partnerships with major financial institutions to unlock the massive market of non -suspended assets thanks to its transversal interoperability protocol (CCIP).

The scope of Chainlink’s strategy has become obvious through recent high -level collaborations, including a pilot with UBS Asset Management and Swift For Tokenized Fund Settlements, a full partnership with the World ABU Dhabi market to develop blockchain standards and integration with the Defici of World Liberty Financial Defic ecosystem.

ChainLink has evolved beyond simple data flows to become the essential infrastructure to connect traditional financial systems with blockchain networks.

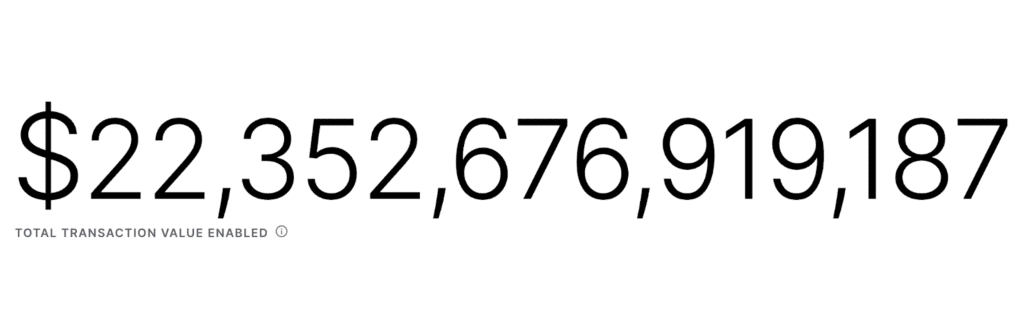

It now deals with more than $ 22 billions of transactions while establishing the technical foundations necessary to provide real assets on the large -scale chain.

All these key partnerships and developments have created a network effect that could exponentially accelerate the migration of traditional assets on blockchain infrastructure.

Production pilot programs: the tendency to adopt institutional tokenization

Chainlink’s methodical approach to institutional partnerships has gone from experimental pilots to the implementations practiced by production that show the practical viability of blockchain technology for traditional financial operations.

At the end of 2024, UBS asset management and SWIFT collaboration have shown that tokenized fund subscriptions and redemptions could operate transparently in existing financial infrastructure while reducing operational costs and settlement delays that afflict the global 63 billion placement fund market.

The success of this pilot as part of the Singapore Guardian Frame has also established a reproducible model that other major asset managers now assess their own tokenization initiatives.

More recently, the partnership with Abu Dhabi Global Market extends the scope of Chainlink in regulated environments, where compliance and techniques standards must perfectly align with traditional financing requirements.

The robust regulatory framework of ADGM for tokenization projects provides the legal certainty that the main institutions require before committing substantial resources to the adoption of blockchain.

The collaboration allows the ADGM registration authority to take advantage of ChainLink’s technical services for token workers while guaranteeing complete regulatory compliance.

He creates a model for similar partnerships with other international financial centers seeking to settle like poles of innovation blockchain.

The success of these pilots has created momentum for the scaling of tokenization efforts in the wider financial services sector. Each successful implementation reduces the resistance to adoption among traditionally conservative institutional actors.

Bind technical analysis points to an escape potential

From a technical point of view, the structure of ChainLink’s graphic has a convincing configuration.

The 4 -hour graph reveals a conventional descending triangle pattern with a link currently positioned at the Apex where the downward resistance converges with a horizontal support around $ 13.186.

This technical training is often resolved with explosive movements during the upward rupture, in particular when accompanied by solid fundamental motors such as target massive addresable market chain targets.

The most encouraging aspect of the technical configuration is the robust defense of the support area from $ 12,442 to $ 13.186 thanks to several tests.

The Blue Arrow target projection targets $ 26.094, representing a doubling of the current levels as a function of the measurement of the height of the triangle and the projection up of the rupture point.

This target aligns closely with the previous levels of resistance, suggesting that the market has identified this area as a realistic objective given the expansion role of Chainlink in the tokenization ecosystem.

The weekly deadline also provides even more convincing evidence of a major bullish movement, with links consolidating in a large symmetrical triangle after its peak around $ 29 at the end of 2024.

Momentum indicators show an upward divergence, prices forming lower prices while the oscillator is higher and recently broke over its bearish phase.

This model of weekly divergence is particularly powerful because it often precedes major trend inversions or major breakthroughs, which suggests that the link constitutes energy for a substantial advance.

The convergence of multiple mobile averages around current price levels indicates a major directional decision -making point. Any escape above the resistance zone of $ 15 to 16 could trigger a measured movement around $ 20 to $ 25 initially.

The ultimate objective could go back to the previous heights nearly $ 29 to $ 30 if the tokenization thesis is gaining ground and ChainLink successfully captures a significant market share from the opportunities of not suspended assets at 260 billions of dollars.

Overall, the technical structure suggests that although short -term volatility remains possible, the longer term configuration strongly promotes an upward resolution.

The market for not suspended assets with a post -chain eyes of $ 260 billion – can reach $ 30 on the success of the CCIP? appeared first on Cryptonews.