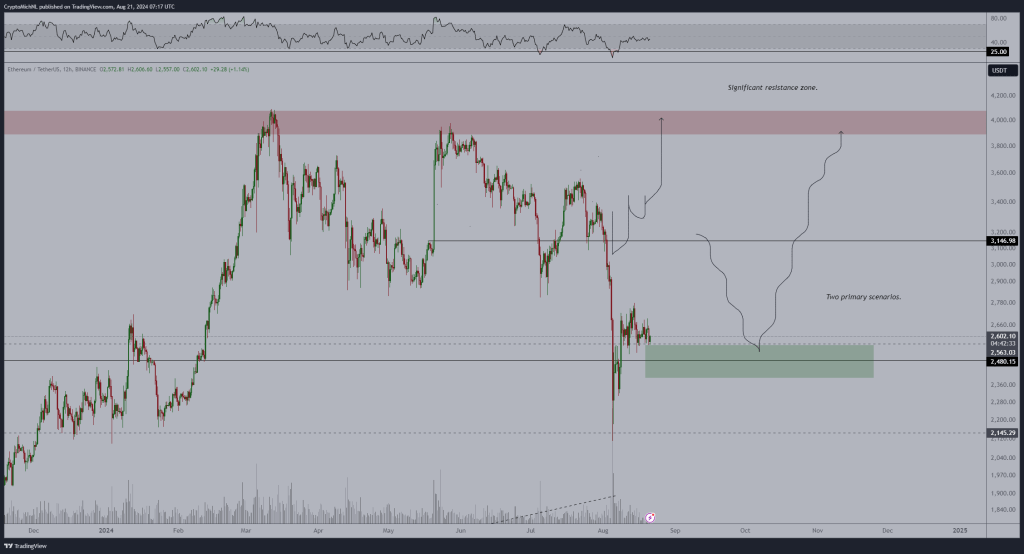

Ethereum, like most altcoins, is under significant selling pressure and is struggling to recover from the weakness seen in early August. While there have been flashes of strength after the decisive sell-off on August 5, prices are still below $2,800.

The only bright spot so far, at least looking at the daily chart, is the bulls’ impressive resilience. Despite the wave of lower lows, buyers have absorbed the deluge of selling pressure, keeping prices above the $2,500 mark.

The bearish formation remains, however, but one analyst believes that rejection of prices below $2,500 is essential.

Ethereum bulls need to keep prices above $2,500

In an article on X, the analyst said Bulls need to keep Ethereum above $2,500 for the uptrend to continue. The round number, which looks at price action on the daily chart, marks the base of the bull flag.

Related Readings

Over the past few days of trading since the August 8 peak, Ethereum has been trading below the $2,700 and $2,800 resistance areas. At the same time, support remains clear at $2,500. As price action consolidates, a bull flag has formed, signaling strength.

According to the analyst, if buyers hold $2,500 as an anchor, Ethereum is likely to soar, reaching $3,150 in the next session. The recovery is welcome, given that the sell-off from August 1 to August 5 was a bearish breakout formation. This sell-off broke through critical support areas from April to July 2024.

Impact of Spot ETFs and growth of the ecosystem

The analyst added that the surge is likely due to capital flowing into Ethereum spot ETFs. Since the approval of spot ETFs in July, institutions have been keen to find exposure.

Speaking to X, an ETF analyst Remarks Capital inflows now exceed $2 billion, not including outflows from Grayscale’s ETHE. During this period, BlackRock’s iShares Ethereum ETF has boosted demand.

Beyond the influx of Ethereum spot ETFs, Vitalik Buterin think There have been some positive developments that could support prices. These include lower gas fees on the main network and through Tier 2 solutions like Base.

Related Readings

Additionally, the co-founder noted that Arbitrum and Optimism’s decentralization efforts are massive. Arbitrum and Optimism recently announced their error-proofing systems. However, Optimism reverted to a centralized error-proofing system after an audit report, which helped fix the flaws.

Main image of DALLE, chart from TradingView