Key notes

- Bitcoin gathers at $ 107,000, driven by ETF inputs and weaken the long -term holder’s profits.

- Bitfinex warns to discolor the momentum, because objects and MacDs show signs of exhaustion.

- Bulls have objectives of $ 140,000 via FIB levels, but macro catalysts like Fed policy will probably dictate the next escape.

After having briefly exceeded $ 107,000 with a leap of 13% of the volume of exchanges, the largest cryptocurrency in the world could target $ 140,000, but the road to come may not be as simple as Bitcoin

BTC

$ 106 728

24h volatility:

0.7%

COURTIC CAPESSION:

$ 2.12 T

Flight. 24 hours:

$ 21.85 B

Investors expect.

Long -term holders show resilience, but professions to profit

Analyst Darkfost pointed out that the unrened profits of long -term holders (LTH) have regularly decreased and are now approaching the levels observed for the last time during the October 2024 correction.

However, with an average profit not made of around 220%, against 300% and 350% in previous cycles, there is still room for the rise. Darkfost noted that to reach the profit levels comparable to previous peaks, Bitcoin should reach $ 140,000.

📉 The unrealized profits of the LTH continue to lower and now approach the levels observed for the last time during the correction of October 2024.

The unrealized average profit, based on the MVRV ratio, is currently about 220%.

It may seem high for BTC, but compared to the previous one … pic.twitter.com/netcmxzvty

– Darkfost (@darkfost_coc) July 1, 2025

The price made for long -term holders is now at $ 39,000, strengthening that most LTHs remain deeply in profit and cannot continue to hold that if a parabolic movement materializes.

Bitfinex: discoloration of the momentum, probable consolidation

Bitfinex analysts, however, offered a more prudent perspective. In their latest market report, they noted that the momentum begins to decline after a rally of almost three months which pushed Bitcoin by more than 41% compared to its $ 73,273 stockings.

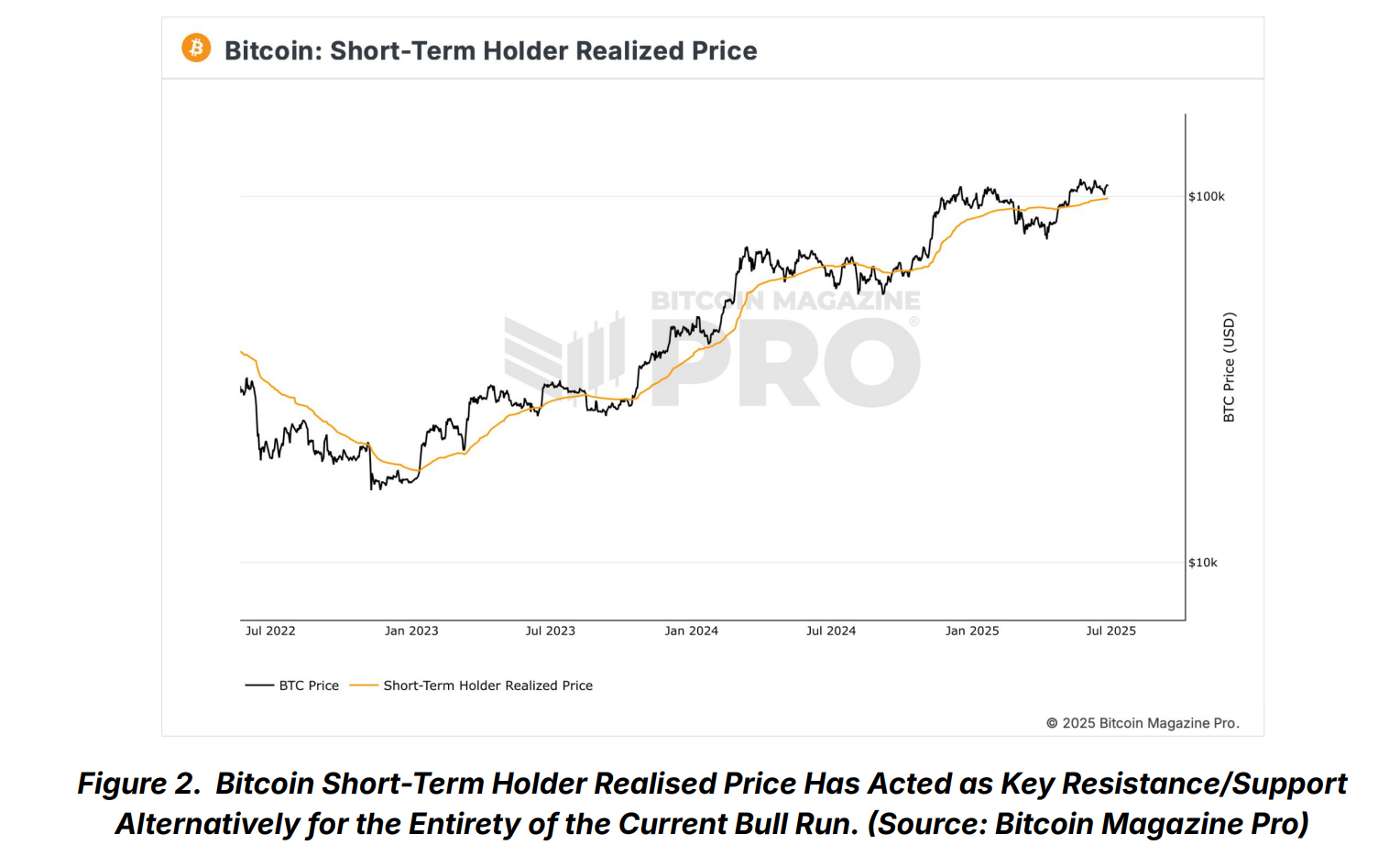

“For the first time in this upward trend, the momentum began to fade,” they said, adding that the chain data point to a reduced point of purchase and an increase in profits, especially among short-term holders who have penetrated positions below $ 80,000.

BTC SH Price produced | Source: Bitfinex

The command flow data indicates that Bitcoin can enter a consolidation phase rather than preparing for another vertical rally, according to Bitfinex.

FNB entries and macro-factors are always favorable

Despite signs of exhaustion, institutional appetite remains strong. In the United States, FNB Bitcoin experienced 15 consecutive days of net entries, totaling $ 4.75 billion on June 30.

On June 30, the Bitcoin Spot ETFs experienced a total net of $ 102 million, marking 15 consecutive days of net entries. The ETHEREUM SPOT ETFs recorded a total net influx of $ 31.76 million, the nine ETFs showing no outing.

– Wu Blockchain (@wublockchain) July 1, 2025

Economist Timothy Peterson described the $ 2.2 billion entries last week as “massive”, expecting the positive sequence to continue and potentially supports prices.

Massive entries in American FNB Bitcoin last week!

$ 2.2 billion!

This has been ranked among the first 10 weeks since creation.

70% chance next week will also be positive, which is generally correlated at prices upward pressure. pic.twitter.com/m8x9Sy9dvo– Timothy Peterson (@Nnsquaredvalue) June 29, 2025

Eyes are now on the next interest rate decision of the federal reserve on July 30. The lower rates generally promote risk assets such as Bitcoin, although current market estimates suggest only 19% of reduction.

Technical perspectives: key levels of fibonacci in play

As visible on the daily graphic, Bitcoin is currently negotiated near the level of 0.786 Fibonacci at around $ 108,000, a crucial resistance area.

If this level is decisively broken, the next main fibonacci objectives is at a FIB extension of 1.618 ($ 118,275), an FIB 2.618 ($ 130,538) extension and 3.618 FIB extension ($ 142,801).

Bitcoin OBV, MacD indicators on the 1D graph | Source: tradingView

On the other hand, the support levels are near the 0.618 ($ 105,000) and the psychological barrier at $ 100,000.

The volume of balance (OBV) remains stable, which suggests that despite taking advantage, there is no mass exodus of the asset. However, the MACD shows the first signs of a potential lowering crossing, indicating a possible short -term weakness.

following

Non-liability clause: Coinspeaker undertakes to provide impartial and transparent reports. This article aims to provide precise and timely information, but should not be considered as financial or investment advice. Since market conditions can change quickly, we encourage you to check the information for yourself and consult a professional before making decisions according to this content.

Cryptographic journalist with more than 5 years of experience in the industry, Parth has worked with the main media in the world of crypto and finance, the collection of experience and expertise in space after having survived bear markets and bulls over the years. STHTH is also an author of 4 self-published books.

Parth Dubey on LinkedIn