Key notes

- Dogecoin increased by 9% to direct the top 10 cryptos, driven by the optimism of ETFs and the activity of heavy derivatives.

- Open interest jumped from 13.16% to 3.82 billion dollars, signaling an aggressive speculative positioning beyond the gains in the cash market.

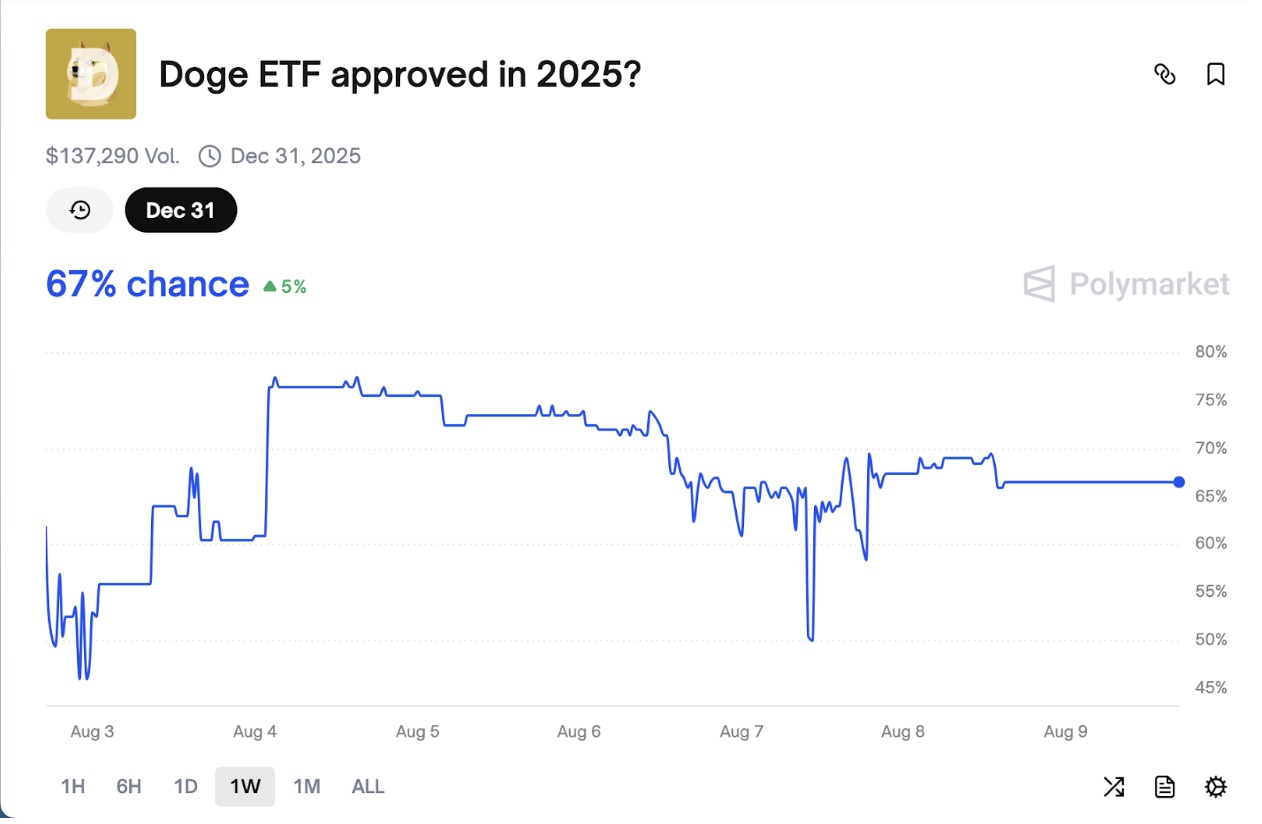

- Polymarket data show that FNB approval ratings up 5%, more fueling bullish feeling and trading volumes. .

Dogecoin jumped 9% on Saturday August 9, exceeding the level of $ 0.25 for the first time in 14 days dating from July 27. Dogecoin has passed Ethereum to emerge as the best performer among the Top 10 cryptocurrencies by market capitalization.

The Dogecoin price rally was fueled by a combination of optimism linked to FNB and a strong increase in the speculative negotiation activity.

DOGUOIN ETF Approval Cotes on August 9, 2025 | Source: Polymarket

The feeling of the market improved following a 5% increase in confidence concerning the potential approval of a DOGECOIN ETFAccording to real -time data from Polymarket of the prediction market. This increase increased the approval ratings to 67% at the time of the press, adding momentum to a wider market rally already in motion, sending DOGE above its 14-day mobile resistance level.

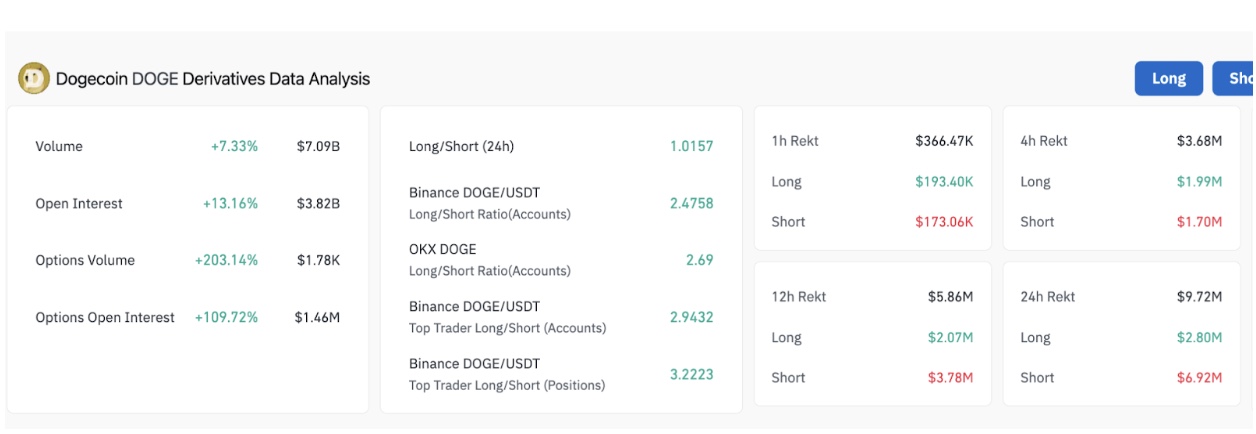

Dogecoin derivative market analysis, August 9, 2025 | Rinsing

Dogecoin derivatives exchanging measures in the past 24 hours reflected this increase in the bullish appetite. As in the Coiglass table aboveOpen interest jumped from 13.16% to 3.82 billion dollars, exceeding the rate of cash prices and signaling that leverages are positioned for more increase.

The long / short ratio through Major exchanges In addition, confirmed bullish prejudices. On Binance, the long / short global ratio based on the accounts amounted to 2.47, while the Top Traders held an even more aggressive bull ratio of 3.22. The same feeling was reflected on OKX with a 2.69 report.

Liquidations in the past 24 hours have totaled $ 9.72 million, biased to short films with $ 6.92 million in the long -term dollars for long. This confirms that the short compression effect probably propelled the last escape from Doge prices to $ 0.25.

Dogecoin price forecasts: Bulls Eye 0.268 $ escape target

Technically, Dogecoin has decisively broken above the Mid-Bollinger group and a mobile average of 50 days to $ 0.225, in pace to display four consecutive daily earnings. As we can see below, the next resistance of the major general costs of DOGE is now at $ 0.26, marked by the Bollinger upper band, a level not seen since the end of July.

Dogecoin derivative market analysis, August 9, 2025 | Rinsing

The daily RSI is 61.39, reflecting a strong momentum while still being shy excessive conditions. Given that the main assets like Ethereum and Solana have already called for new monthly calendar peaks, short-term strategic traders can consider the undervalued Dogecoin price, despite its current signals.

A daily fence greater than $ 0.243 with a sustained volume could see DOGE push towards $ 0.258 as provisional resistance, before releasing the top of the 0.268 strip. An escape greater than 0.268 would open the door to a rally around $ 0.285, where the preliminary sales pressure gains crowned last month.

Failure to comply with the support of $ 0.225 could see a decline at $ 0.211, the mid-range of the recent rally. A drop below $ 0.211 would expose the Bollinger strip lower than $ 0.182, effectively efforcing current monthly gains in the monthly calendar.

However, this scenario currently seems unlikely. The positions of Dogecoin derivatives have greatly biased for a long time and the intraday rally of 2% bitcoin at $ 117,900 on Saturday, After Harvard took a 26 million dollars participation in Blackrock Ibit BTC Etftriggering an upward freshness.

following

Non-liability clause: Coinspeaker undertakes to provide impartial and transparent reports. This article aims to provide precise and timely information, but should not be considered as financial or investment advice. Since market conditions can change quickly, we encourage you to check the information for yourself and consult a professional before making decisions according to this content.

Ibrahim Ajibade is a seasoned research analyst with training by supporting various web3 and financial organizations. He obtained his undergraduate diploma in economics and is currently studying for a master’s degree in blockchain and distributed major book technologies at the University of Malta.

Ibrahim Ajibade on LinkedIn