Main to remember

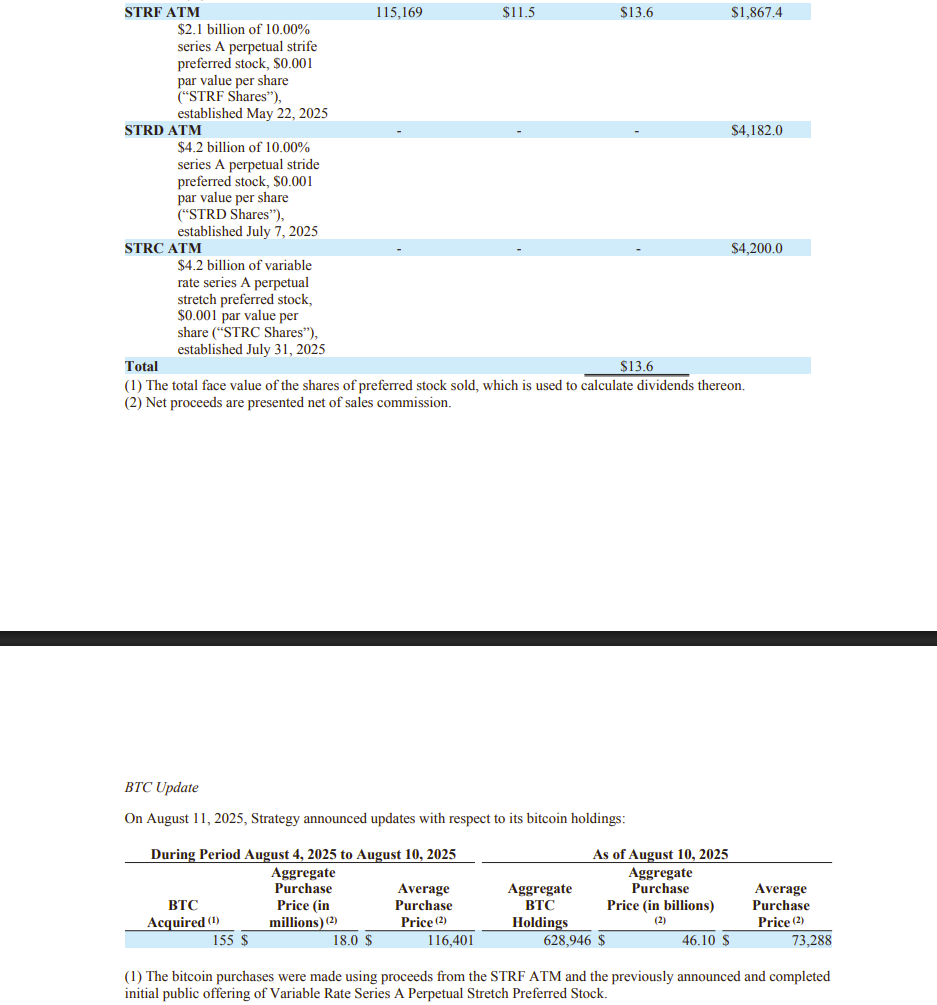

- The strategy bought an additional 155 bitcoin for $ 18 million, increasing its digital assets.

- The acquisition price is equivalent to more than $ 116,000 per Bitcoin.

Share this article

Strategy, the largest holder of the Bitcoin company in the world, resumed its acquisition of the BTC. The company announced on Monday that it added 155 BTC to its treasure last week, its smallest purchase since mid-March.

Michael Saylor, the executive president of the company, left an index on the acquisition yesterday. When Saylor publishes Bitcoin Tracker, he is often followed by an ad in a few days.

If you don’t stop buying Bitcoin, you don’t stop making money. pic.twitter.com/g9s2gpo1t8

– Michael Saylor (@saylor) August 10, 2025

The last purchase, disclosed in a dry file, was made at an average price of $ 116,401 per BTC. Bitcoin briefly recovered $ 122,000 earlier in the day, according to TradingView.

Following the purchase, the BTC Holdings strategy increased to 628,791 BTC. The BTC now negotiating at around $ 119,500, the reserve is estimated at more than $ 75 billion, giving the Company of unrealized winnings of approximately $ 29 billion.

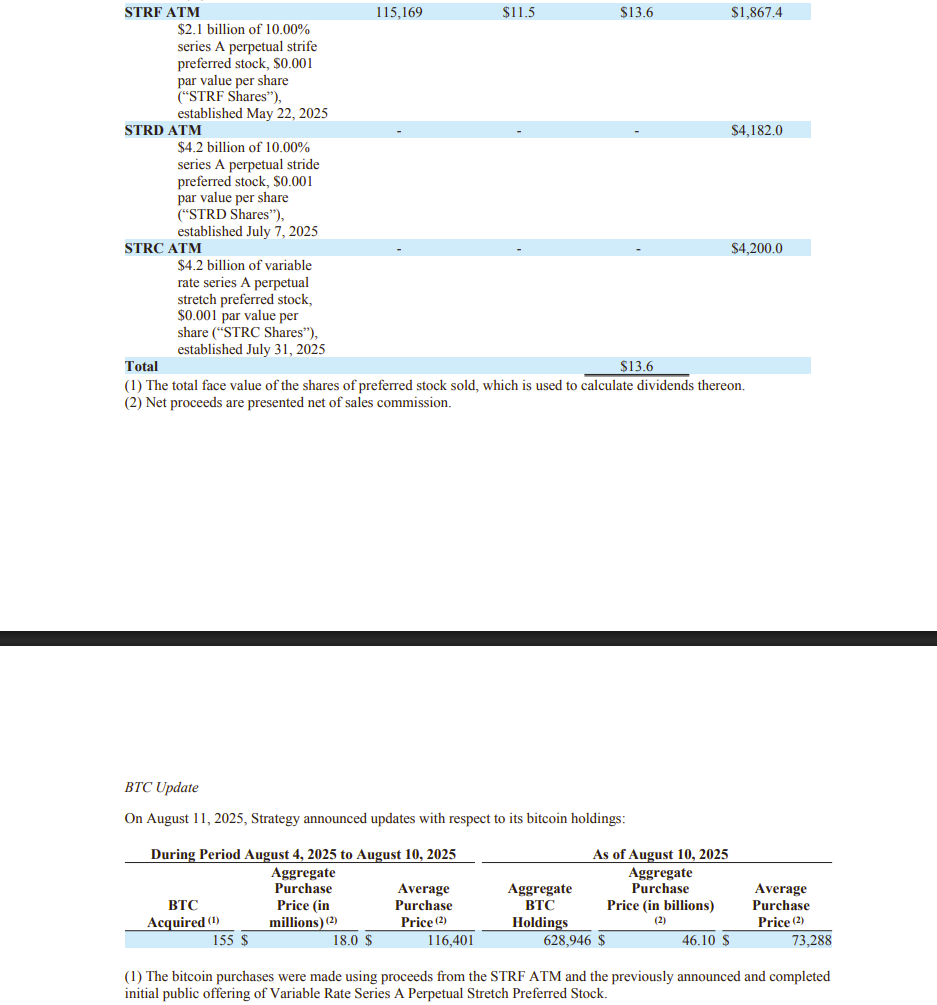

The strategy has financed its latest acquisition with the product of the sale of privileged shares of the A perpetual Strife series (STRF) and the IPO ended in the series at variable rate A between August 4 and 10, it sold more than 115,000 STRF shares, reports more than $ 13 million in net products.

The strategy could potentially accumulate up to 7% of the world Bitcoin supply, as indicated by Saylor. However, he insists not to aim for total domination, emphasizing a model that promotes decentralized participation in Bitcoin.

Saylor ardently supports the growth in the adoption of Bitcoin companies and the ethics of decentralization of the cryptographic ecosystem.

Share this article