Skycrest Capital, a world leader in the management of AI assets, has today announced a major upgrade of its owner sax system (Skyalpha X Institutional Core), officially raising it in an inter-industry structured intelligence platform. Industry observers see this as a disruptive leap for AI technology on world capital markets and the allocation of multi-industrial resources.

From commercial engine to strategic nucleus

Originally launched in 2021, Sax-Iceora began as a high performance and high performance quantitative execution system, capable of identifying the possibilities of high frequency trading and verifiable trading in perpetual cryptographic contracts, American actions and ETF rotation strategies, allowing users to achieve substantial yields on volutile markets.

With this upgrade, Sax-Icore has gone from a “high performance trading engine” to a structured decision center in the transversal industry, now offering:

– Global management of multi-network capital management and strategies

– structural recognition and monitoring of cross -time markets in real time and trends monitoring

– instantaneous interpretation and quantitative cartography of international policies and macro events

– Business finance, supply chain and optimization of the operational structure

– legal and compliance automated audits (including cross -border activities)

– School and capture of the signal from information sources, plus risk alerts

The CEO of Skycrest Capital commented:

“Sax -Ilem is no longer just a merchant tool – it is an intelligent nerve center for management teams, decision -makers and political decision -makers.

Skycrest’s R&D head noted:

“This type of long-term, stable and institutional institutional capital corresponds perfectly to the structured capture capacities of the sax-idiot. The system can identify the signals at the early stages of world capital flows and automatically adjust asset allowances via its AI models. ”

Institutional access and strategic partnerships

For the first time, Sax-Iceora will open the API interfaces of institutional quality to qualified strategic partners, with the first wave, in particular:

– Global investment banks and asset managers

– Setting -based payment and payment platforms

– Energy and Commodities Trading Enterprises

– high -tech manufacturing groups and supply chain management

SKYCREST aims to build a global IA decision -making network, providing partners with advanced structured solutions to critical points of capital flow, industrial deployment and political response.

IPO plans and market attention

Skycrest Capital also announced that Sax-I public will go public in November 2025.

The news aroused significant interest from individual institutions and investors.

Currently, the institutional version of Sax-Icore has generated $ 500 million in cumulative revenue and has been adopted by several global global financial institutions. The personal version will be launched in November, with priority purchase rights granted to advanced Skycrest Capital members.

Analysts believe that this decision will not only expand the market share of the Sax-I-love, but will also promote a new interactive ecosystem between individual and institutional investors, accelerating the adoption of the management of AI active ingredients.

Data security and compliance framework

Another highlight of the upgrade is complete integration with dry, Finra and several international financial regulators.

All trading suggestions, execution newspapers and system capital flows are fully traceable and encrypted to meet regulatory jurisdictional standards.

Skycrest’s compliance director said:

“Our customers not only hunt yields – they want safety, compliance and sustainability.”

Global expansion and vision

Skycrest Capital has created operational and R&D centers in New York, London, Singapore and Dubai, with plans to make a strategic expansion on Asian and Middle East markets by 2026.

Dr. Ethan Carter stressed in an interview:

“We are considering Sax -Icore in the main global decision platforms – not only operating on exchanges, but actively shaping decisions in conference rooms, international negotiations and government planning offices.”

About Skycrest Capital

Founded in 2020 and whose headquarters are in Manhattan, New York, Skycrest Capital specializes in multi-network management focused on AI and global strategic investment. Its sax-idiot system is renowned for high power and an inter-industry structured analysis, serving individuals with high content, family offices, multinational societies and government institutions.

Recording and compliance information

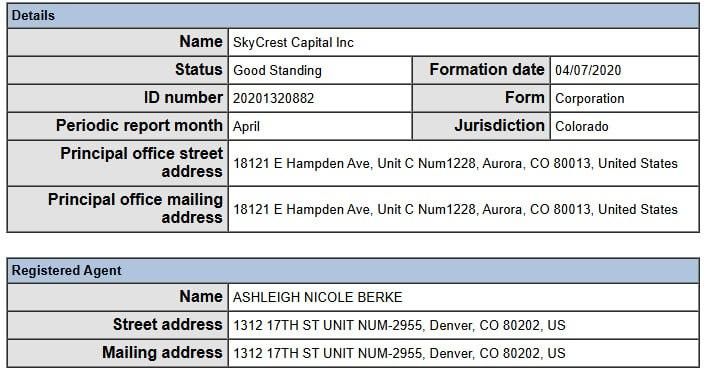

SEC Deposit: Skycrest Capital Inc. registered with the Securities and Exchange American Commission

CIK: 0002069870

Type: D | Act: 33 | File number: 021-547038 | Film number: 25979412

Address: 18121 e Hampden Ave, unit C NUM1228, Aurora, CO 80013, United States

Business recording:

State: Colorado

Date of incorporation: April 7, 2020

Registration number: 20201320882

Status: rule

Registered agent: Ashleigh Nicole Berke

Agent address: 1312 17th st unit num-2955, Denver, CO 80202, United States

This registration and deposit framework provides Skycrest Capital with the legal and compliance foundation for global operations, laying the basics of international Sax-I-I-IP and the next IPO.

Notice of non-responsibility: The information provided in this press release is not a request for the investment, nor investment advice, financial advice or commercial advice. It is strongly recommended to practice reasonable diligence, including consultation with a professional financial advisor, before investing or negotiating cryptocurrency and titles.