Development Corp. (NASDAQ: DFDV) has expanded its Solana holdings to a new major purchase, adding 110,000 soil at an average price of $ 201.68, worth around $ 22 million.

The acquisition increases the total balance of the company to 1,420,173 Sol and Sol equivalents, valued at around 273 million dollars.

This decision postponed the key performance metric of the company, soil per share (SPS), to 0.0675, an increase of 9% since August 4 and a leap of 48% in last month. SPS in US dollars are now $ 13.02.

Development Corp is expanding Sol Treasury with a new purchase, marked out all new participations

According to an article on X, the company said: “This last purchase means that soil by DFDV share increased by 48% in the last 30 days”, confirming that all newly acquired soil are immediately set up. “We earn the performance while securing the Solana network.”

The first company listed on the stock exchange to fully build its cash strategy around Solana, Development Corp. was on a regular accumulation path throughout 2025. In July, he reached the symbolic milestone of holding 1 million soil after buying 141,383 tokens for around $ 19 million.

To finance the acquisitions, the company draws from a credit line of $ 5 billion, although only 0.4% has been used so far.

The latest purchase marks another stage of the company’s long -term plan to hold and aggravates its Solana position by staunch rewards and Validators’ revenues.

The soil “Impentiment All” unlocked is currently marked out, spread over several validators, including Defi Development Corp. The company also obtains revenues from third -party delegators using its infrastructure.

Like the other players of the Crypto Treasury, the model makes comparisons with the Bitcoin strategy of Michael Saylor. However, 1 managers highlights the advantages of the design of the proof of Solana.

“Sol is a more productive asset than Bitcoin because it can earn stimulation awards,” said the company in previous statements.

In the second quarter, Defu Development Corp. said $ 1.98 million in income, up $ 400,000 a year ago and a net profit of $ 15.4 million against a loss of $ 800,000 in the previous year.

The company estimates that its network of validators generates an “annualized organic return” of 10%, or about $ 63,000 per day, in terms of soil, depending on its assets.

Growth also came from the scaling of its validator, obtaining a larger third party delegation and project management validators based on Solana, including the same Dogwifhat.

The partnership shares to mark the awards with the community. “The institutions direct infra. Degens run vibes. We are running both, “joked the company to announce the launch of the official Dogwifvalidator”.

Beyond his own treasure, Defu Development Corp. Launched the DFDV Treasury Accelerator, a global franchise style program designed to help partners establish their own Solana reserves. In return, the company takes action in shares in these local companies, expanding its influence through the network.

The accumulation strategy was supported by institutional financing. In July, the company closed an increase in convertible debt of $ 122.5 million led by Cantor Fitzgerald. The product has been used to strengthen its soil position and expand operations.

Institutional demand for Solana increases while Holdings crosses $ 1 billion

The institutional appetite for Solana is accelerating, several public companies adding major positions in recent weeks. In July, Bit Mining announced its intention to raise $ 200 million to $ 300 million for the conversion of the Solana Treasury.

However, this month, the company entered the market, buying 27,191 soil for $ 4.5 million and launching its own validator to generate implementation.

Upexi, owner of a brand focused on the supply chain, extended its assets from 735,692 soil at the end of June to more than 2 million tokens after having collected more than $ 200 million for additional accumulation.

Development Corp., now among the best institutional holders, is committed to marking most of its reserves through a network of validators, including its own. Formerly a real estate financing company, the company has passed the management of cryptographic cash flow following its acquisition by former managers of Kraken, making its first floor purchase in April.

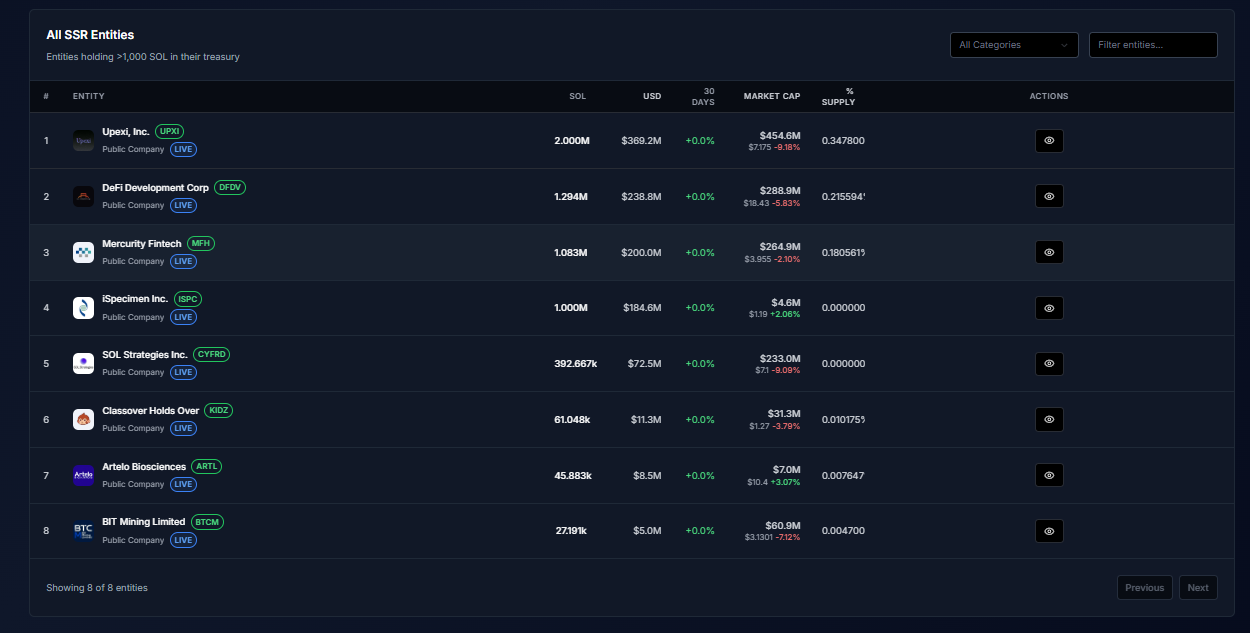

According to the Solana Strategic Sol Reserve Tracker, eight institutional entities now collectively hold 5.9 million soil, or around 1.09 billion dollars, which represents 1.03% of the total supply.

The Upexi leads with 2 million soil ($ 369.2 million), followed by Defu Development Corp. With 1.42 million soil and Mercurity Fintech with 1.08 million soil. The growth of the reserve increased sharply from August 14, ending weeks of flat accumulation.

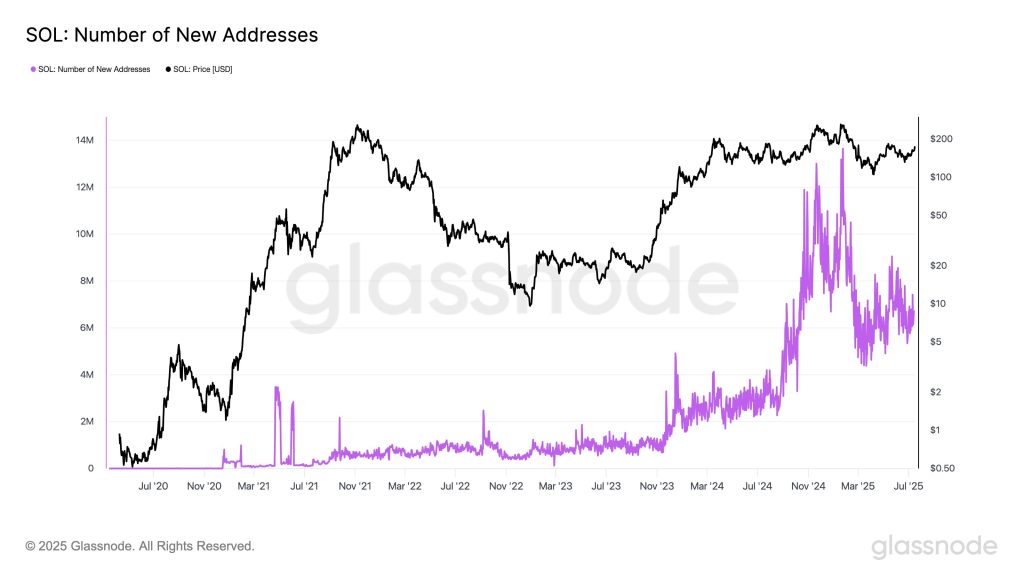

Glassnode chain data point to both detail and “smart money” for rally demand. New addresses transacted in soil for the first time have increased by 51% since August 3, while portfolios holding more than 10,000 soil reached a summit of 5,224.

Solana has also exceeded Ethereum in the perpetuals’ negotiation volume 24 hours a day and leads all blockchains in the daily start of Stablecoin, with total stablecoin capitalization greater than $ 12 billion.

Solana briefly affected $ 205 this week before retreating to $ 186.78, down 4.5% in the last 24 hours, but on the wider cryptography market.

Analysts look at the level of $ 200 as a key threshold for potential trips to $ 250, supported by a high demand for ignition and an increase in FNB entries.

The post Development Corp is betting on 273 million dollars on 110k Solana while soil per bothersome 48% action appeared first on Cryptonews.

50/50 awards with the

50/50 awards with the  Speed, security, memes

Speed, security, memes RUP:

RUP: