The main dishes to remember:

- Toyota Blockchain Lab presents the Mobility orchestration network (Mon)Built on Avalanche (AVAX), to fill the data, regulations and industry silos in mobility.

- The system brings together institutional, technical and economic evidence in an identity based on blockchain for vehicles, allowing financing, insurance and cross -border use.

- If it is deployed beyond the prototype stage, my could transform the way in which car manufacturers, regulators and service providers coordinate on a global scale, while increasing the adoption of the real world of Avax.

Toyota, the largest car manufacturer in the world with more than 10.8 million vehicle sales in 2024, is Expand your blockchain imprint. Thanks to its R&D arm, Toyota Blockchain Lab, the company has unveiled a new framework: Mobility orchestration network (Mon)aimed at creating a digital layer with confidence for global mobility systems.

Toyota Push blockchain: cars with cryptographic infrastructure

Mobility activity is evolving at a huge pace. Electric vehicles (electric vehicles), automated drivers and the increase in costs cause industry to be repeated in the way the value is captured and shared, between car manufacturers, insurers and regulators. The pattern behind Toyota using the blockchain is to link what was once a broken ecosystem together using the missing blockchain fabric.

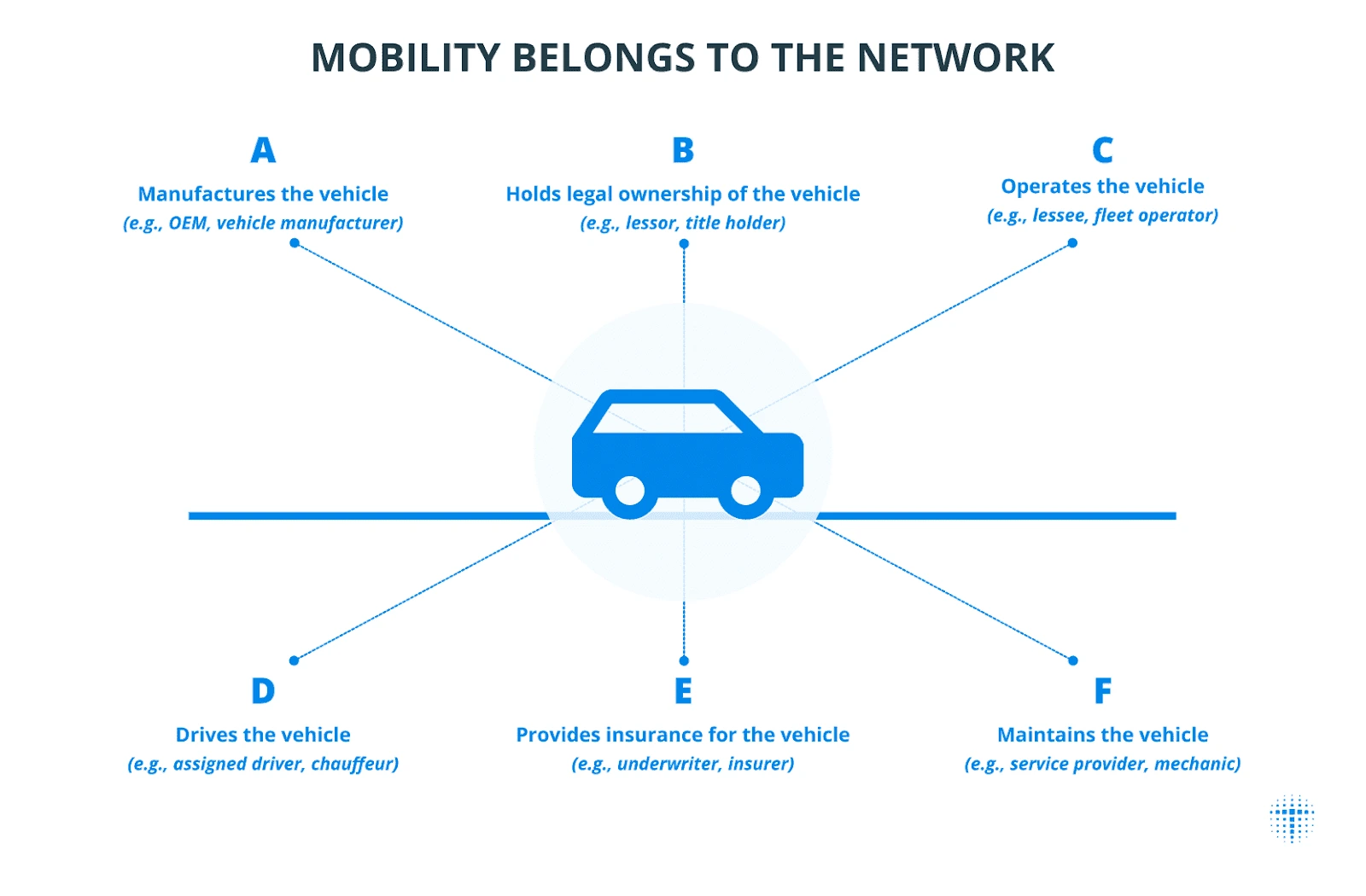

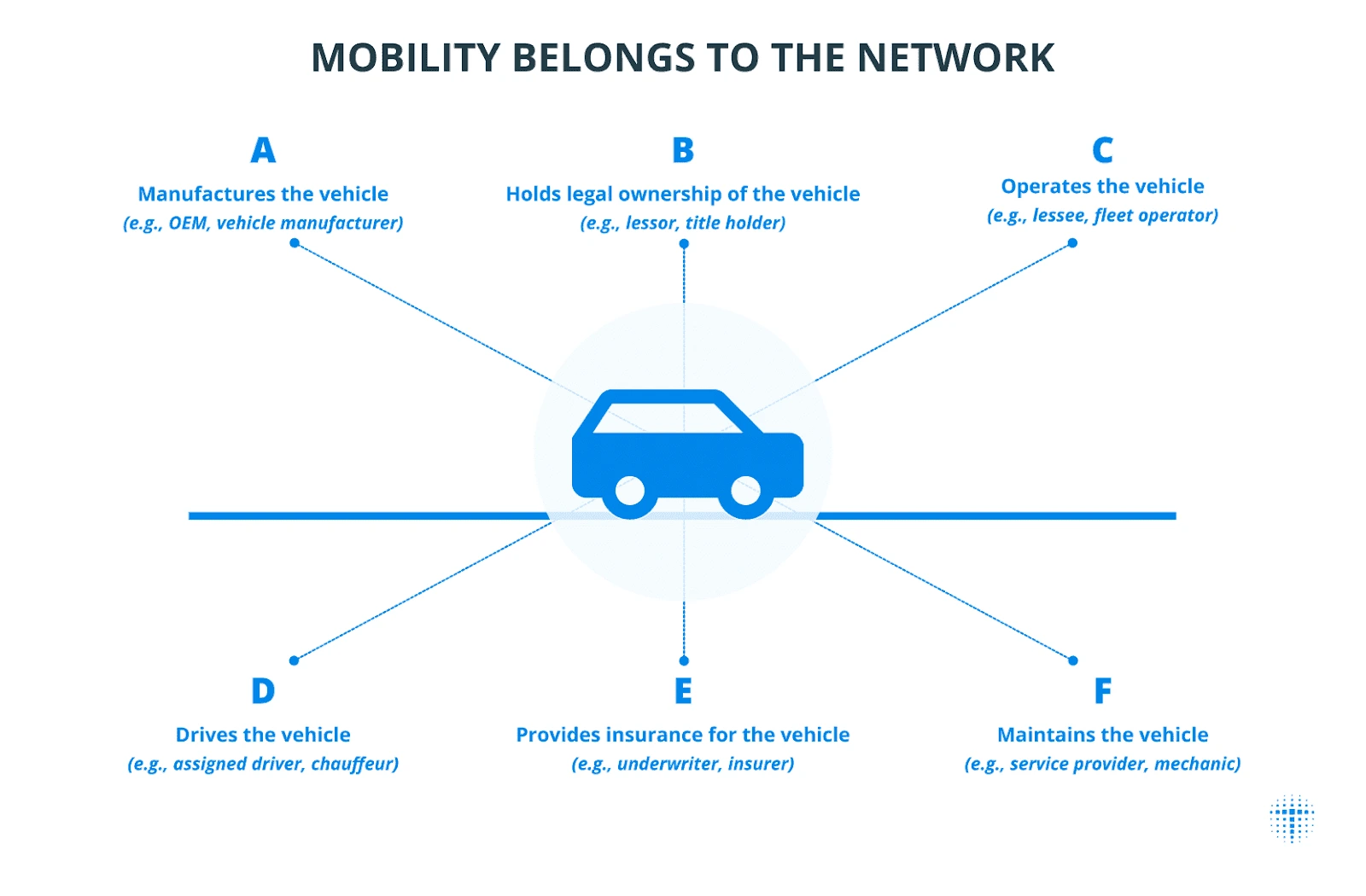

On the date of announcement on August 20, 2025, the Lun prototype is conceptualized to mediate relationships that support ownership of vehicle mobility, compliance with insurance, taxation, evidence of security audits and operational data. Rather than treating cars as isolated objects, one in terms of mobility as a network of verifiable relationships between several stakeholders.

This system is not only experimental. Toyota emphasizes the MO in response to three structural challenges in mobility:

- Organizational ditch – Vehicle data is locked in separate silos between agencies and businesses.

- Industrial ditch – No open and interoperable network exists to connect car manufacturers, insurers, financiers and service providers.

- National ditch – Regulations, tax systems and insurance plans vary according to the country, which complicates the recognition of cross -border assets.

Aiming to automate the interaction of vehicles and services, Toyota aims to digitize relationships thanks to the use of the implementation of “trusted channels based on blockchain: which minimize the use of paper procedures and invisible databases.

Why Avalanche? Multi-chaînes speed, scale and flexibility

Toyota chose Avalanche (Avx) as blockchain, under which its “Mon” will be built because of its low latency consensus, its multi-chain structure and its integrated interoperability solutions. Unlike the Ethereum single chain congestion model, Avalanche allows the creation of layer 1 (L1) networks specific to the user needs of use.

For the prototype of my, Toyota described four L1 interconnected:

- Security token network – to issue titled assets supported by mobility portfolios.

- Mobility Trust Network (my himself) – For property rights and evidence.

- Public service network – For daily mobility services such as ruin, EV burden and access rights.

- Stable network – For payments, service costs and income distribution.

The design makes financial flows, operating data and regulatory evidence to synchronize modular. These networks are connected via Interchain messaging protocol (ICM) Created by Avalanche and allow secure inter-chain messages as well as the Atomic Delivery-VS (DVP).

Read more: dry repels the decision on Avalanche and Cardano de Graycale and Cardano Etf

How the mobility orchestration network works

Basically, my numeralizes confidence in cars in three pro -proof evidence:

- Institutional proof – titles, registrations, compliance with insurance and tax status.

- Technical proof – Vehicle identification numbers (wine), OEM manufacturing data, micrologetal certificates and checked maintenance records.

- Economic proof – Rate of use, income performance and activity recording.

The aggregation of this evidence in a so-called Account oriented on mobility (MOA). My creates a vehicle identity from a blockchain

Fungibility scale – Transforming cars into negotiable assets

To release finance, my employs a “fungibility scale”:

- Property like nft – The MOA of each vehicle is linked to a non -bubble token.

- Wallet – Gather several vehicles in semi-fongible wallets for risk assessment.

- Safety tokens – Establishment of fungible financial instruments and in accordance with the regulations supported by these portfolios.

What this transformation means is that capital costs can be reduced by the securing fleets of electric vehicles, robo-taxis or logistics vehicles, then exchange them in a simple and transparent way.

Read more: Best NFT markets: 11 Top 11 platforms to buy and sell NFTS in 2025

Applications through mobility and finance

Toyota plans to overcome a number of real mobility finance obstacles:

- EV fleets on emerging markets – Provide verifiable files on the channel to attract foreign investments in the adoption of HIV at high cost.

- Autonomous taxis – Offer investors operational and security files transparent to financial deployment.

- Network vehicle services (V2G) – The monetization of Bev fleets as distributed energy storage agents, with the health of batteries and green energy evidence.

- Green logistics – The grouping fleets and their validated emission data to issue security tokens on the theme of the ESG.

The scenarios show how Lun can reduce reasonable diligence costs and offer standardized data in cross -border funding.