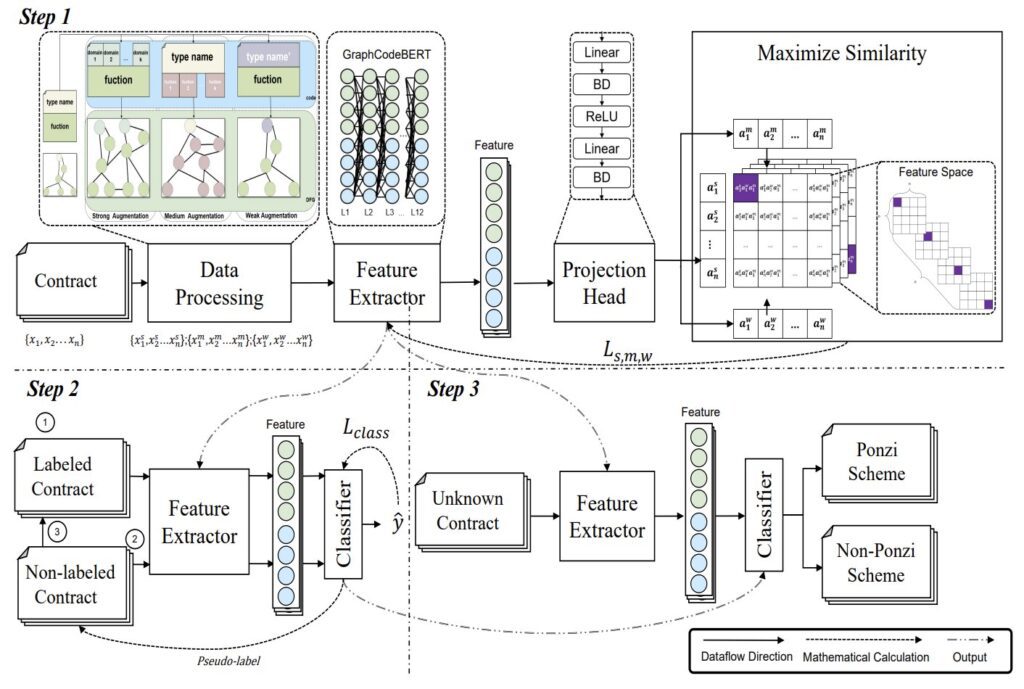

The global framework: Step 1: Form the model functionality extractor with a predefined self-supervised representation learning framework using unmarked data. Step 2: The classifier is trained jointly using labeled data and not marked in extract the functionalities via a functional extractor. Step 3: Enter the unknown intelligent contract in the functionality coder formed to extract features and enter them in the classifier formed to complete the classification task. Credit: arxiv (2025). DOI: 10.48550 / Arxiv.2507.16840

Blockchain technologies are digital systems that work by distributing copies of information on several computers, also called nodes, which are all connected to a common network. These technologies underpin the trading of cryptocurrencies, as well as the functioning of other emerging digital services.

Although Blockchain technology opens up new opportunities for cryptocurrency trade, digital arts and other digital assets, they are also often used for fraudulent activities. Perhaps more particularly, they are now widely used for fraudulent investment diets called Smart Ponzi plans.

In a Smart Ponzi program, individuals are invited to invest in digital currencies or specific assets and to sign a supposedly intelligent contract which automatically draws money regularly. Their investments could initially seem fruitful, but the first investors are in fact paid with the money invested by new people. After a while, the entire system collapses, because there are no longer enough resources to pay all investors.

In recent years, computer scientists and financial security experts have attempted to design strategies to automatically detect these fraudulent diets. Until now, most of the solutions developed are based on in -depth learning algorithms formed to identify the models associated with Smart Ponzi diagrams in blockchain transactions.

Despite their promise, to perform well, these techniques based on in -depth learning must be formed on large data sets containing blockchain transactions labeled by human experts. Since the labeling of this data requires significant time and resources, existing solutions may not be ideal for reliable detection of Smart Ponzi diagrams in real world parameters.

The University of Electronics and Technologies of China, the University of Macao of Macao and the University of Technology of Swinburne have recently developed Casper (contrastive approach for Smart Ponzi Deteter), a frame based on in -depth learning which can detect intelligent Ponzi diagrams with good precision without requiring labeled training.

This new technique, introduced in an article published on the arxiv Preprint Server is based on models that can learn to detect these fraudulent activities by comparing the similarities and the differences between the different blockchain transactions.

“The traditional methods of detecting Ponzi patterns based on in -depth learning are generally based on fully supervised models, which require large amounts of labeled data,” wrote Weija Yang, Tian Lan and their colleagues in their article. “However, these data are often rare, hampering an effective model training. To meet this challenge, we offer a new contrasting learning framework, Casper (contrastive approach for Smart Ponzi Detect with more negative samples), designed to improve the detection of the Ponzi School diagram in blockchain transactions.”

To collect signs of Smart Ponzi diagrams in blockchain, Yang, LAN transactions and their colleagues used an approach known as contrastive learning. It is a automatic learning technique through which a calculation model learns to distinguish different things by comparing them.

“By taking advantage of contrastive learning techniques, Casper can learn more effective representations of the smart contract source code using unmarked data sets, considerably reducing both operational costs and system complexity,” the researchers wrote.

The team assessed the new PONZI program detection technique in a series of tests, in which it was fed by blockchain transactions from a set of data accessible to the public. Their framework has notably worked well, despite its training on a limited amount of labeled data.

“We evaluate Casper on the XBBLOCK data, where it surpasses the basic line of 2.3% in F1 score when formed with 100% labeled data,” wrote the team. “More impressive, with only 25% of labeled data, Casper obtains an F1 score almost 20% higher than the basic line under identical experimental conditions. These results highlight the potential for Casper for effective and profitable detection of intelligent Ponzi patterns, opening the way to evolving fraud detection solutions.”

In the future, the CASPER framework could be improved and tested on more real data, to further assess its potential for detecting and attenuation of intelligent PONZI diagrams. Finally, he could make his way in parameters from the real world, where he could help protect digital money investors from malicious activities.

Written for you by our author Ingrid Fadelli, edited by Stephanie Baum, and verified and examined by Robert Egan – This article is the result of meticulous human work. We are counting on readers like you to keep independent scientific journalism alive. If this report matters to you, please consider a donation (especially monthly). You will get a without advertising count as a thank you.

More information:

Weijia Yang et al, Casper: contrastive approach for the intelligent ponzi scheme Detteter with more negative samples, arxiv (2025). DOI: 10.48550 / Arxiv.2507.16840

arxiv

© 2025 Science X Network

Quote: The contrastive learning framework can detect the Smart Ponzi schemes based on the blockchain (2025, August 24) recovered on August 27, 2025 from

This document is subject to copyright. In addition to any fair program for private or research purposes, no part can be reproduced without written authorization. The content is provided only for information purposes.