- XRP has formed a short-term range within a thirteen-month-old range formation

- A slight drop in prices, followed by a resumption of $0.585 by the bulls, is anticipated but not guaranteed.

XRP saw whales accumulate 50 million tokens during the latest price drop. This could have boosted investor confidence, but in the short term, market sentiment has been somewhat bearish.

The whale exchange flow has reached a multi-year low and is another indicator that long-term investors can be happy about. However, the price action on the daily time frame has not inspired much confidence.

XRP Forms Another Smaller Range

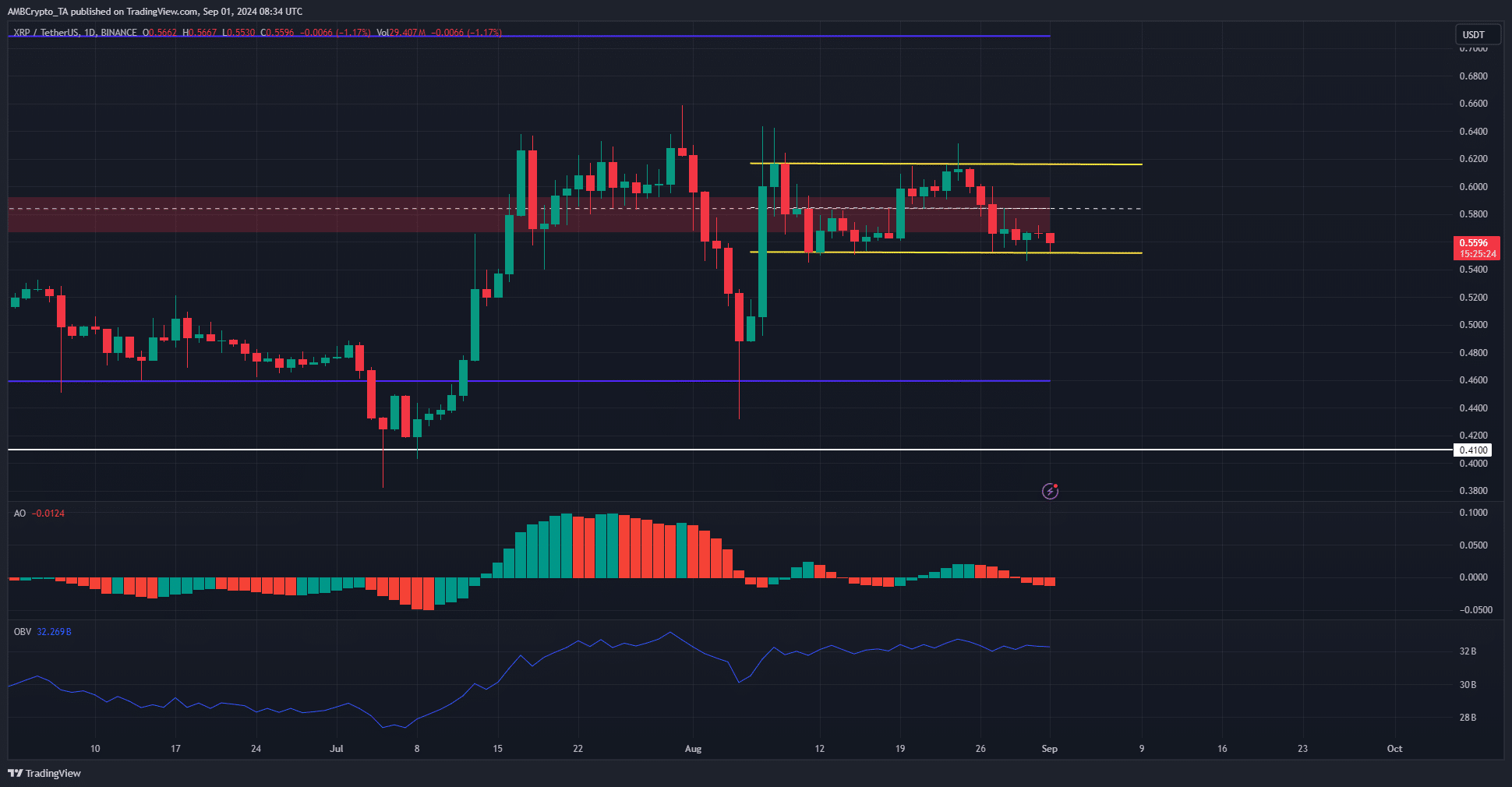

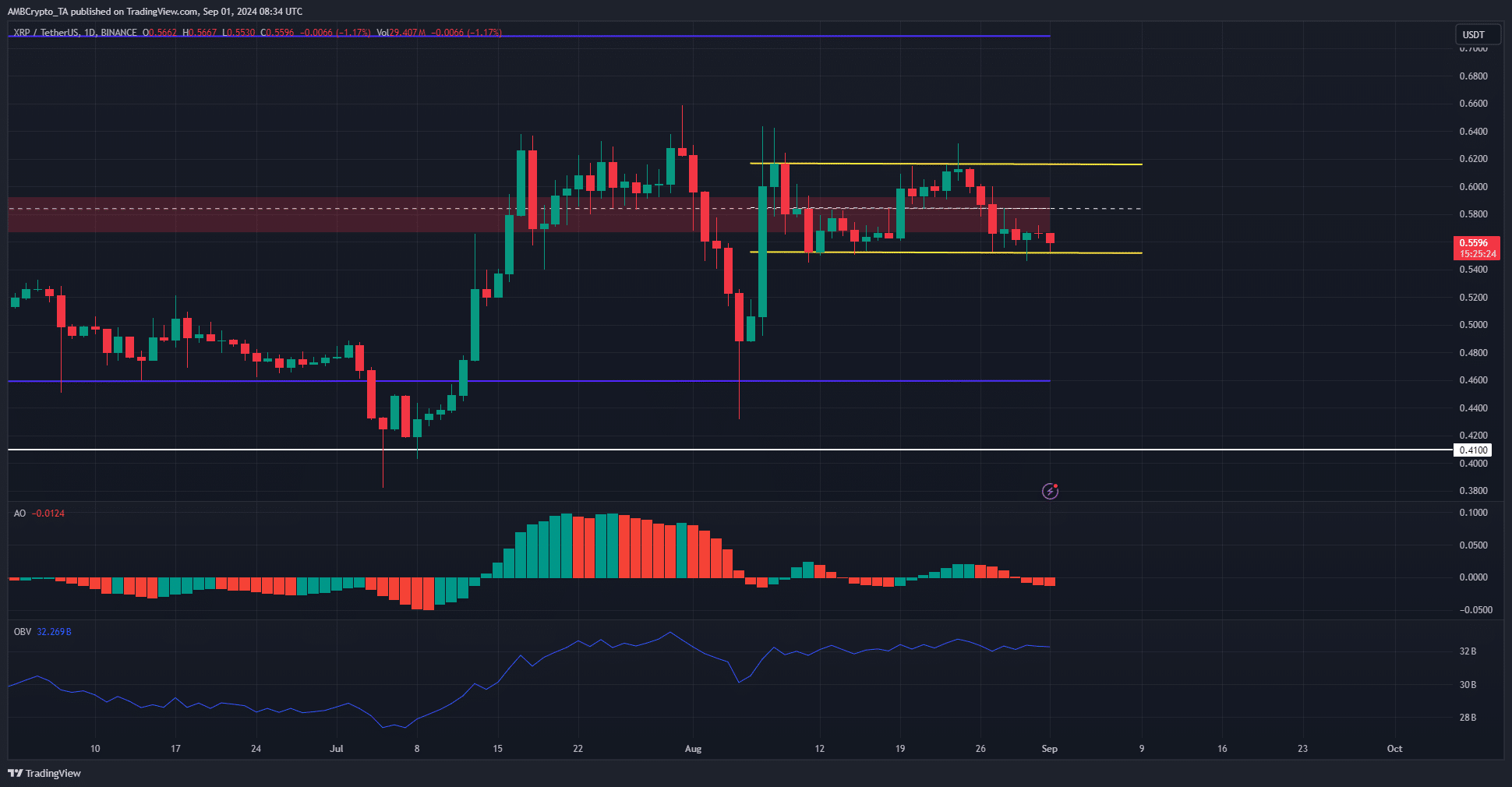

Source: XRP/USDT on TradingView

The yearly range (purple) has its midpoint at $0.585. XRP has formed another range here that extends from $0.553 to $0.617. At press time, it was trading near the range lows.

The OBV hasn’t fallen too much in recent days. Over the past three weeks, it has managed to form a series of slightly higher lows, meaning traders can expect this decline to be a buying factor as well.

At the same time, the Awesome Oscillator fell below the 50-point mark, signaling bearish upward momentum. This move came in response to the price rejection in the $0.62 area on Saturday, August 24.

Short term traders can use the $0.54-0.55 area to bid XRP expecting the price to bounce back to $0.617-0.62.

Liquidation Levels Push XRP Lower

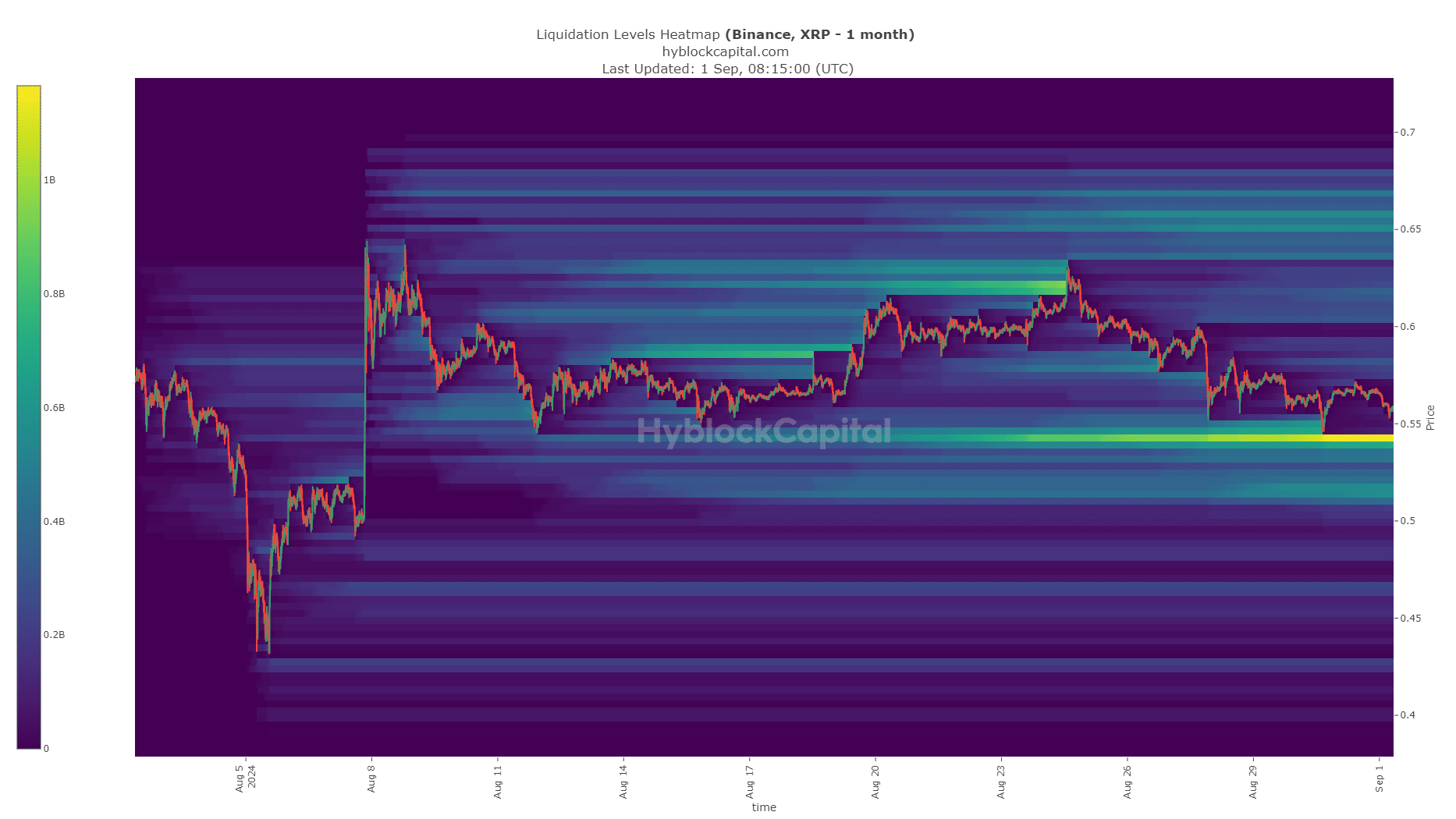

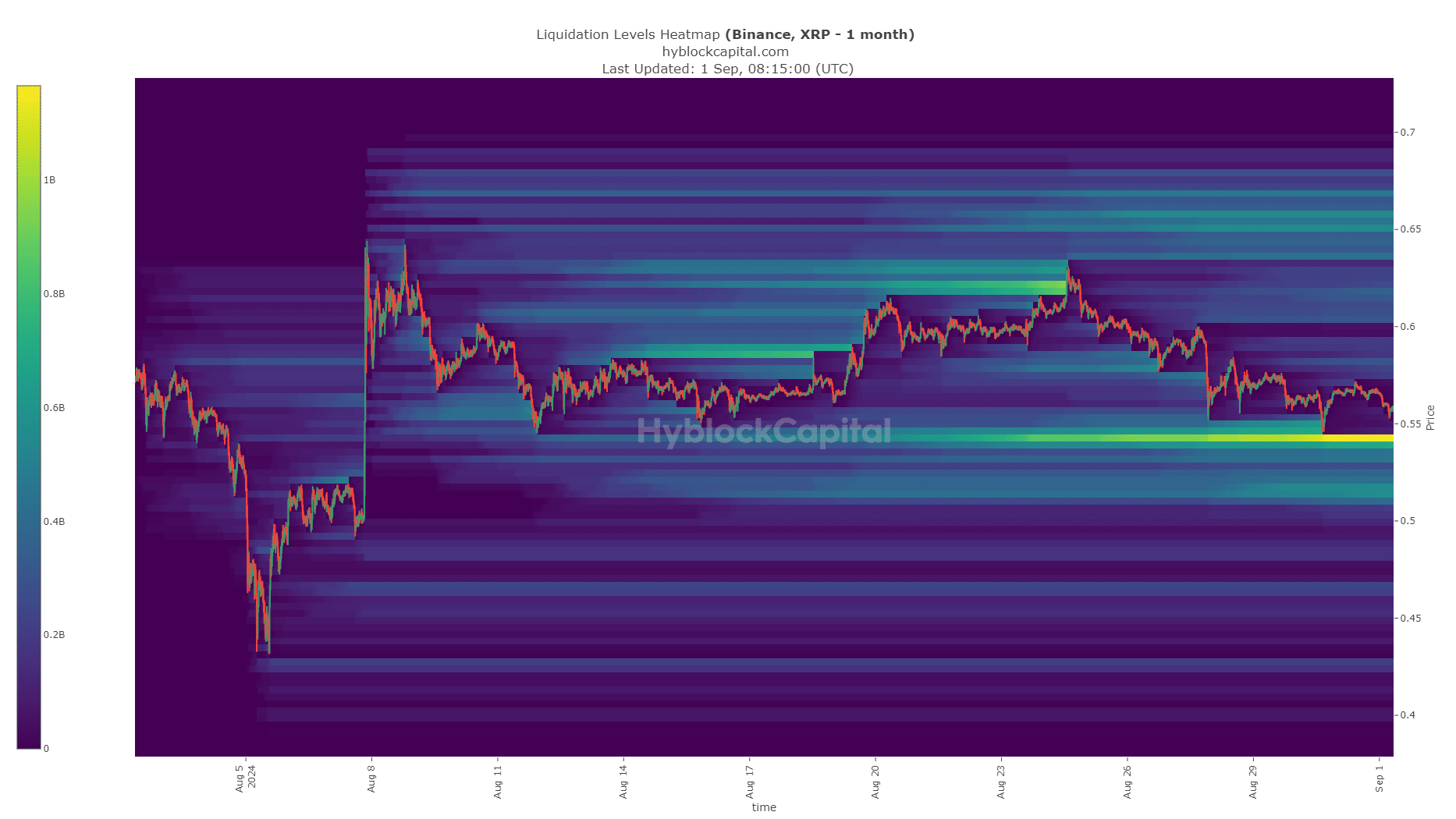

Source: Hyblock

AMBCrypto then analyzed the liquidation heatmap over the one-month lookback period and found that there was a large pool of liquidity at $0.5425. This would mean a price move just below the range marked in a previous chart.

Is Your Portfolio Green? Check Out the XRP Profit Calculator

Such a move would provide a low-risk, high-probability buying opportunity for traders with a clear invalidation below $0.5317. The OBV trend has encouraged the idea that bulls can eventually reclaim the $0.585 level as support and make a sustained run towards the $0.7 range high.

Disclaimer: The information presented does not constitute financial, investment, trading or other types of advice and represents the opinion of the author only.