Join our Telegram Channel to stay up to date on the coverage of information on the breakup

Solana is ready for “an epic end -of -year race” as the possible launch of Solana and a commitment to the corporate treasury of $ 1.65 billion provides firepower to a rally.

It is according to Bitwise (CIO) Investment Director Matt Hougan, who said in a September 9 note To investors this “Solara season” could echo the dynamics which led Bitcoin and Ethereum to several new peaks of all time.

“When demand exceeds supply, prices generally increase,” he wrote.

Several major transmitters, including Grayscale, Vaneck, Fidelity and Franklin Templeton, have applied for a Solana ETF spot, with the decisions of Securities and Exchange Commission (SEC) scheduled by October 10.

At the same time, Galaxy Digital, Jump Crypto and Multicoin Capital promised $ 1.65 billion to advance the industries, a new Solana cash company listed that will buy and acquire soil.

Forward Industries also appointed the co-founder of Multicoin, Kyle Samani, the president, positioning him to defend soil publicly as one of his “most articulated and coherent promoters”, similar to what Michael Saylor did for Bitcoin and Tom Lee for Ethereum, said Hougan.

With the market capitalization of $ 121 billion in Solana, a fraction of 2.2 billions of dollars of BTC and $ 529 billion from Ethereum, even the modest entries could move the needle on soil disproportionately, he suggested.

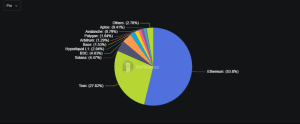

The largest cryptos by market capitalization (source: Coinmarketcap))

He estimated that the land purchase of $ 1.65 billion inward industries would have the same effect as the purchase of $ 33 billion in Bitcoin.

“My suggestion? Keep an eye on Solana in the coming months,” he said.

The recipe that propelled BTC and Eth

Bitcoin climbed around $ 40,000 in January 2024, when the FNB Bitcoin Spot were launched, to a new summit of almost $ 125,000, he said, before adding that the price of the ETH also tripled between April and August this year in the same circumstances.

There was also an increase in demand during this period. During these months, the Bitcoin network produced 322,681 BTC, while the ETPs (products negotiated on the stock market) bought more than 1.1 million BTC.

Meanwhile, the Ethereum network produced 388,568 ETH, while ETPs and companies have acquired 7.4 million ETH, noted the ILO CIO.

“It is not surprising that the recipe works,” he said. “It is classic supply and demand.”

🏛️ Sector movements:

🔹 Forward industries increases $ 1.65 billion in Solana Treasury (shares + 128%)

🔹 Approved soil strategies for @Nasdaqexchange Listing (Ticker: Stke)

🔹 Galaxy Digital Tokenise The actions recorded on dry on Solana

🔹 @Gemini Deploys Solana Slaking + USDC…– Coinmarketcap (@coinmarketcap) September 10, 2025

But Solana may need a catalyst to match Bitcoin and Ethereum

Hougan has warned, however, that business purchases of companies and possible launches of ETFs will not be enough to propel the price of Altcoin to the new heights of all time.

“There must be a fundamental reason for investors to be interested in these vehicles,” he wrote.

Hougan said Ethereum only took off when he became clear that his network would be the main beneficiary of the Boom of Stablescoin.

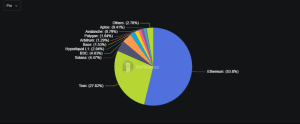

Stablescoin market share by chain (source: Defillama))

For Solana, Hougan thinks that the major draw will be its much higher speeds and its significantly lower costs both to Bitcoin and Ethereum.

He described the Solana Blockchain as a programmable network designed for the floors, tokenized assets and decentralized finance (DEFI).

Related items:

Best wallet – diversify your crypto wallet

- Easy to use cryptographic wallet, easy to use

- Get early access to ICO to toys to come

- Multi-chaînes, multi-walk, non-guardians

- Now on the App Store, Google Play

- Pape to win the native token $ the best

- 250,000+ monthly active users

Join our Telegram Channel to stay up to date on the coverage of information on the breakup