Reason to trust

Strict editorial policy which focuses on precision, relevance and impartiality

Created by industry experts and meticulously revised

The highest standards in the declaration and publishing

Strict editorial policy which focuses on precision, relevance and impartiality

Morbi Pretium Leo and Nisl Aliquam Mollis. Quisque Arcu Lorem, quis pellentesque nec, ultlamcorper eu odio.

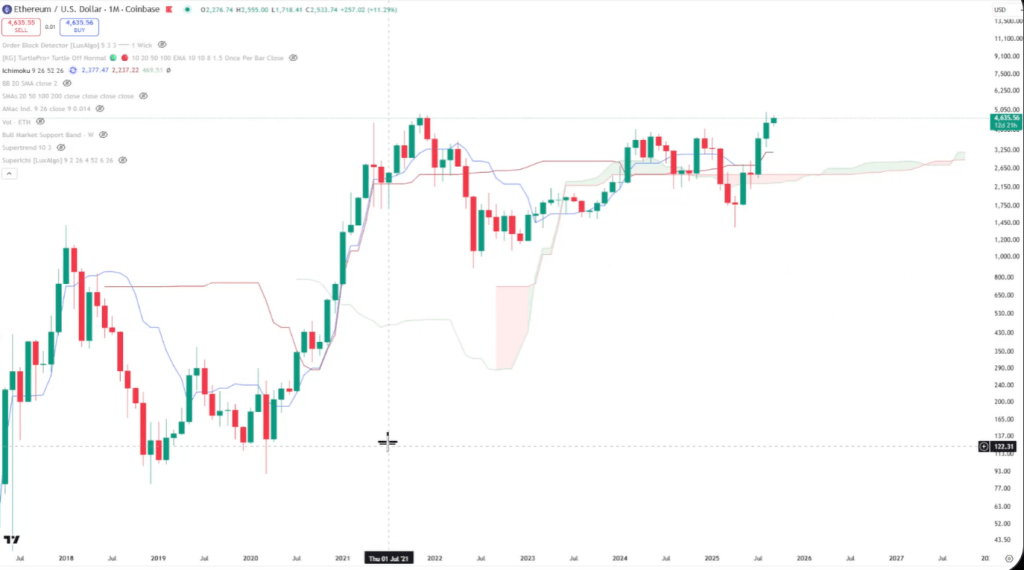

Ethereum approaches a decisive phase that could transport it in a five-digit territory, according to a multi-time analysis of Catonian trader Cat (@cantonmeow).

Ethereum ready to break the heights of all time

In a video published today, the analyst maintains that the ETH has erased a group of late cycle resistance and now has a confluence of technical signals – on monthly, weekly, daily and intrajournable graphics – which “favor some of the highest targets to reach, perhaps 1.272, 1.414, 1.618, anywhere in the five figures.”. These FIB levels would put ETH at $ 7,752, $ 9,883 and $ 14,011 respectively.

On the monthly graph, the analyst centers his case on the structure of fibonacci on a logarithmic scale and the volatility regime. ETH, he says, spent months calculating the return of 0.886 nearly $ 4,000 – the same area which repeatedly pushed the market in previous attempts – but “last month, we had the rupture here, convincingly.”

Related reading

He notes that the wick of the last push has already been above the wick of the November 2021 peak, strengthening the idea that the supply to the ancient summit stops. Simultaneously, Bollinger’s monthly bands are developing while the price “will impulse upwards here with the upper group of Bollinger”, a backdrop which he describes as compliant with the acceleration of trends rather than an average reversion. “This promotes some of the highest targets to reach,” he said, while highlighting the sequencing: “We have to somehow break over the previous one of all time here before we can really talk about climbing further.”

A second pillar of the Haussier thesis is the profile of Ichimoku through the cycles-in particular the fusion of Tenkan-Sen (conversion line) and Kijun-Sen (basic line). “When you have the Tenkan and Kijin merged together and Price goes up with him, this merger here is called Katana,” he said. Historically, he said, it “precipitates a big blow”, and with the price now above Katana, “the Katana draws the price.” On the current structure: “We have obtained a katana under construction and the price will currently impulsively increase, which is also favorable to Ethereum.”

On the weekly time, the Cantonese cat frames ETH’s advance through a three -cycles model defined by a “cycle liquidity zone” acting as a pivot. Each anterior cycle has seen deviations above and below a trend line governing before a sustained movement once the area is recapped. He places the current consolidation directly on this plan: after having broken the “level of liquidity of $ 4,000”, ETH “console laterally … trying to find some energy before breaking”. A back test is possible but not compulsory, he said; The “main case” remains the continuation unless the graph divalid.

Lower calendar signals

The lower deadlines, in his opinion, already align with this result. On the daily graphic, he highlights an “model of continuation Adam and Eve” in intended development in a classic cup and handle, where “the volume of the handle … is not so great”, which he considers a manual, followed by “an optimistic swallowing candle”.

MEASURED to the retractions on the logarithmic scale, the price was rejected at 0.786, found the support at 0.5 and “now tries to break 0.6 … Go up the path … at 0.786”, a pace that he says “is respected quite decently”. It also indicates a short -term background sequence – “you can see something called a brush background … if you have somewhere about two or three of this type of wick that stuck like that, it is generally a fairly decent background” – and a “morning star” inversion with three colors: “It’s quite good”.

Related reading

On the 12 -hour table, it reads the structure as a reacting in a Wyckoff direction, referring to the “rounded bottom”, a secondary reinforcement test – “ST is higher than the VCLX” – and the emergence of a “Creek” overload that the price seems ready for Vaullon. “It looks like a reactile type model … showing a certain strength … Laterally consolidating … to update before (a) bullish continuation,” he said, adding that after the previous vertical leg, digestion at high levels is constructive.

Relative force diagnostics, he maintains, strengthen the narrative led by ETH. The Ethereum market sharing gauge (ETH.D) “broke over the Ichimoku cloud … forcefully”, then “test the cloud for about four weeks”, and can wait for Tenkan “goes up … as support” before the next step. On a basis of monthly volatility, he adds: “The 20-month mobile average has been recovered … and we have simply spent a month here in the back test”-proof that the dominance could rise up if the back test takes place. “It is essentially that Ethereum wants to continue to surpass the rest of the cryptocurrency market here in the foreseeable future,” he said.

Extended indicators outside the ETH also include the risk in its context. The Total 3 index 3 (Capto Stock Exchange Crypto excluding Bitcoin and Ethereum) is “tried to break up above and form a top of all time” on a monthly structure “Cup and round”, while the “other” index (market capitalization excluding the first 10 parts) struck the level of 0.786 over the week and “Gravitat (ING) … 0.886 ”.

It emphasizes the distinction between the logarithmic and linear retractions, noting a linear break of 0.886 failing in a previous attempt: “If we were to break the linear, as well as the newspaper 0.886 here in style, then I think that others would end up very well and end up following the steps of Ethereum.” His conclusion is unambiguous: “I am optimistic about Ethereum. I am optimistic about Altcoin. I am optimistic about the cryptocurrency market space in general. ”

At the time of the press, ETH exchanged $ 4,565.

Star image created with dall.e, tradingView.com graphic

(Tagstotranslate) ETH (T) ETH News (T) ETH Prix (T) Ether (T) Ethereum (T) Ethereum News (T) Ethereum Prix (T) Ethereum Price Analysis

Source link