Join our Telegram Channel to stay up to date on the coverage of information on the breakup

Swift develops a large book based on blockchain to allow 24/7 cross -border payments in real time, with the developer of the Ethereum Consensys ecosystem creating the initial prototype.

The solution is part of an effort to allow cross -border payments on a “unprecedented scale”, said the Society for Interbank Financial Telecommunication, or SWIFT, in the press release.

“We pave the way for financial institutions to pass the payment experience to the next level with the proven and reliable platform of Swift at the center of digital processing of the industry,” said CEO Javier Pérez-Tasso.

The system will have “Parallel tracks of innovation to improve the experience on existing “Fiat” rails, as well as to prepare industry for digital finance, “he said.

The company expects the big book, a secure and real -time newspaper transactions between financial institutions, will record, sequente and validate transactions and apply the rules through intelligent contracts, said the company.

Consensys and large banks collaborate with Swift

Ansensys was responsible for developing the conceptual prototype of the regulation layer fueled by the blockchain. The company is well known for developing the popular Wallet Wallet Metamask, as well as several other products from the Ethereum ecosystem.

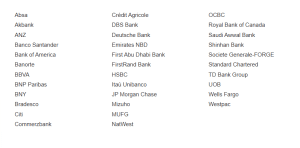

In addition to consensys, the financial institutions of 16 countries also provide rapidly (which represents Society for Worldwide Interbank Financial Telecommunication) With comments on the system design, according to the press release.

They include Bank of America, BNY, Deutsche Bank, JP Morgan Chase, Standard Chartred and Wells Fargo.

Group of banks working on the design of rapid solutions (source: Booming passages))

Swift monopolized Tradfi, seeks to extend the scope of the blockchain space

Swift does not really move money, but acts more like a messaging layer between banks around the world. This is intended to reduce errors and the risk of fraud.

With more than 11,500 institutions of more than 200 countries connected to its interbank messaging system, exclusion The SWIFT system can effectively reduce a global financial system or bank.

A report From the US Federal Reserve Bank of New York underlined the power of SWIF and said that “the sanctions that limit access to this network have become particularly expensive for sanctioned entities”.

With its blockchain solution, Swift now seeks to extend its influence to the ecosystem of the big distributed book.

As a historic moment for the global financial system and the blockchain industry, Swift announced to Sibos 2025 that he is launching a new big book based on blockchain:

We congratulate our Swift partner and the wider community of Swift for the adoption of blockchains and… pic.twitter.com/gsqgsyrwgk

– Chainlink (@chainlink) September 29, 2025

The last announcement of a solution fueled by the blockchain follows a report from last week that Swift began to test payments and messaging on the channel using Linea Linea from Network Layer-2 of Ethereum.

The report also indicates that Swift plans to launch its own stablecoin, but did not specify on which network the product would be deployed.

Swift also did not mention what blockchain the new layer of colony will be built. However, consensys involvement suggests that it can be Ethereum.

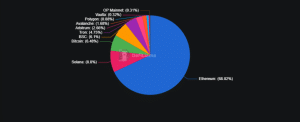

Ethereum is currently the main blockchain network in terms of total locked value (TVL) on the market. Defillama’s data show that $ 87.47 billion is locked in the Ethereum blockchain, which is equivalent to around 68.02% of the value in the different networks on the market.

TVL through blockchains (Source: Defillama))

Ethereum also has a share of 53.55% of the Stablescoin market, which has a capitalization 294.856 billion dollars.

Not the first movement of the Swift Blockchain

The collaboration of Swift with Consensys’ blockchain is not the company’s first visit to the technology of the big book distributed.

In March of last year, the company recognized the value of the tokenization and the blockchain model. However, Swift argued that these shared books are not “well suited to the transport and storage of high data volumes” because of the way the data is synchronized between the nodes. This is why he thinks he can provide a messaging layer for a blockchain -based financial system.

Later of the same year, in November, Swift also provided its global financial messaging network to integrate token fund processes with existing Fiat payment systems. The initiative was carried out using UBS Asset Management and the Oracle Network Chainlink Blockchain.

At the end of 2024, SWIFT also announced that banks in North America, Europe and Asia would start trials of digital assets on its network.

Related items:

Best wallet – diversify your crypto wallet

- Easy to use cryptographic wallet, easy to use

- Get early access to ICO to toys to come

- Multi-chaînes, multi-walk, non-guardians

- Now on the App Store, Google Play

- Pape to win the native token $ the best

- 250,000+ monthly active users

Join our Telegram Channel to stay up to date on the coverage of information on the breakup