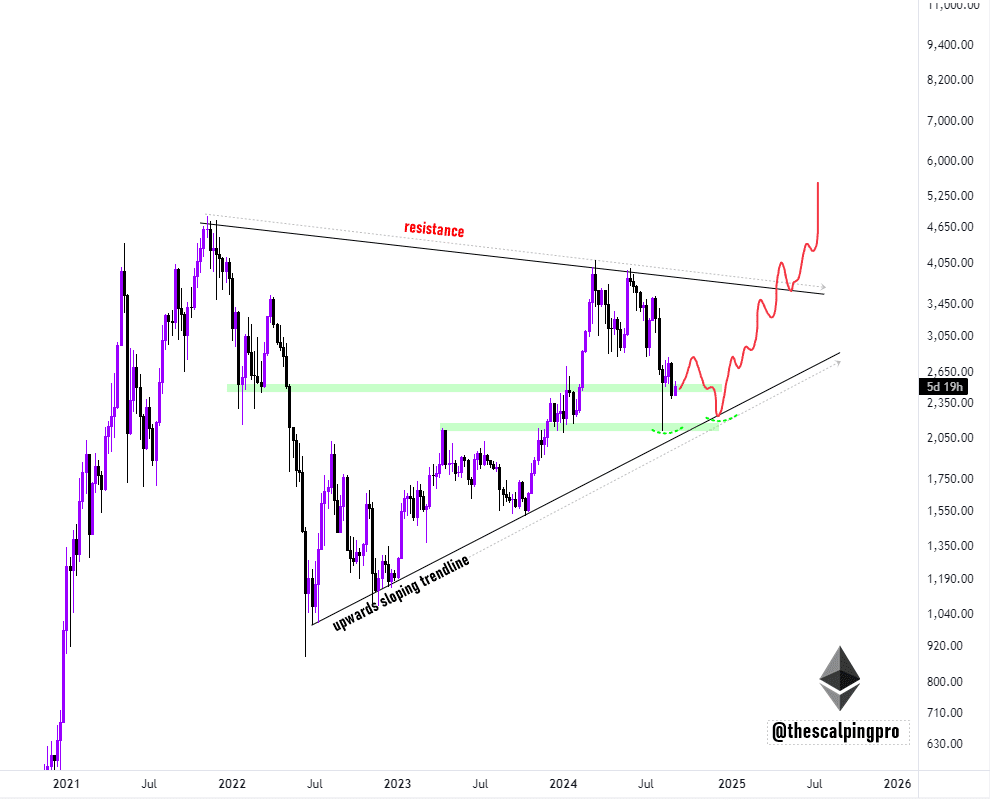

- Ethereum was trading within a massive triangle at press time, with analysts predicting a possible double bottom pattern.

- Whale transactions and active addresses have increased, signaling potential upward momentum for ETH price.

Ethereum (ETH) has faced significant challenges in recent weeks, continuing its bearish trajectory in terms of both price and market sentiment. After a price drop last month, ETH has continued to experience a bearish market trend.

Over the past 24 hours, the asset has seen a further 4.5% decline, bringing its trading price down to $2,399, marking a further 2.3% decline in the broader market context.

Amid this lingering bearish sentiment, some analysts remain optimistic about Ethereum’s future price action.

Crypto analyst Mags, on X (formerly Twitter), recently common his take on Ethereum’s potential to reverse its downward trend.

A possible recovery of Ethereum?

In her post, Mags noted:

“Ethereum is moving within a massive triangle, and we could see a double bottom formation near the ascending trendline support before it moves higher.”

This analysis indicates that ETH could be approaching a pivotal moment, with the potential for a bullish reversal on the horizon.

In technical analysis, a double bottom formation is a bullish reversal pattern, which suggests that the asset’s price is approaching a low and may be ready to rise again.

This pattern forms when price falls twice to a support level, with a slight upward move between the two lows.

If Ethereum price follows this pattern, as Mags suggests, we could see a significant upward move after the current bearish phase.

Source: Mags/X

Ethereum’s technical indicators support the possibility of a rebound, with the asset trading near critical support levels at press time.

If the double bottom pattern plays out, Ethereum could break out of its prolonged downtrend and start a new rally.

However, this scenario remains speculative, it is worth noting that caution should be exercised as Ethereum approaches these key price levels.

Whale Transactions and Active Addresses Bounce

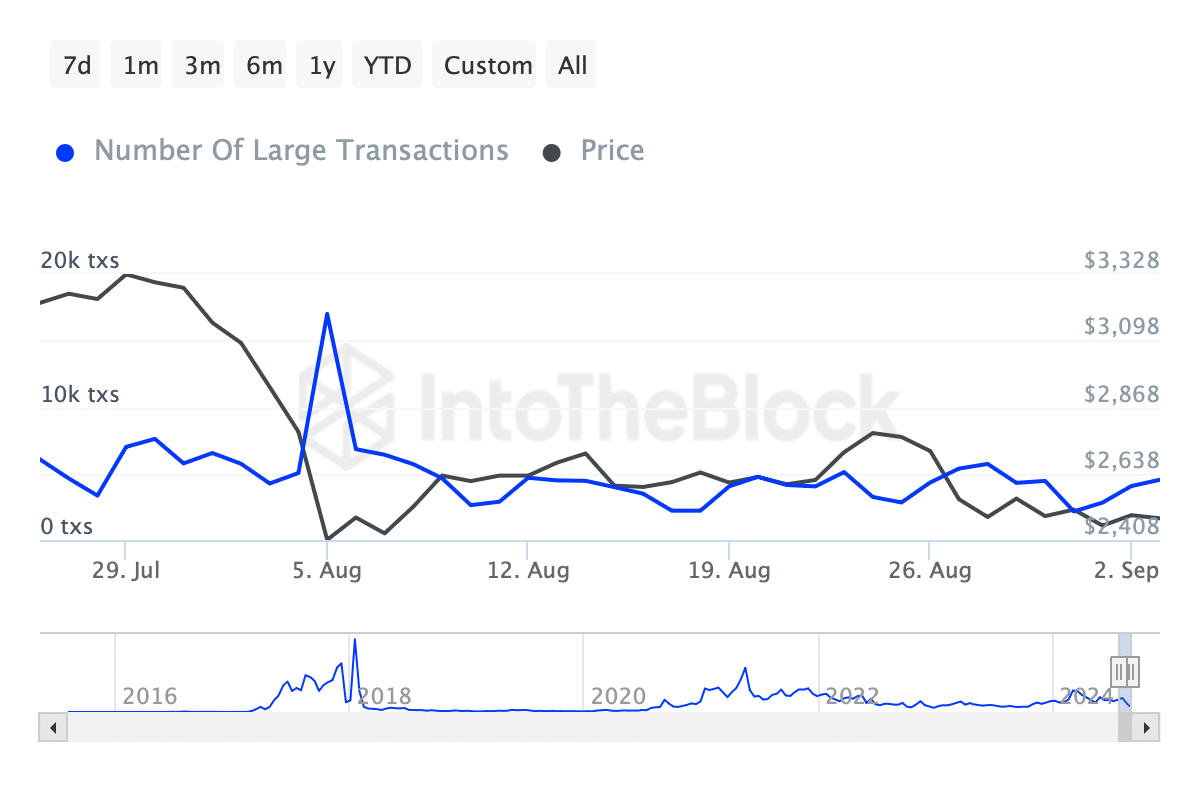

Interestingly, despite the drop in Ethereum price, some of the asset’s underlying fundamentals have started to show positive signs.

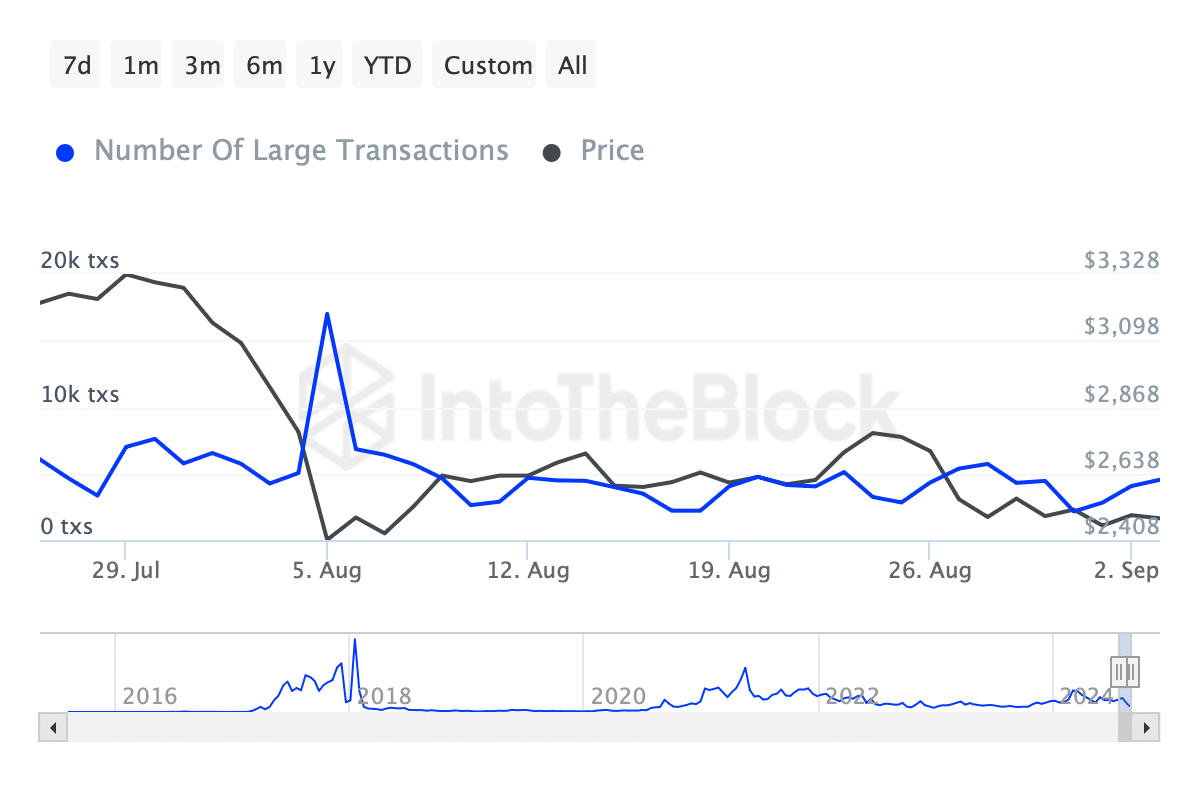

For example, data IntoTheBlock revealed that Ethereum whale transactions – those exceeding $100,000 – have started to recover after a significant drop in early August.

On August 5, these transactions peaked at over 16,000 before plunging to around 2,210 on August 10. More recent data has indicated a recovery, with whale transactions The number of visitors was 4,530 at the time of going to press.

Source: IntoTheBlock

This rebound in whale activity suggests that large investors may be positioning themselves for a potential recovery in Ethereum’s price.

An increase in whale trading is generally seen as a positive indicator, as it signals increased interest from wealthy investors, which could fuel a broader market rally.

Read Ethereum (ETH) Price Prediction 2024-2025

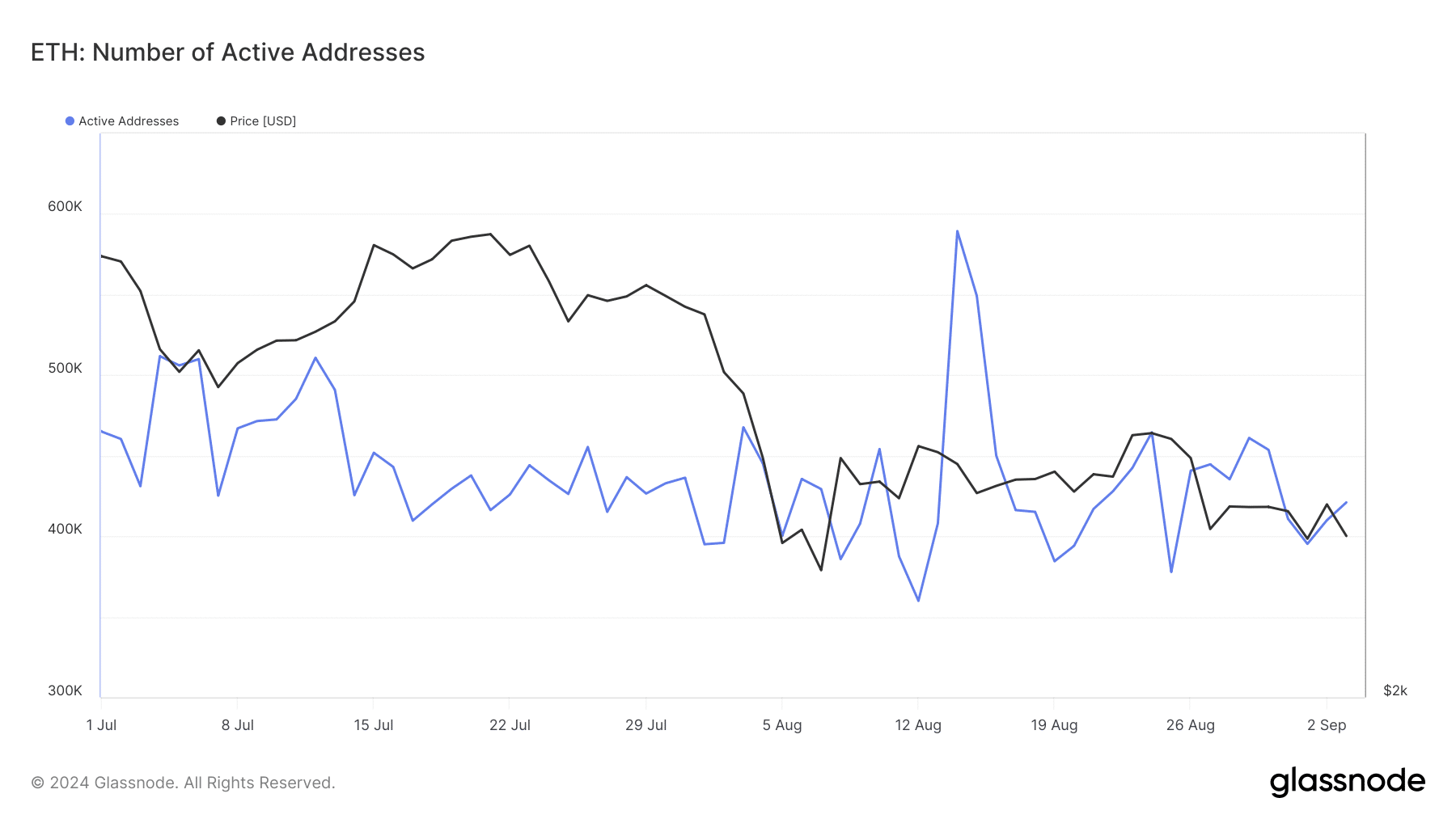

In addition to whale trading, data Glassnode’s article highlighted a recovery in Ethereum’s active address count. While the number of active addresses peaked at 589,000 on August 14, it fell below 400,000 last week.

Source: Glassnode

At press time, this metric has risen again to 420,000. An increase in the number of active addresses usually reflects increasing user activity on the network, which could also contribute to a price increase.