Join our Telegram channel to stay up to date with the latest news

BlackRock’s Bitcoin ETF (exchange-traded fund) IBIT posts ‘utopian’ returns even after $19 billion crypto market flash crash.

This is according to Eric Balchunas, analyst at Bloomberg Intelligence ETF, who noted the the fund has surged 76% over the past year despite the recent crisis. This is also an increase of 37% over the last six months.

According to data from Google Finance, the price of IBIT fell more than 3% on October 10 and another 3% after hours in response to US President Donald Trump’s announcement of additional 100% tariffs on Chinese exports.

IBIT Price (Source: Google Finance)

Investors should ‘zoom out’ to see IBIT’s true performance

IBIT is designed to track the price of the leading crypto, Bitcoin (BTC), while providing investors with a regulated way to purchase the digital asset.

Commenting on IBIT’s performance since its inception last year, Balchunas said the fund had posted exceptional returns.

He criticized investors for all the “angst and lament” around the ETF’s performance following the latest crypto market correction that wiped out more than $19 billion in trading in a matter of hours.

During this correction, Bitcoin fell below $120,000 and is trading at $111,338.31 as of 12:32 a.m. EST, CoinMarketCap. data watch. Like IBIT, BTC is up over 77% over the past year.

The one-year $IBIT return is still 84% after the pullback. So much anxiety and whining about what is utopia. Daily price charts are the media’s best friend but the investor’s worst enemy. Zoom out. pic.twitter.com/YH6xqUKux8

– Eric Balchunas (@EricBalchunas) October 11, 2025

“Daily charts are the media’s best friend but the investor’s worst enemy,” Balchunas said, before asking his more than 370,800 followers to “zoom out” when reviewing fund performance in order to see the big picture.

IBIT was close to the $100 billion mark in assets under management before the flash crash with approximately $99.5 billion in funds.

“It’s still an inevitable step in my opinion, but it’s crazy how close this has come,” Balchunas wrote. “Two steps forward, one step back indeed.”

IBIT attracts capital as other US spot Bitcoin ETFs bleed Friday

IBIT is the Bitcoin ETF of choice for US investors and has seen the majority of cumulative inflows since the funds hit the market last year.

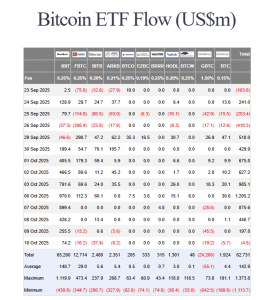

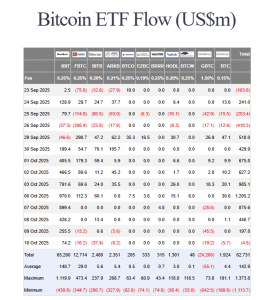

Data from Distant investors shows that IBIT saw $65.260 billion in cumulative inflows as of October 10, with Bitcoin appreciation adding about $34 billion to the ETF’s assets under management. The second largest is Fidelity’s FBTC, which saw $12.714 billion in cumulative inflows.

US Spot Bitcoin ETF Flow (Source: Farside Investors)

The IBIT is also on a nine-day inflow period in a row. This after the investment product brought in another $74.2 million on Friday, while other funds saw outflows or no new flows that day.

Since September 30, the IBIT has seen more than $4.4 billion added to its reserves. Its best day during this period was October 6, when investors added $970 million to the product’s reserves.

Related articles:

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news