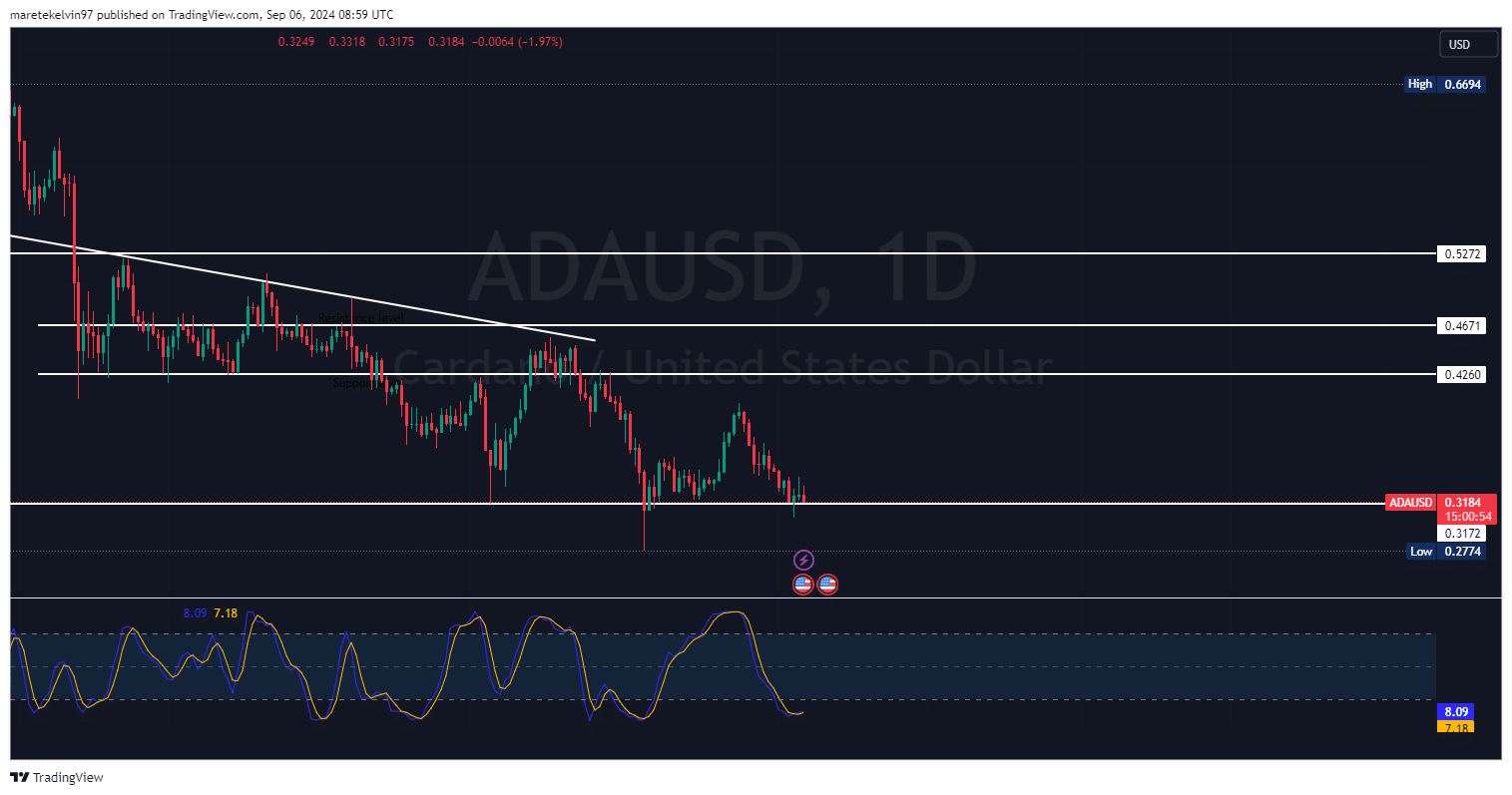

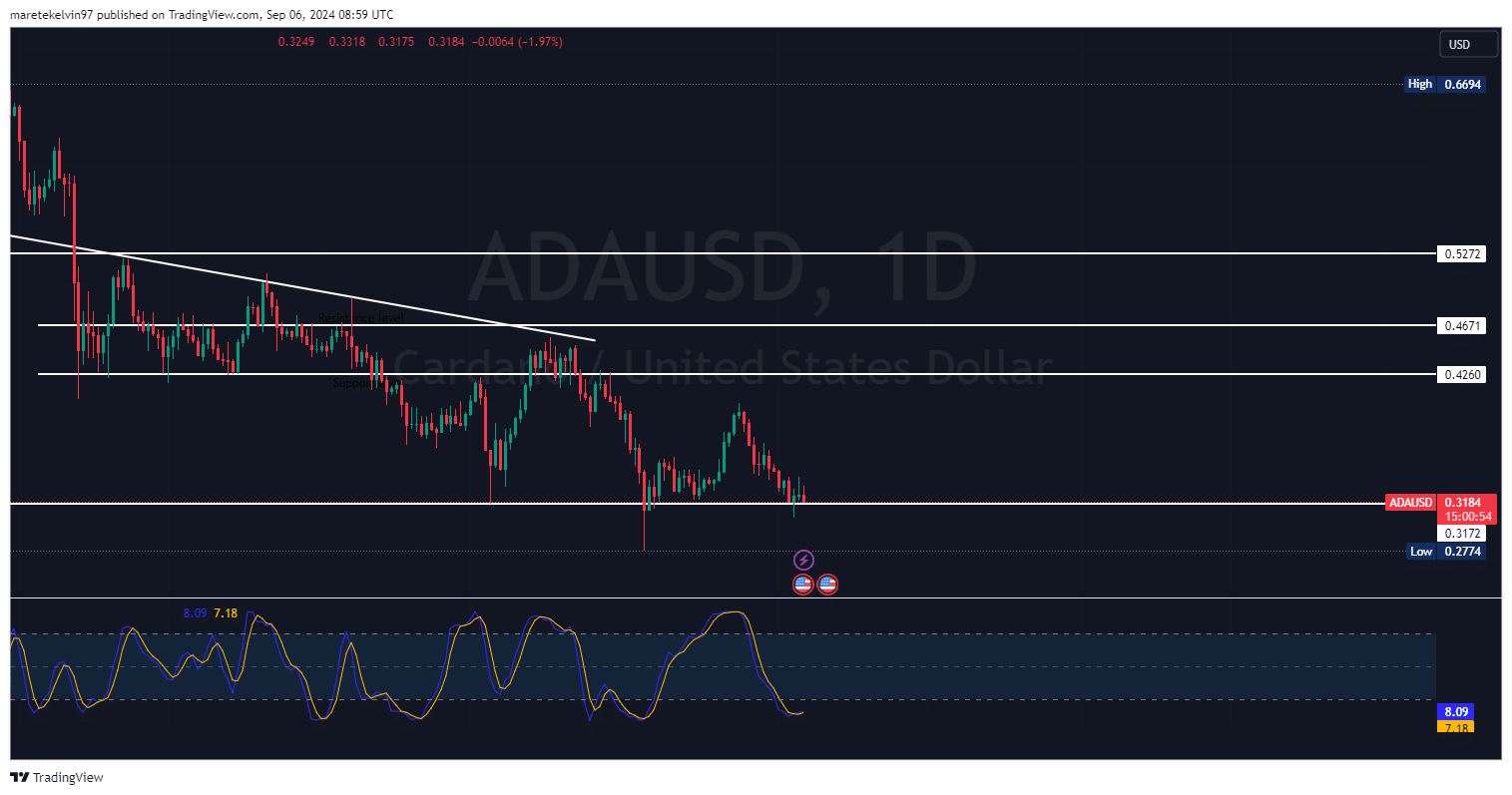

- Cardano was trading near a critical support level at $0.3172.

- The measures signaled growing market interest.

Cardano (ADA) price has seen a 1.47% decline over the past 24 hours, with a larger 11.04% drop over the past week.

At press time, the market cap stood at $11.7 billion, having fallen 1.40% according to CoinMarketCap.

At press time, trading volume jumped 29.46% to $320.634 million, indicating increased market activity amid falling prices.

Key support level remains strong

At press time, Cardano was trading near an important support level around $0.3172. This level has been important in the past, acting as a potential rebound zone.

However, ADA is trading below a descending trendline, which may suggest further downward pressure if this support level fails.

A break below this support could lead to a bearish continuation, potentially targeting the next support at $0.2774.

Source: TradingView

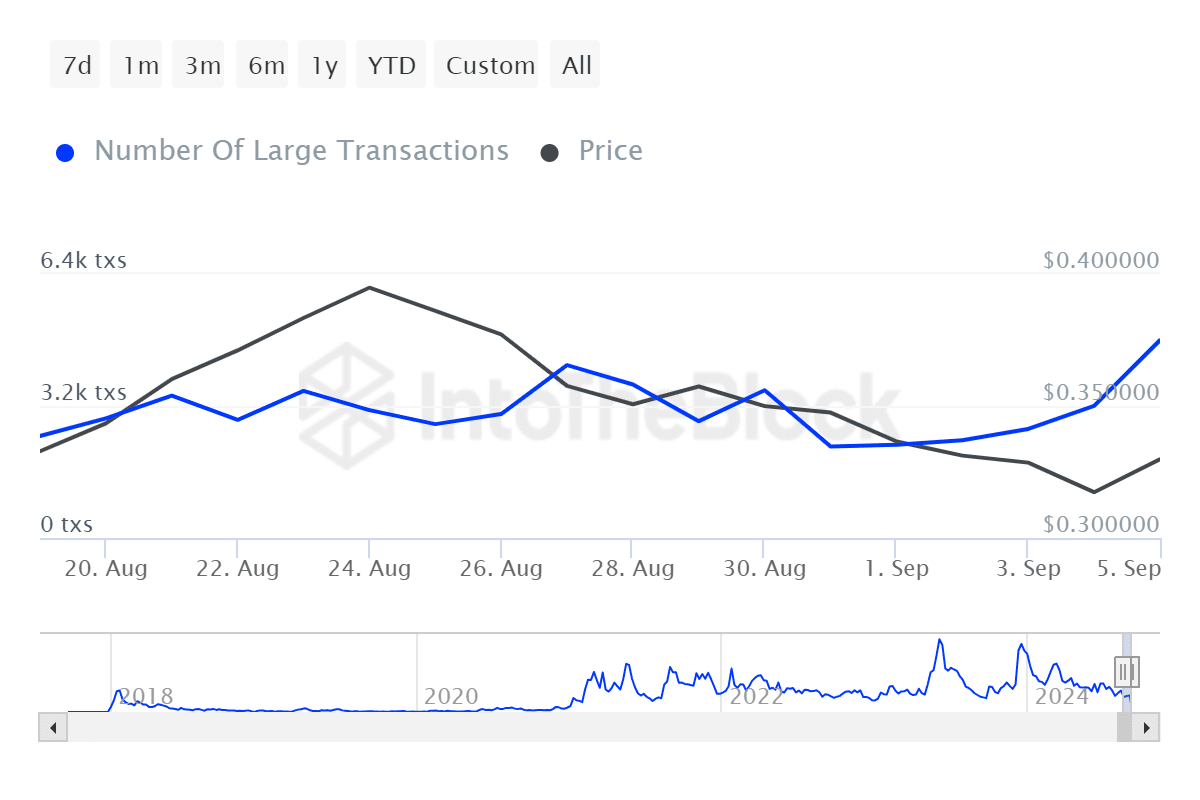

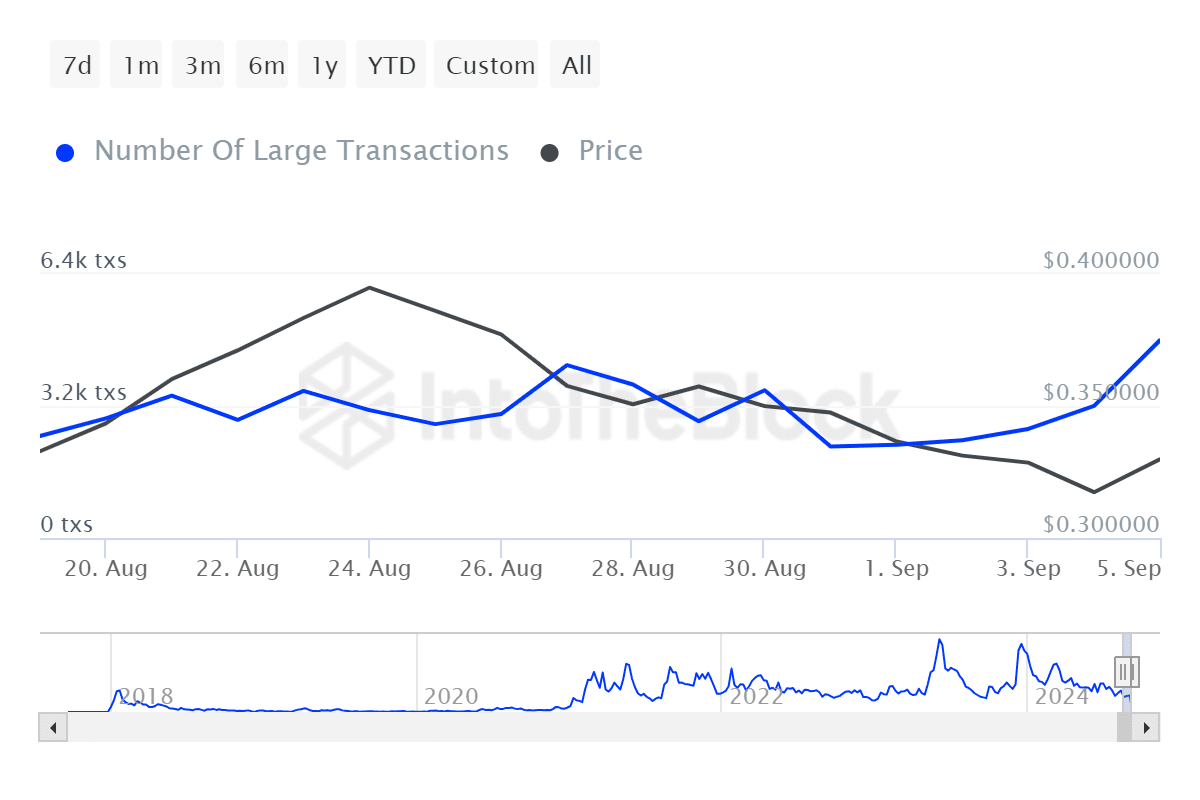

Whales in motion

Large trades have increased by 8.56% in the last 24 hours, indicating that large investors are positioning themselves for a potential price move.

This increase in whale activity may have a stabilizing effect on the market, especially if accumulation continues at lower price levels.

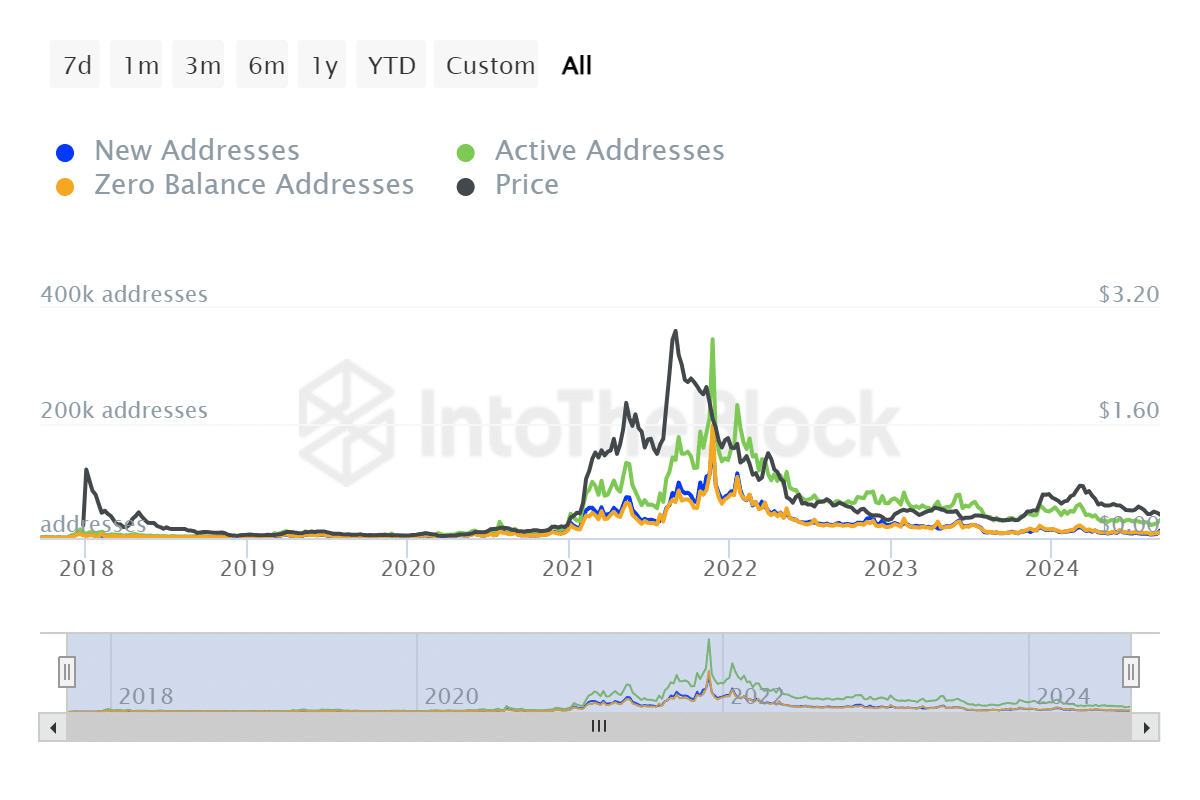

Source: IntoTheBlock

Additionally, the 109.41% increase in active addresses suggests that Cardano is gaining significant attention, which could boost speculative interest and trading activity.

Source: IntoTheBlock

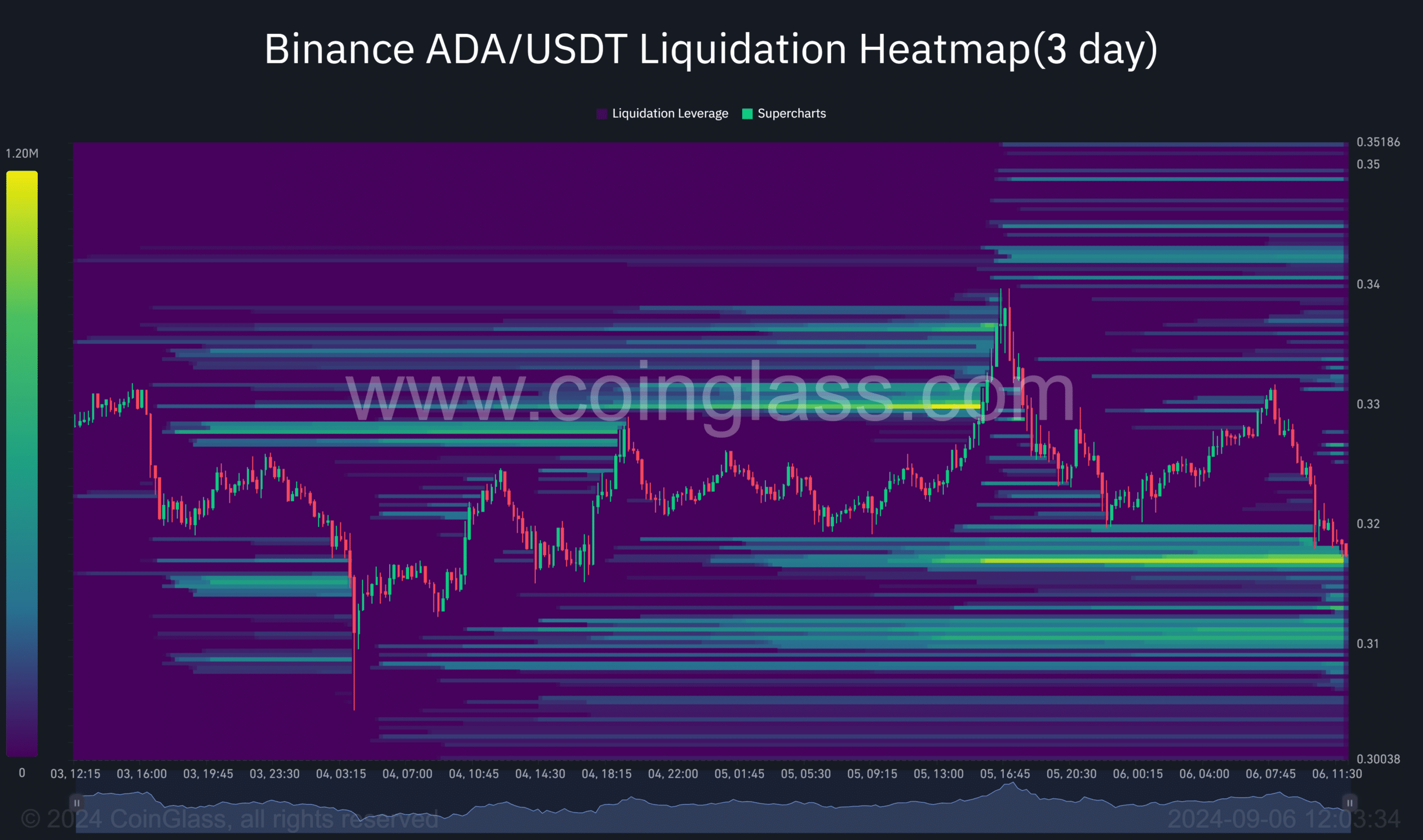

Cardano Liquidation Risks

At press time, there was a notable liquidation pool of around 990,000 Cardano, highlighting a potential risk of increased selling if prices fall further.

Coinglass’ liquidation heatmap data provided a bearish market bias and may act as a bearish magnet to regroup the price at the $0.3169 level ahead of a possible bullish move.

Source: Coinglass

Technical indicators point to a possible market trend reversal

From a technical perspective, the Cardano Relative Stochastic Index was indicating an oversold zone at press time, with a potential bullish crossover on the horizon.

Read Cardano (ADA) Price Prediction for 2024-2025

This could signal a possible price recovery if buyers step in to capitalize on oversold conditions.

However, the overall trend remains bearish unless ADA makes a significant bullish move above the current support level at $0.3172 to the next resistance levels in line.