- BONK could surge 30% to the $0.000021 level if it closes a four-hour candle above $0.0000165.

- Coinglass’ BONK long/short ratio suggests trader sentiments are bullish

BONK, the popular Solana-based memecoin, is poised for a significant price rally due to its bullish on-chain metrics and potential breakout. In fact, despite the persistent bearish market sentiment, BONK has outperformed major cryptocurrencies including Bitcoin (BTC), Ethereum (ETH), and Solana (SOL).

BONK Price/Performance Ratio

At press time, BONK was trading near the $0.0000161 level, after rising by more than 2.5% over the past 24 hours. At the same time, its trading volume increased by 46% over the same period. This indicates increased participation from traders.

Technical analysis and upcoming levels

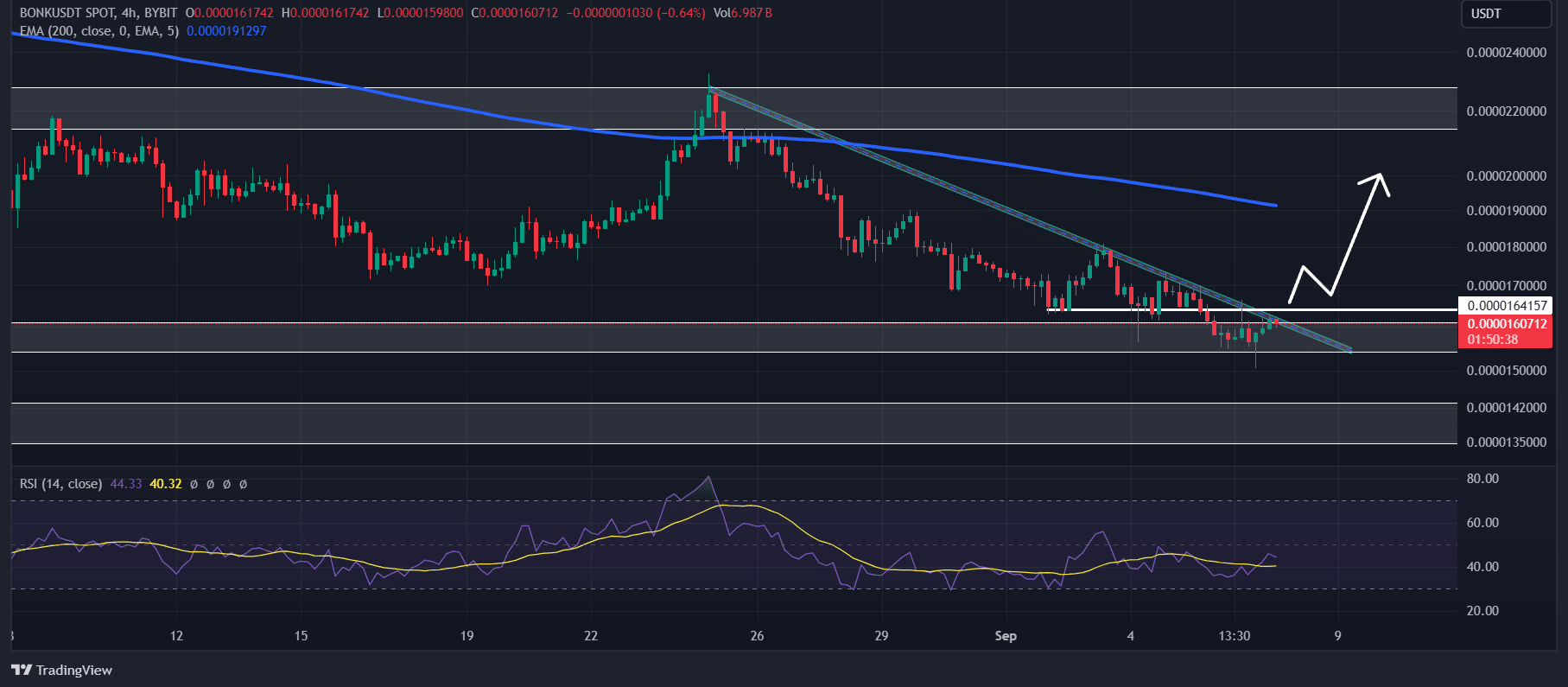

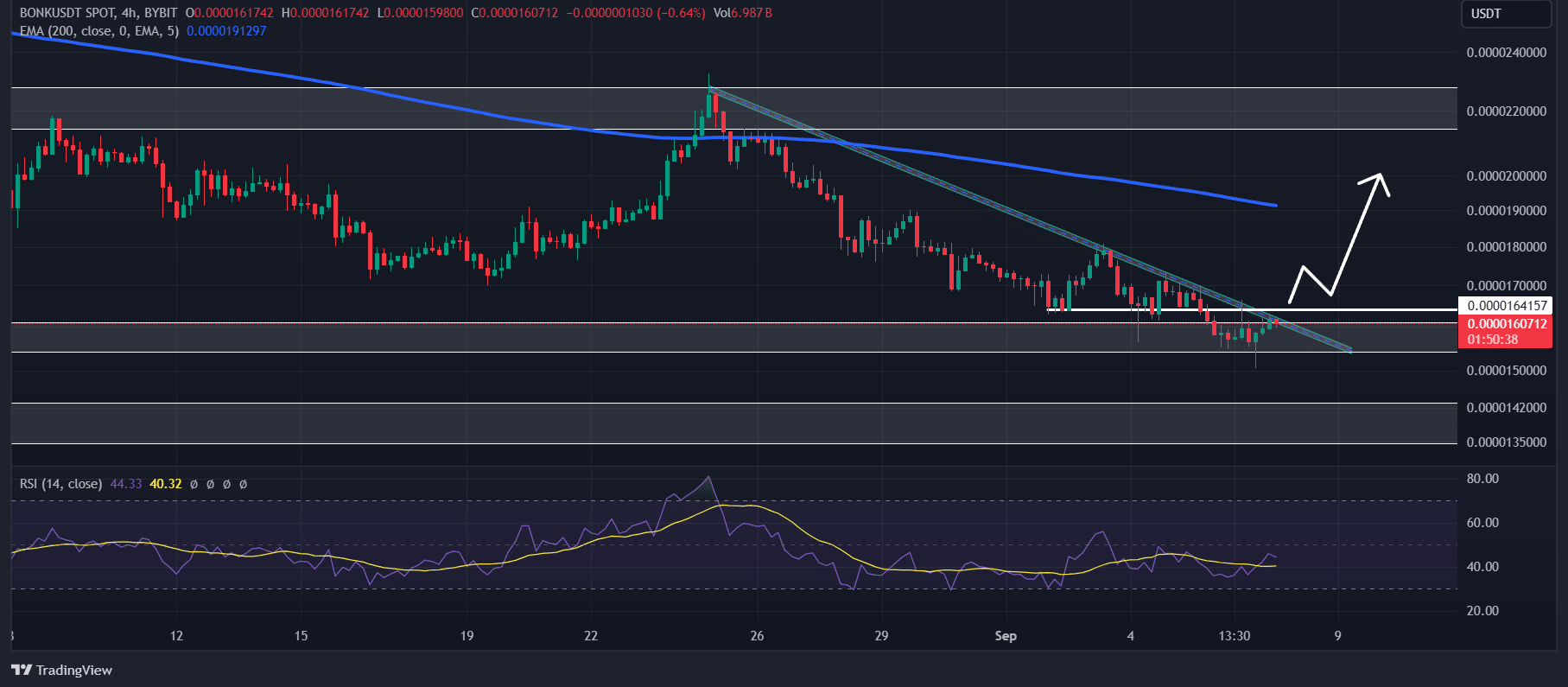

A look at the memecoin’s charts revealed that BONK appeared to be trading near the crucial support level of $0.0000155. It was trading below the 200 exponential moving average (EMA) on the daily timeframe, indicating a downtrend.

However, there is a possibility of bullish movement here. On a four-hour time frame, BONK could be about to break out from a descending trendline. If it breaks out and closes a candle above $0.0000165, there is a strong possibility that it will surge 30% to $0.000021 in the coming days.

Source: Tradingview

BONK’s Relative Strength Index (RSI) supported this bullish outlook as it was in oversold territory, potentially indicating a bullish reversal.

However, this bullish thesis will only work if BONK closes a candle above the $0.0000165 level. On the other hand, if it fails to break above this level and falls below $0.0000152, there is a high chance that it will turn bearish and drop 12% to $0.0000134.

On-chain indicators signal bullish sentiment

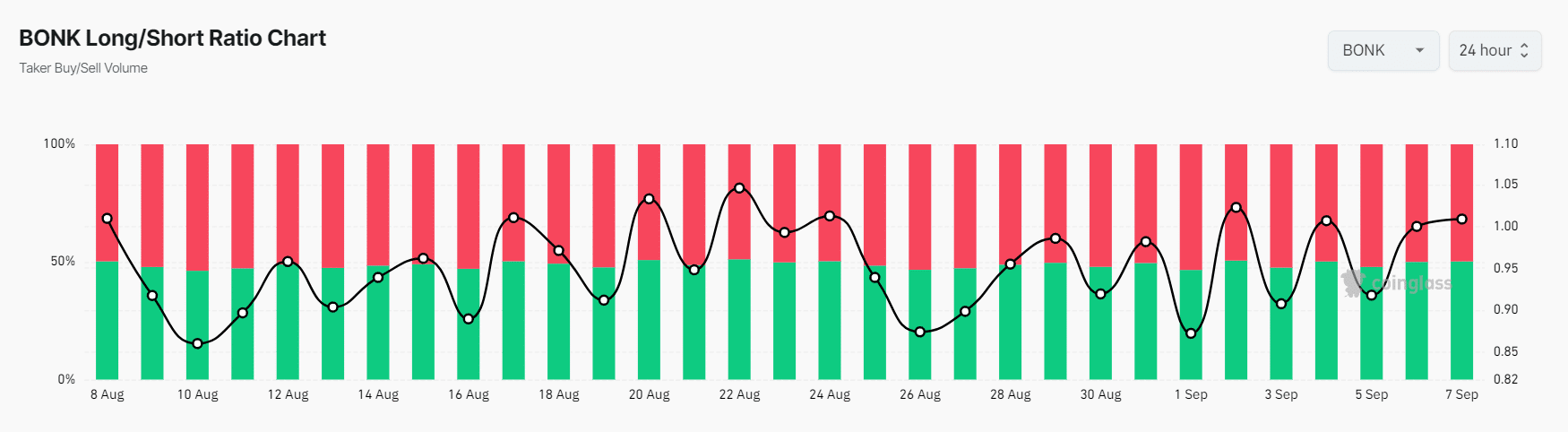

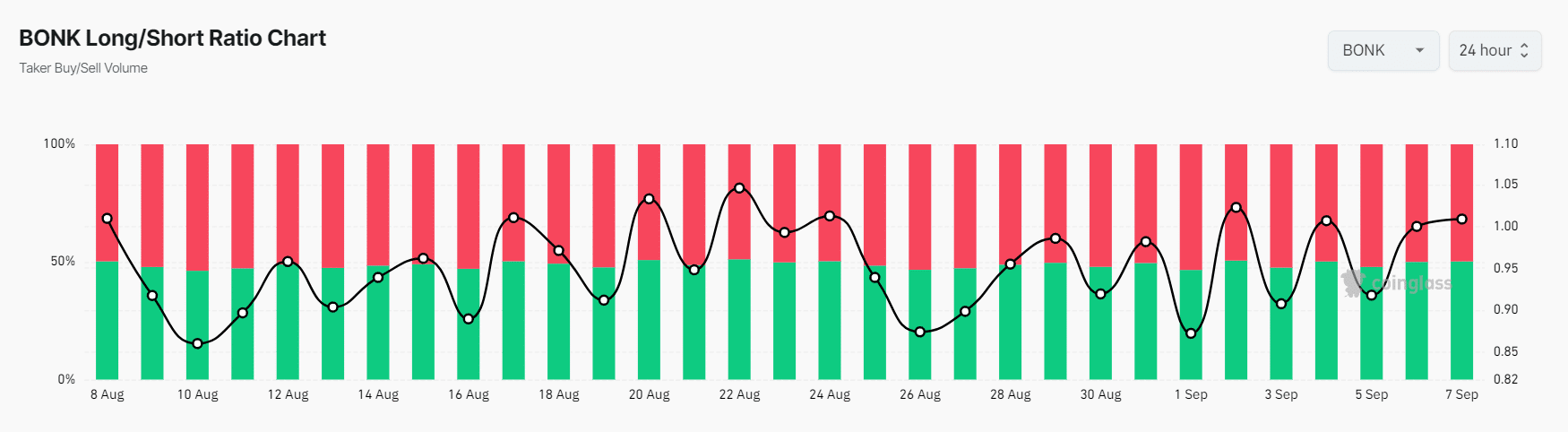

Coinglass’ BONK long/short ratio suggests that trader sentiment is bullish. At the time of writing, the ratio had a value of 1.0264 (a value greater than 1 signals bullish sentiment).

Moreover, the open interest of BONK futures contracts is constantly increasing. Over the last 24 hours, for example, it has increased by 11%.

Source: Coinglass

Rising open interest and a long/short ratio above 1 are potential buy signals and traders often follow this combination to bet on trades in either direction.

At the time of going to press, 51.05% of top traders held long positions while 48.98% held short positions.