Ethereum is struggling to rise above the $4,000 level as market sentiment remains uncertain and volatility keeps investors cautious. Despite several attempts, the bulls failed to maintain momentum, suggesting hesitation at key resistance levels. However, new on-chain data is drawing attention to potentially large-scale liquidity movements that could influence Ethereum’s next direction.

Related reading

According to Lookonchain, an Ethereum OG holding 736,316 ETH (worth approximately $2.89 billion) recently deposited $500 million USD into vaults launched by ConcreteXYZ and Stable, just before their official announcement. This has sparked a lot of curiosity within the crypto community, as the transaction appears strategically timed and could signal preparation for major yield or liquidity activity.

ConcreteXYZ is a next-generation liquidity protocol designed to connect institutional capital and DeFi via tokenized vaults. It allows users to allocate stablecoins and crypto assets into yield-generating strategies while maintaining full transparency and composability within the Ethereum ecosystem.

The whale’s massive filing – preceding public disclosure – suggests potential insider positioning or high-conviction participation in these vaults. Such large inflows often act as early indicators of changing liquidity dynamics, particularly when aligned with projects positioned at the intersection of DeFi infrastructure and institutional finance.

Whale Domination in Aave and Stablecoin Vaults Raises Strategic Questions

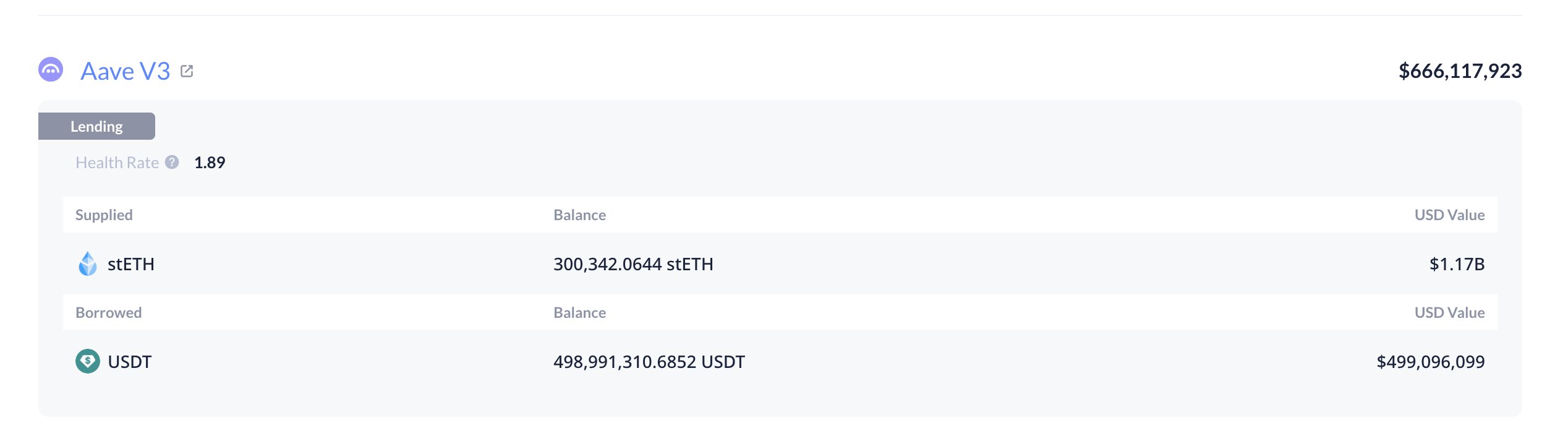

According to Lookonchain, the same Ethereum OG that recently interacted with ConcreteXYZ and Stable deposited 300,000 ETH into Aave and borrowed $500 million USD. Of the total US$775 million deposited into the new vaults, this single whale accounted for 64.5% of the total liquidity, highlighting its dominant role in this sudden market activity.

This move represents a sophisticated on-chain strategy often seen in experienced whales. By providing ETH as collateral on Aave – one of the largest decentralized lending protocols – and borrowing USDT against it, the whale effectively unlocks liquidity without selling its Ethereum holdings. This allows them to deploy significant amounts of money into yield opportunities, such as the recently launched ConcreteXYZ vaults, while maintaining exposure to the long-term upside of ETH.

Such a concentration of liquidity from a single entity can have several implications for the market as a whole. On the one hand, this highlights the growing confidence of deep-pocketed players in the stability and profitability of the DeFi ecosystem. On the other hand, this raises questions about market influence and systemic risk, as a single participant holds a very large share of capital inflows.

Related reading

If this borrowed liquidity is used for yield farming or strategic positioning rather than short-term speculation, it could strengthen the fundamentals of the Ethereum ecosystem by increasing DeFi activity and on-chain engagement. However, if market conditions deteriorate and the value of collateral falls, liquidations could amplify volatility.

Essentially, this massive Aave-ConcreteXYZ transaction demonstrates how whales are leveraging DeFi infrastructure to maintain dominance, optimize liquidity, and influence ecosystem-wide capital flows, making it one of the most significant on-chain moves of the quarter.

Ethereum rebounds but faces resistance near $4,000

Ethereum price is currently trading around $3,964, showing signs of a modest rebound after recent volatility. The daily chart indicates that ETH has attempted to recover from its October lows. But it remains stuck below key resistance between $4,000 and $4,200, where the 50-day and 100-day moving averages converge. This is an area which often acts as a zone of strong rejection during consolidation phases.

Despite the short-term gains, Ethereum’s broader structure still reflects uncertainty. The 200-day moving average near $3,200 continues to provide strong dynamic support, preventing a deeper breakdown. However, the inability to break above $4,000 has left the asset vulnerable to further selling pressure if momentum weakens.

Related reading

Volume trends suggest limited conviction among buyers as each rally attempt has been met with diminishing strength. To regain a sustainable bullish outlook, Ethereum needs a decisive close above $4,200. This would signal a potential continuation towards $4,500 and above. Conversely, failure to reclaim this range could lead to a retest of $3,600-$3,500.

Featured image from ChatGPT, chart from TradingView.com