Standard Chartered CEO Bill Winters expects every transaction to one day take place on blockchain, calling it a “complete rewiring” of global finance.

Standard Chartered CEO believes blockchain will eventually house all the money

As reported by CNBC, Bill Winters spoke on Monday about the future of finance and Hong Kong’s role in the global digital assets space during a Hong Kong FinTech Week panel. “Our belief, which I think is shared by Hong Kong leaders, is that virtually all transactions will eventually be settled on blockchains and all money will be digital,” the Standard Chartered CEO said.

This comment comes as there has been a push towards tokenization of the digital ledger around the world. Payments giant SWIFT, for example, is developing a blockchain-based ledger, as announced in September.

Tokenizing an asset creates a digital copy of it that can be traded on the blockchain. Last year, Hong Kong launched a project to test the application of tokenization in real-world business scenarios, with Standard Chartered as a participant.

Standard Chartered is a British bank with operations around the world, including Hong Kong. The institution, designated a Global Systemically Important Bank (G-SIB) by the Financial Stability Board (FSB), has recently increased its presence in the digital assets space.

Earlier this year, the bank became the first of its scale to launch a Bitcoin and Ethereum spot trading desk for institutional clients. It also formed a joint venture with Animoca Brands and Hong Kong Telecom (HKT) to obtain a stablecoin license from the Hong Kong Monetary Authority (HKMA).

Stablecoins represent a prominent example of tokenization, acting as blockchain counterparts to fiat currencies. Standard Chartered is considering launching such an asset based on the Hong Kong dollar (HKD).

Today’s tokenized assets may be just the beginning if the bank CEO’s prediction that all money will eventually become digital comes true. “Think about what that means: a complete overhaul of the financial system,” Winters noted.

Bitcoin suffered a 3% decline over the past day

Bitcoin started the new week with another retracement as its price returned to the $107,500 mark. The chart below shows what the recent cryptocurrency trend looks like.

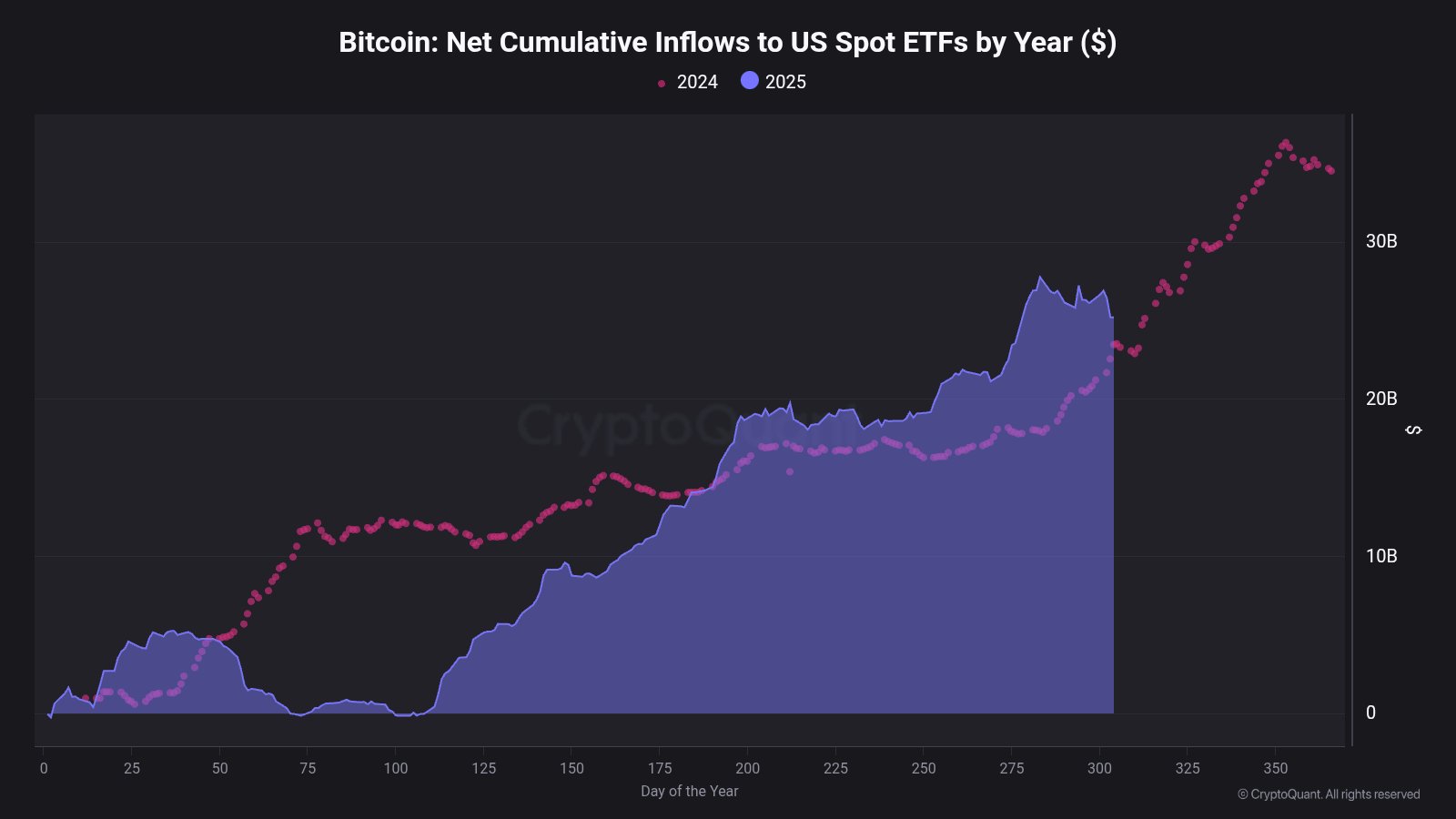

However, despite the recent bearish wave, Bitcoin is still outperforming in 2024 in terms of spot exchange-traded fund (ETF) inflows. As CryptoQuant community analyst Maartunn pointed out in an article X, 2025 is ahead of 2024 in terms of year-to-date inflows.

How the cumulative spot ETF inflows have compared between the two years | Source: @JA_Maartun on X

This time last year, US Bitcoin spot ETFs saw around $22.5 billion in cumulative inflows. The same figure for 2025 now stands at $25.18 billion.

Featured image of Dall-E, CryptoQuant.com, chart from TradingView.com

Editorial process as Bitcoinist focuses on providing thoroughly researched, accurate and unbiased content. We follow strict sourcing standards and every page undergoes careful review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance and value of our content to our readers.