Bitcoin price fell below $104,000 on Tuesday, but Wednesday saw a defense above $103,500. Meanwhile, Arthur Hayes believes it is too early to announce the end of market dynamics.

Maelström’s investment director note in an article on Tuesday, the price of Bitcoin has fallen 27% over the past month. He nevertheless believes that the Federal Reserve could still pave the way for a new rally.

Hayes said the next chapter for Bitcoin could begin when the Fed begins what he calls “stealth quantitative easing,” a quiet return of liquidity disguised as cautious policy.

For now, he said, markets are feeling the pressure of a liquidity crunch linked to the ongoing U.S. government shutdown.

Hayes also admitted that there was no way of knowing when this change would come. Fed Chairman Jerome Powell has said quantitative tightening will end by Dec. 1, although there is no guarantee of another rate cut next month.

Why are long-term Bitcoin holders selling?

The CME FedWatch tool puts the probability of another rate cut is about 72%. Still, analysts say the lack of clarity is affecting risk appetite in markets.

This caution is reflected in the price of Bitcoin. The asset fell about 10% last week. Also spot Bitcoin ETFs saw nearly $1 billion left the market during the same period, a sign of weak sentiment.

Hayes urged investors to preserve their capital and prepare for volatile trading until the shutdown ends. He previously said that Bitcoin could reach at least $200,000 before the end of the year.

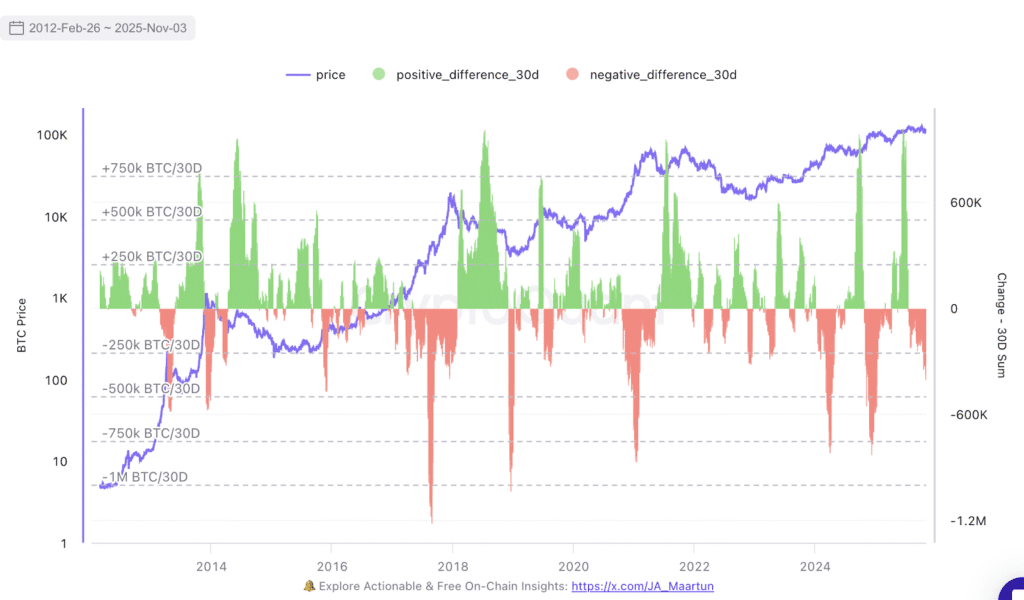

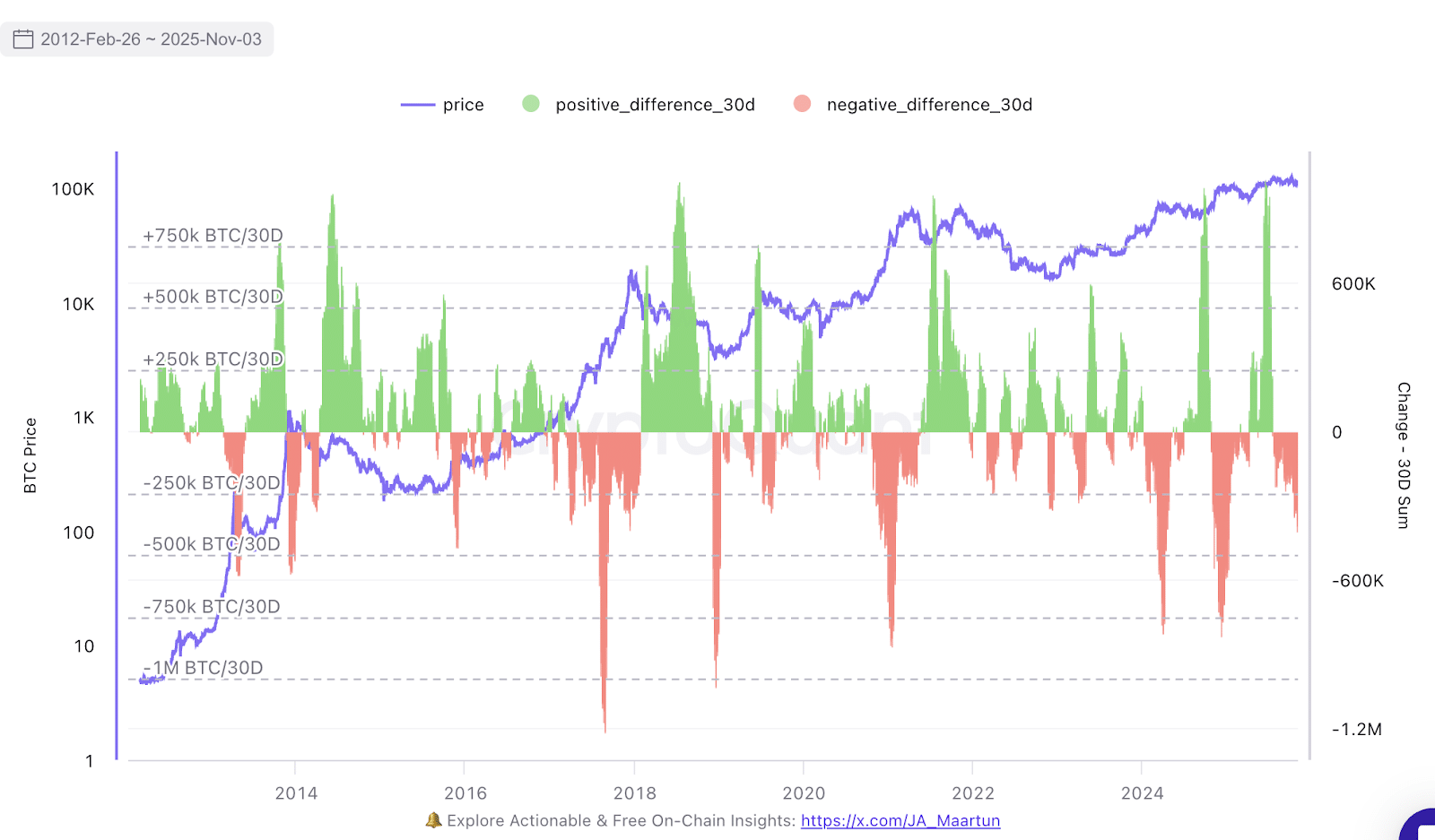

CryptoQuant data show that long-term holders have sold more than 827,000 BTC over the past month, worth around $86 billion.

(Source: CryptoQuant)

This amount represents almost 4% of Bitcoin’s total supply and marks the largest monthly decline since July.

EXPLORE: 20+ Next Cryptocurrencies That Will Explode in 2025

Bitcoin Price Prediction: Does a Break Below October 10 Low Signal More Bearishness?

Bitcoin slipped towards the $101,000-$102,000 area on Monday, testing a support level that has held since early October.

Analyst Ali Martinez said the area could serve as a short-term floor. He noted that the price had hit a historic demand zone, which had previously helped stabilize the market.

Bitcoin $BTC could bounce here to at least $106,500 or $112,000. pic.twitter.com/BaWBJ7VCTx

– Ali (@ali_charts) November 4, 2025

Its chart indicates a possible rebound towards $106,500, and if momentum builds, the move could extend to around $112,000. He also expects the market to move somewhat sideways before a clear recovery.

A second analyst offered a more cautious view. He said Bitcoin had already fallen below its October 10 low, signaling a structural breakdown that could increase pressure on the market.

He noted that this is the last major support before Bitcoin slides towards the $98,000 zone, a price last touched during the sell-off linked to Middle East tensions in June.

The chart shows repeated sweeps near current lows, hinting at diminishing strength and continued selling pressure.

$BTC It has now fallen below its October 10 low.

This is the last major level before the Mideast war fund’s June low of $98,000. pic.twitter.com/41Lzflq7db

– Daan Crypto Trading (@DaanCrypto) November 4, 2025

Both charts show a rapid decline from the $114,000 to $116,000 area in late October, followed by strong selloffs.

The market is now at a critical point. Buyers must maintain this range or risk a deeper decline.

If Bitcoin cannot return above the nearby resistance soon, the price could drift towards the thin liquidity zone near $98,000. This would reinforce a gloomy outlook for the market.

EXPLORE: Best New Cryptocurrencies to Invest in in 2025

Join the 99Bitcoins News Discord here for the latest market updates

The post Arthur Hayes Says Bull Market Still in Play: Monetary Policy Blocks Prolonged BTC Price Growth appeared first on 99Bitcoins.