Artist Robert Alice first discovered Tad Smith nearly a decade ago, when he was a porter at Sotheby’s, and Smith was the auction house’s managing director.

Alice then left Sotheby’s to become a full-time artist, while Smith left in 2019 when the auction house was bought by Patrick Drahi. But by chance, they met again in July 2024. “I was at the Bitcoin conference in Nashville watching (President Donald) Trump speak, which was pretty surreal, and then I looked over and Tad was there,” Alice says. “So, I looked it up and I was like, wow, this is interesting.”

When Alice left Sotheby’s to pursue an art practice full-time, the Venn diagram of people who understood blockchain and who also understood art was very small, he says. “You still have this pretty divided community,” Alice says. “So seeing Tad at this conference was a strong signal…I think Tad is a tremendous signal to the mainstream arts community, which he obviously led and was a part of, that there was something interesting here.”

Before the Beeple phenomenon of March 2021, Alice became the first artist to sell an NFT through a major auction house in October 2020, when he sold BLOCK 21 (42.36433° N–71.26189° E) of his 2019 Portraits of a Spirit series at Christie’s for $131,250, ten times the estimate of $12,000 to $18,000. Now another blockchain based work from the same series, BLOCK 1 (24.9472° N, 118.5979° E)will be offered at Sotheby’s in New York next week, during The Now and Contemporary Evening sale on November 18, with an estimate of $600,000 to $800,000.

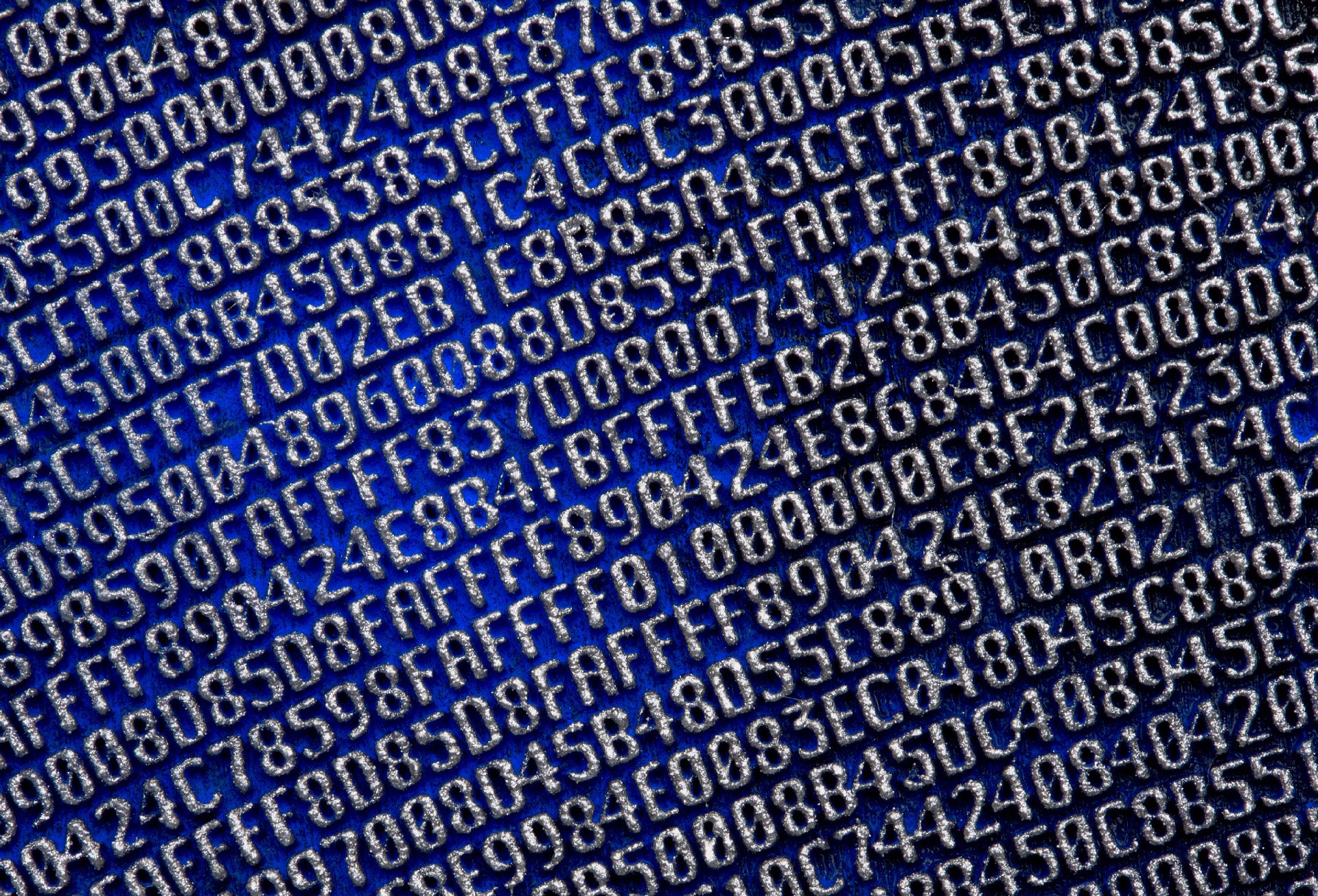

Like all the paintings in Portraits of a Spirit series, BLOCK 1produced between 2019 and 2022, is a hybrid work, a physical painting connected to an NFT. The circular gold leaf and acrylic on canvas are covered with hand-painted code, referencing the blockchain’s genesis block. It is described by Sotheby’s as “the most important work available at Portraits of a Spirit“, an ongoing project launched in 2018 that represents a complete transcription of the original codebase behind Bitcoin – each of the 40 paintings and corresponding NFTs in the series contains 322,048 digits of the original code developed in 2009 by Satoshi Nakamoto, the person(s) who developed Bitcoin. The process of then distributing these works to collectors will, according to Alice, “decentralize the artwork.”

BLOCK 10 (52.5243° N, -0.4362° E) of the Portraits of a Spirit series was purchased by the Center Pompidou in Paris last year, while another, BLOCK 37was recently purchased by Smith.

On a zoom call with The arts journal in early November, Smith clarified that he was not the sender of the BLOCK 1 at Sotheby’s (the seller bought the work directly from Alice, according to the catalog), and he is not the guarantor either. “In an indirect way, I would like to see it (BLOCK 1) succeed, but not for financial reasons,” he says. “I would like to see it succeed because it will promote Robert’s genius, it will promote Bitcoin, it will promote Sotheby’s. This is great for Sotheby’s and will get the younger generation, millennials and Gen Z excited about more traditional ways of buying art.

Block 1 contains 322,048 digits of the original code developed in 2009 by Satoshi Nakamoto.

Courtesy of the artist

During his tenure as chief executive at Sotheby’s from 2015 to 2019, Smith worked to digitize the auction house and one of the acquisitions made during his tenure was that of AI startup Thread Genius, which uses image recognition technology and machine learning to show users more art they might like, in 2018. Smith’s interest in art and assets digital is therefore hardly surprising. In addition to serving as chairman of the supervisory board of The Fine Art Group, Smith is currently a partner in a growth capital firm called 50T Holdings that invests solely in digital assets.

“I love art, and that’s a really important point,” Smith says of his interest in the field. Taste transitions are typically generational, he says, and each new development in art will inevitably horrify traditionalists. So, the division around digital art and NFTs is not new. “It’s a normal transition,” Smith says. “When you look at baby boomers, and to some extent Gen

What’s new, Smith says, is that in a digital world, “there’s no real way to acquire ownership unless you have a way to record ownership, because otherwise it’s just a JPEG file that exists freely on the Internet. Blockchain creates the possibility of that ownership, and so art can start to have value.” The significant wealth transfer is accelerating this shift as digital-born millennials and Generation Z have greater purchasing power. “There are works of art that are, in effect, digital extracts that have a blockchain record and are already trading for millions of dollars,” says Smith. “Although this is only a small part of the market, it is growing rapidly. »

Smith admits that much digital art is difficult for the uninitiated to buy: “It’s not an easy user experience, you can’t get your hands on it. » This is why hybrid works, a physical object combined with an NFT, are popular, because they are much more tangible. In Alice’s words, the fact that her work has “one foot in both the physical space and the digital space” makes it more accessible and inviting, which is why the majority of her buyers are traditional art collectors.

Alice, whose book On NFTs was published by Taschen last year (priced at £1,500), also notes a “wave of institutionalization” of digital art, pointing to recent acquisitions of blockchain-based art by institutions such as MoMA, the Whitney and, of course, the Pompidou. “The institutionalization of Bitcoin as a financial asset over the past six months has reflected the institutionalization of blockchain art,” explains Alice. “The Bitcoin ETF (exchange traded fund) probably happened around the same time that the Pompidou started collecting NFTs, or MoMA started showing NFTs.”

Alice has one work at Lacma’s Digital Wallet, three at the Center Pompidou, and five at Monnaie de Paris, where he has had two exhibitions, with more announcements from American institutions to come. But, to his knowledge, “no British institution has yet acquired NFTs”. He adds: “I think more and more collectors, critics and curators are starting to understand that as Bitcoin and blockchain mature and people start to see it as one of the major narratives of the 21st century, these works will have important cultural resonance. »