Join our Telegram channel to stay up to date with the latest news

Strategy, the leading Bitcoin treasury company, has 174% upside potential and still offers investors an attractive option for exposure to Bitcoin, says investment bank TD Cowen.

He maintained a $535 price target even after MSTR plunged more than 34% and Bitcoin 15.5% over the past month, arguing that the decline reflects market volatility rather than a breakdown in the firm’s BTC accumulation model.

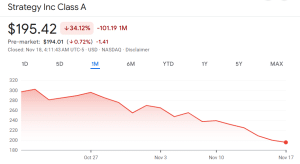

MSTR stock price (Source: Google Finance)

“The strategy remains an attractive vehicle for those looking to build exposure to Bitcoin,” said analysts Lance Vitanza and Jonathan Navarrete.

MSTR is down more than 52% over the past six months, while Bitcoin is down more than 27% from the all-time high (ATH) of $126,841.89 set on October 6, 2025, according to data from CoinMarketCap.

Amid these declines, the strategy’s market net asset value (mNAV), which is the value of the company’s total market capitalization relative to the value of its holdings, fell below 1. But it has since recovered and currently stands at 1.21, according to Strategy’s website.

Schiff declares strategy’s business model a ‘fraud’, starts Saylor debate

While TD Cowen analysts maintain their optimistic view of the strategy, gold advocate and BTC critic Peter Schiff said on November 17 that the strategy is a “fraud.”

“MSTR’s business model relies on income-oriented funds that purchase its ‘high yield’ preferred shares,” he wrote on X.

MSTR’s business model relies on income-oriented funds that purchase its “high-yielding” preferred shares. But these published returns will never actually be paid. Once fund managers understand this, they will abandon preferences and $MSTR will no longer be able to emit any, triggering a death spiral.

-Peter Schiff (@PeterSchiff) November 16, 2025

“But these published returns will never actually be paid. Once fund managers realize this, they will abandon the preferences and $MSTR will no longer be able to issue, triggering a death spiral,” Schiff added.

Schiff disputed Saylor at a panel discussion at Binance Blockchain Week in Dubai in December, which both are expected to attend. Saylor did not respond.

Strategy Continues Bitcoin Accumulation in Market Downturn

Strategy started buying Bitcoin in 2020 and became the largest BTC holding company in the world, with 649,870 BTC on its balance sheet, data Bitcoin Treasury issues.

The company’s most recent purchase was announced yesterday, when Strategy founder Michael Saylor said in an article on

Strategy acquired 8,178 BTC for ~$835.6 million at ~$102,171 per bitcoin and achieved a BTC return of 27.8% since the start of 2025. As of 11/16/2025 we held 649,870 $BTC acquired for ~$48.37 billion at ~$74,433 per bitcoin. $MSTR $STRC $STRD $STRE $STRF $STRK

-Michael Saylor (@saylor) November 17, 2025

The most recent purchase was made with proceeds from the market sale of Strike Perpetual Preferred Stock (STRK), Strife Perpetual Preferred Stock (STRF), and Stretch Perpetual Preferred Stock (STRC). The company also used proceeds from its recently unveiled Euro-denominated preferred shares (STRE).

Related articles:

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news