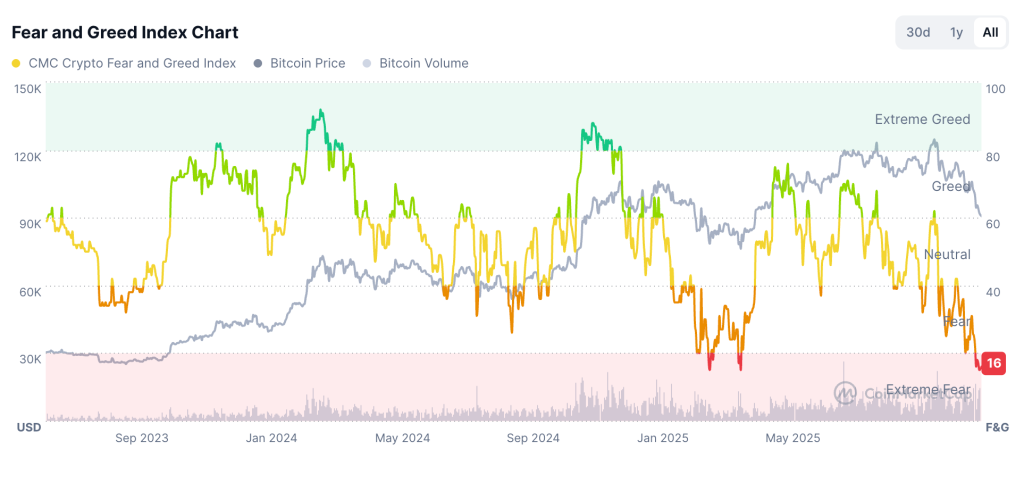

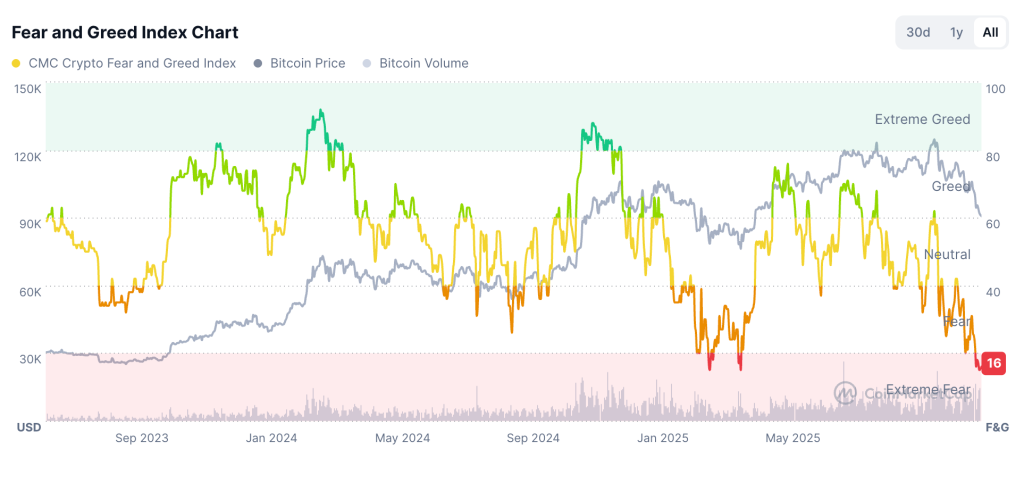

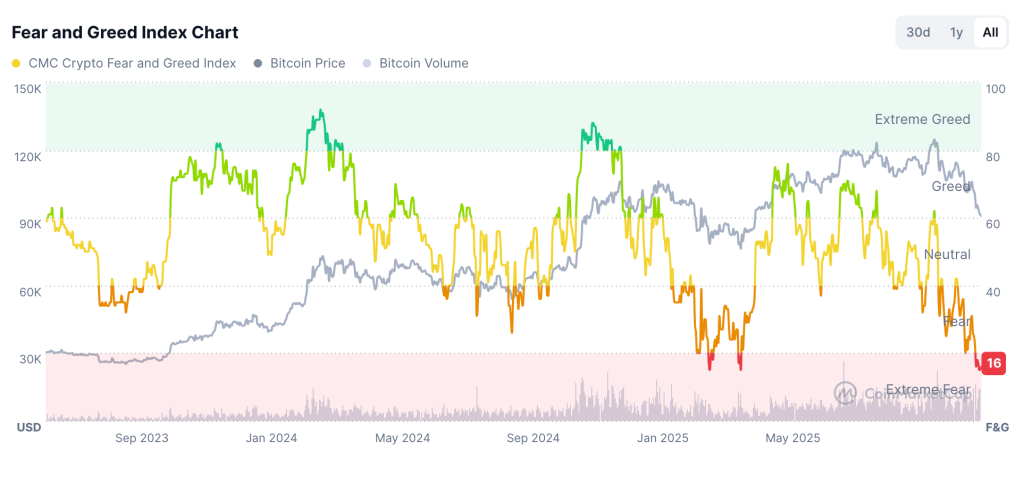

The Altcoin season still seems far away even if a few names continue to climb in a context marked by extreme caution. The Crypto Fear and Greed Index is near 16, close to its yearly low, and Bitcoin is trading around $91,000 after falling towards $90,000, pressured by ETF outflows and global growth concerns.

Most altcoins remain under pressure, but MYX Finance, Starknet and AB are advancing, providing a narrow reading for capital participation when sentiment remains weak.

Crypto Fear and Greed Index (Source: CoinMarketCap)

Rotation remains selective rather than broad. Liquidity and positioning data shows that attention is focused around themes offering active incentives, steady development or high turnover potential. These moves provide more insight into how traders are prioritizing specific narratives in a risk-free environment than a general turn toward altcoin season.

MYX Finance: restoring demand

MYX Finance is trading near $3.24, up about 33% in 24 hours, with volume well above recent sessions. Activity is concentrated in pairs related to its liquid restocking and perpetual trading product, which continues to attract attention as many DeFi tokens trade quietly.

Recent discussions around its rewards campaigns and ongoing release schedule tied to past portfolio promotions remain a driver of participation. These mechanisms, as well as the project’s constant visibility in recovery debates, have kept MYX active even as questions around design and sustainability persist.

Starknet: Staking Upgrade Sparks Interest

Starknet’s STRK is trading near $0.254, also up about 36%. The move follows the introduction of a new staking phase that ties rewards to network activity and participation on Bitcoin-related DeFi routes. The foundation’s dedicated reward pool and recent developer-oriented upgrades have supported steady inflows.

This version of the staking program gives Starknet a clearer path for on-chain activity at a time when many scalable networks are competing for liquidity, and its structure appears to be one of the most well-defined catalysts in the market today.

AB: Speculation in the small cap corner

AB is trading near $0.0077, up about 14%, although depth remains slim. AB DAO announced five new senior advisors to “strengthen technology-driven governance, diplomacy and philanthropy,” in addition to the latest $1 stablecoin launch on AB Chain.

AB Price (Source: CoinMarketCap)

Volume trends show bursts of momentum followed by rapid cooling, indicating that the current move is shaped more by speculative flows than long-term development indicators.

What This Says About Altcoin Season in Fear

The combination of rising prices in MYX, Starknet and AB, while the Fear Index hovers near extreme levels, shows that the altcoin season is still limited to isolated themes rather than broad participation. The market continues to separate tokens with active incentive structures or visible development from those without clear drivers.

Bitcoin’s pullback into the low $90,000 range, combined with caution regarding global politics and liquidity, still sets the overall ceiling for risk-taking. Under these conditions, altcoin activity appears strongest where projects offer immediate engagement avenues or concentrated narrative appeal, rather than across the entire market.

The article Altcoin Season Pockets: MYX, Starknet and AB Rise In Extreme Fear appeared first on Cryptonews.

(@Starknet)

(@Starknet)