Ethereum price fell another -9% in the last 24 hours, falling to around $2,700, a level not seen since mid-July 2025, marking a four-month low for the second-largest digital asset by market capitalization. Technical indicators and institutional demand are bearish, which could see ETH fall below $2,500 before the end of 2025.

Ethereum’s DATs (Digital Asset Treasuries), the largest being Bitmine and SharpLink, are falling relative to their respective ETH accumulation, failing to benefit from the success of the original DAT, Michael Saylor’s strategy.

Bearish 2022 Fractal Appears on ETH Chart – $2,500, Next Ethereum Price?

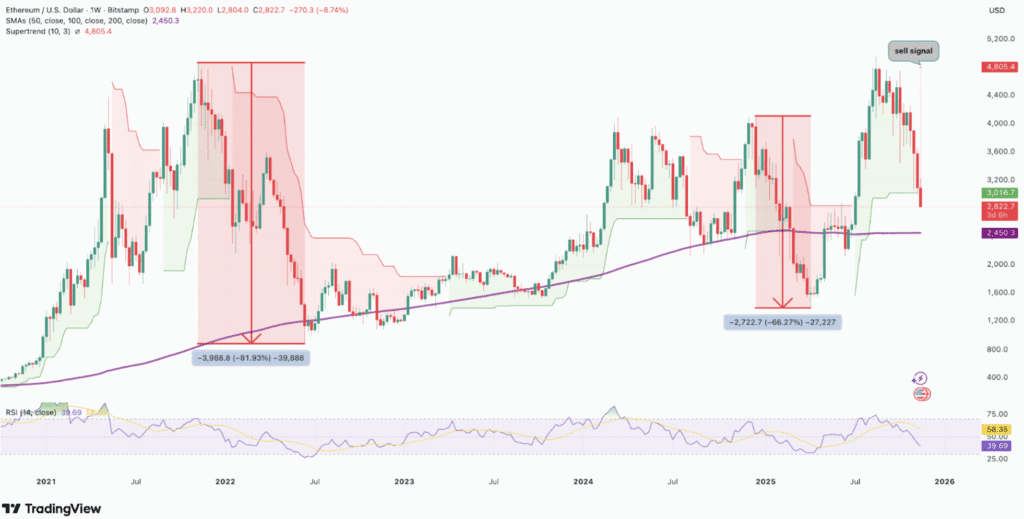

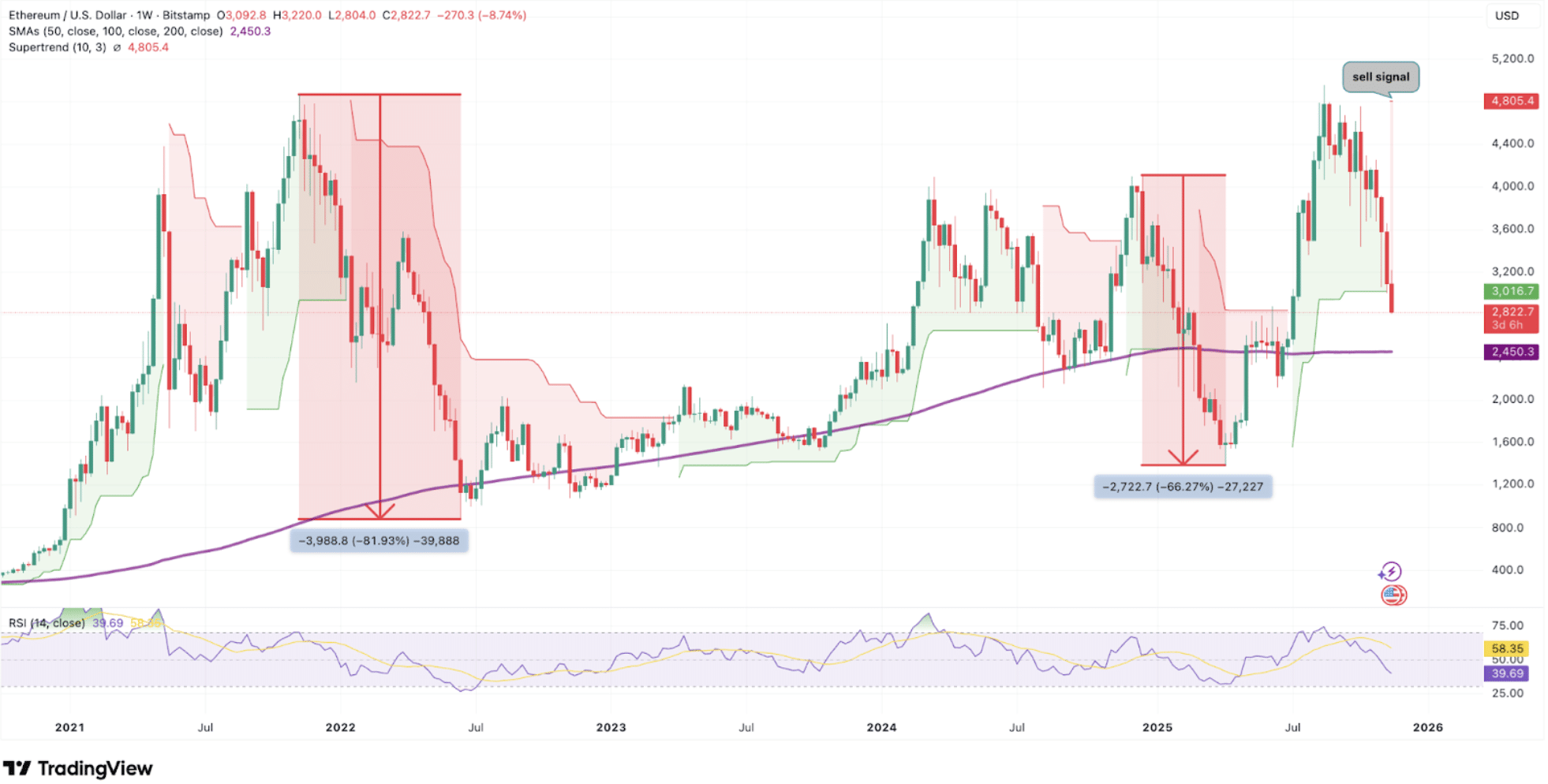

Ethereum price is currently in a four-week losing streak and is now displaying a bearish fractal pattern last seen in 2022, suggesting further decline for ETH ahead of any potential rally.

A market fractal is a repeating pattern that traders can use to identify possible trend reversals in charts. Currently, ETH is exhibiting a bearish fractal pattern similar to that seen in 2022, when ETH fell from $4,750 to $800, a decline of -81.93%.

If ETH experiences a similar decline, it could fall to $2,450, an additional 10% decline from its current price of $2,730. This is part of a broader downtrend that has seen the price of Ethereum fall -28% over the past 30 days.

(SOURCE: Trading View)

ETH Outflows Highlight Strong Selling Pressure as Open Interest

Market flows continue to reflect sustained selling pressure. ETH spot data shows negative outflows in all time frames, from 24 hours to 1 year, signaling a consistent downtrend for Ethereum that has persisted throughout 2025.

These regular outflows correspond to ETH’s difficulty in maintaining any price increase. The 24-hour figure shows a net outflow of $415 million as ETH trades at around $2,700. Therefore, traders continue to interpret this trend as a sign of decreasing demand for the second largest cryptocurrency.

Derivatives data from CoinGlass also appears rough, showing that OI (Open Interest) fell from around $45 billion a month ago to $35.5 billion as of November 21. This decline provides further evidence of diminishing speculative activity and drying up liquidity on ETH.

We’ve seen over $1 billion in open interest removed from both $BTC & $ETH on this downward move over the last 5 minutes.

This is the first time we’ve actually seen acceleration and large liquidations in a single candle, instead of a slow orderly decline. pic.twitter.com/P6tKBzsQLl

– FUTURE GEM (@correctgem) November 21, 2025

DISCOVER: The Best Solana Meme Coins to Buy in November 2025

Ethereum DAT Businesses Are Underwater – A House of Cards to Topple?

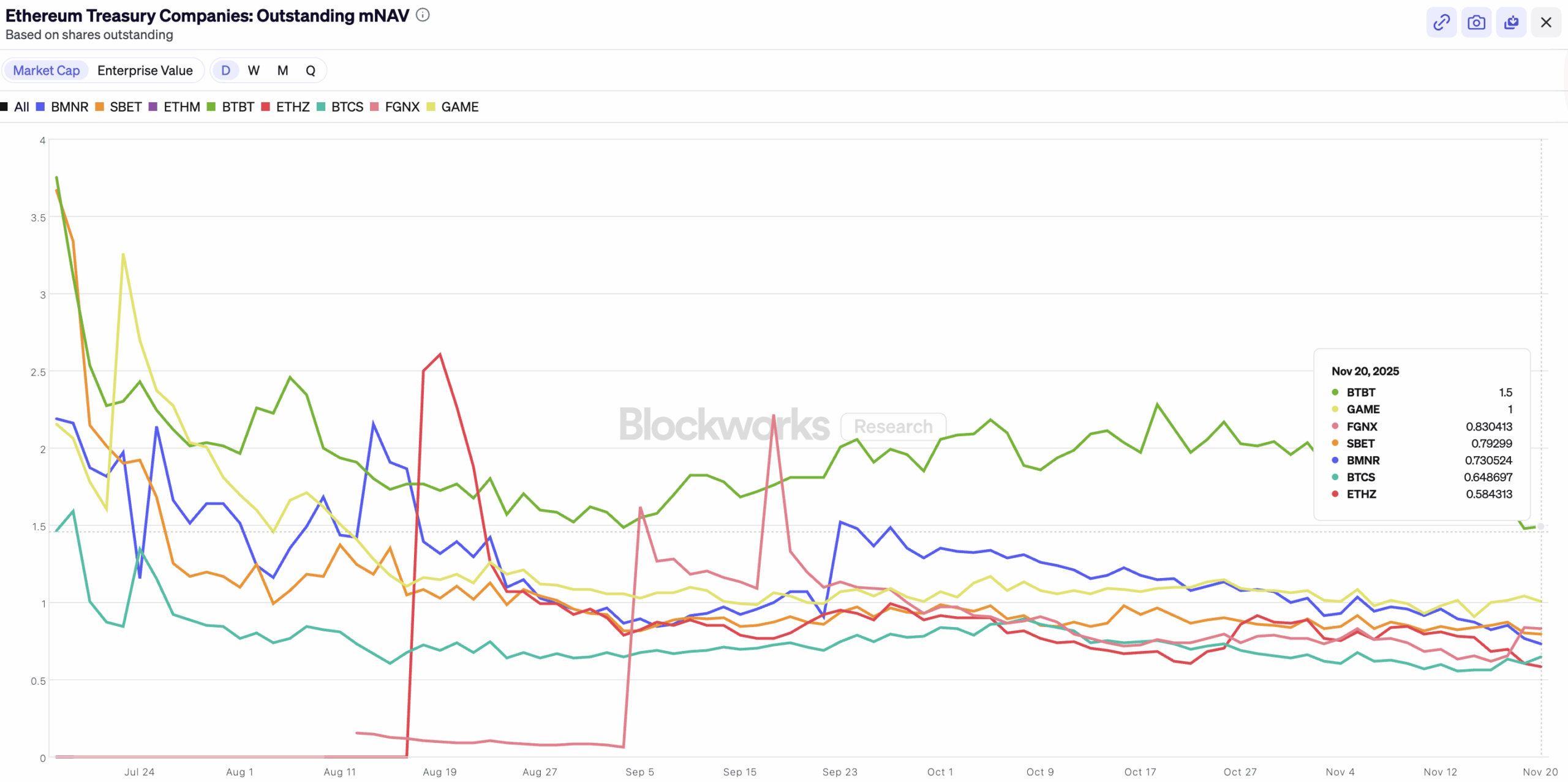

The sharp decline in ETH has made the average Ethereum treasury company unprofitable, leading to millions of dollars in paper losses. Data from BlockWorks Research shows that these companies saw negative returns of 25% to 48% on their ETH holdings.

The top 10 DAT companies are in the red on both weekly and daily time frames. BitMine Immersion Technologies, which holds 3.56 million ETH (2.94% of the circulating supply), has seen returns of -28% and -45% over the last 7 and 30 days, respectively.

BitMine is currently down $1,000 per ETH purchased, implying a total unrealized loss of $3.7 billion on its holdings. SharpLink, The Ether Machine and Galaxy Digital are also suffering losses in the millions, down 50-80% from their annual highs.

(SOURCE: Block work)

BlockWorks data also indicates that net asset market value (mNAV), a metric used to assess the valuation of digital asset troves, has fallen below 1 for most of these companies, signaling a reduced ability to raise capital.

GameSquare (GAME) and Bit Digital (BTBT) are the only two Ethereum DAT companies that still hold an mNAV of 1 or higher, 1 and 1.5, respectively.

There are growing concerns that the price of Ethereum could be further decimated if DAT companies are forced to liquidate their ETH holdings in an effort to protect shareholders.

EXPLORE: Best Meme Coin ICOs to invest in 2025

Join the 99Bitcoins News Discord here for the latest market updates

Ethereum Price Prediction After $3,000 Loss: What Happens to ETH DATs Now Paper Gains Are Gone? appeared first on 99Bitcoins.