Bitcoin’s price and its open interest (OI), which represents the total number of derivatives contracts remaining to be settled, have been relatively correlated in recent months and remain elevated, while total altcoin open interest has fallen 55% since an all-time high in March.

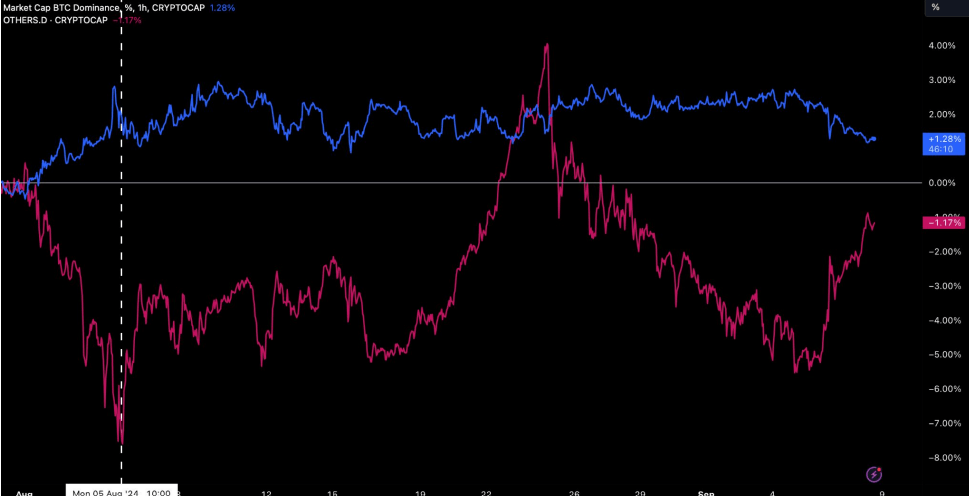

According to a recent Bitfinex Alpha report, Bitcoin’s dominance in the cryptocurrency space – that is, its market share of the total market capitalization – reached its highest value since March 2021 at 57.7% after the market crashed in early August. The September downturn, however, saw altcoins rise while BTC’s dominance fell.

These numbers suggest that sellers are close to exhausting their stocks, with the current total value of these crypto assets standing at just $8.75 billion. According to analysts at Bitfinex, this decline is part of a significant shift in the relative strength of altcoins versus Bitcoin.

The report suggests that investors are moving away from the safety of Bitcoin and betting on other digital assets. It states that during market declines, traders “often liquidate their altcoin holdings into either Bitcoin or fiat currencies,” increasing BTC’s dominance as they seek safety during periods of volatility.

However, the recent downtrend has seen Bitcoin dominance fall by 1.3% while altcoin market cap has increased, suggesting that investors “may be seeing potential value or receiving positive signals from altcoin markets.”

Bitfinex analysts, however, point out that this could also be a result of current market dynamics, as the sell-off was driven by exchange-traded fund (ETF) outflows and sales in the spot market.

Analysts added that with some altcoins already seeing declines of over 80% from their all-time highs, “it is very likely that altcoins have reached a point of seller exhaustion.”

Altcoins have underperformed Bitcoin since the beginning of last year, with a few exceptions. The recent drop in Bitcoin dominance, however, suggests that its dominance may be “approaching a local top,” meaning that “the altcoin sector as a whole could continue to outperform Bitcoin during market upswings and demonstrate resilience during downturns.”

Featured image via Unsplash.