Why did Ethereum fall? Well, the fundamentals haven’t changed for ETH, but my net worth has. .cwp-coin-chart path svg { strokewidth: 0.65 !important; } .cwp-coin-widget-container .cwp-graph-container.positive svg path: nth-of-type (2) { trait: #008868 !important; } .cwp-coin-widget-container .cwp-coin-trend.positive { color: #008868 !important; background-color: transparent !important; } .cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.positive { border: 1px solid #008868; border-radius: 3px; } .cwp-coin-widget-container .cwp-coin-trend.positive::before { border-bottom: 4px solid #008868 !important; } .cwp-coin-widget-container .cwp-coin-price-holder .cwp-coin-trend-holder .cwp-trend { background-color: transparent !important; } .cwp-coin-widget-container .cwp-graph-container.negative svg path: nth-of-type (2) { trait: #A90C0C !important; } .cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.negative { border: 1px solid #A90C0C; border-radius: 3px; } .cwp-coin-widget-container .cwp-coin-trend.negative { color: #A90C0C !important; background-color: transparent !important; } .cwp-coin-widget-container .cwp-coin-trend.negative::before { border-top: 4px solid #A90C0C !important; }

4.67%

Ethereum

ETH

Price

$2,841.69

4.67% /24h

Volume in 24 hours

$19.79 billion

Price 7d

// Make SVG responsive jQuery (document). svg.attr(‘viewBox’, ‘0 0 ‘ + originalWidth + ‘ ‘ + originalHeight); } svg.removeAttr(‘width’).removeAttr(‘height’); } });

Learn more

slipped sharply this week, falling more than 7% in 24 hours due to a mix of structural and psychological pressures colliding – but how does it impact the Ethereum price prediction.

An exploit by Yearn Finance sparked the first wave of selling, but the cascade quickly spread through the market, sending BTC down 5% and bringing the total crypto market cap below $3 billion.

Profit of 1 million dollars in just 1 hour!

Trader pension-usdt.eth opened a 2x short position on 6,358 $ETH($18 million) an hour ago – just before the market crash – he now has an unrealized profit of $1 million. pic.twitter.com/RuuVZ5ztlC

– Lookonchain (@lookonchain) December 1, 2025

Meanwhile, crypto whales are selling their bags and short sellers are sensing an opportunity. Here’s what you need to know about the price of ETH:

DISCOVER: Top 20 cryptocurrencies to buy in 2025

Why did Ethereum fall? A 2015 ICO whale wakes up after a decade

One of the biggest headlines of the day came from an on-chain alert showing an Ethereum ICO 2015 wallet, inactive for ten years, moving 40,000 ETH, originally purchased for $12,400 at $0.31. This reserve is now worth approximately $120 million, a return of 9,677 times over current prices.

Despite fears of liquidation, no foreign exchange deposits have been detected.

Lookonchain: “The transfer appears to be an internal move, not a liquidation event.”

A whale transferred $120,000,000 $ETH after 10 years of dormancy.

He bought them for just $12,400 and now enjoys a 9,633x return.

Life-changing wealth with Ethereum. pic.twitter.com/sOaBGLgMyz

– Ted (@TedPillows) November 30, 2025

Historically, early ETH whales have caused more panic on social media than actual market damage. Dormant wallet activations are narrative events, not typically liquidity events.

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Could Reach 1000x in 2025

Yearn Exploit Sparks Wider Selloff: What’s Next for Ethereum Price Prediction?

The real trigger came from a Yearn Finance exploit reported by CoinDesk, which blindsided markets already stretched by leverage. As the exploit circulated, ETH futures traded aggressively and over $600 million in crypto liquidations were recorded, according to CoinGlass.

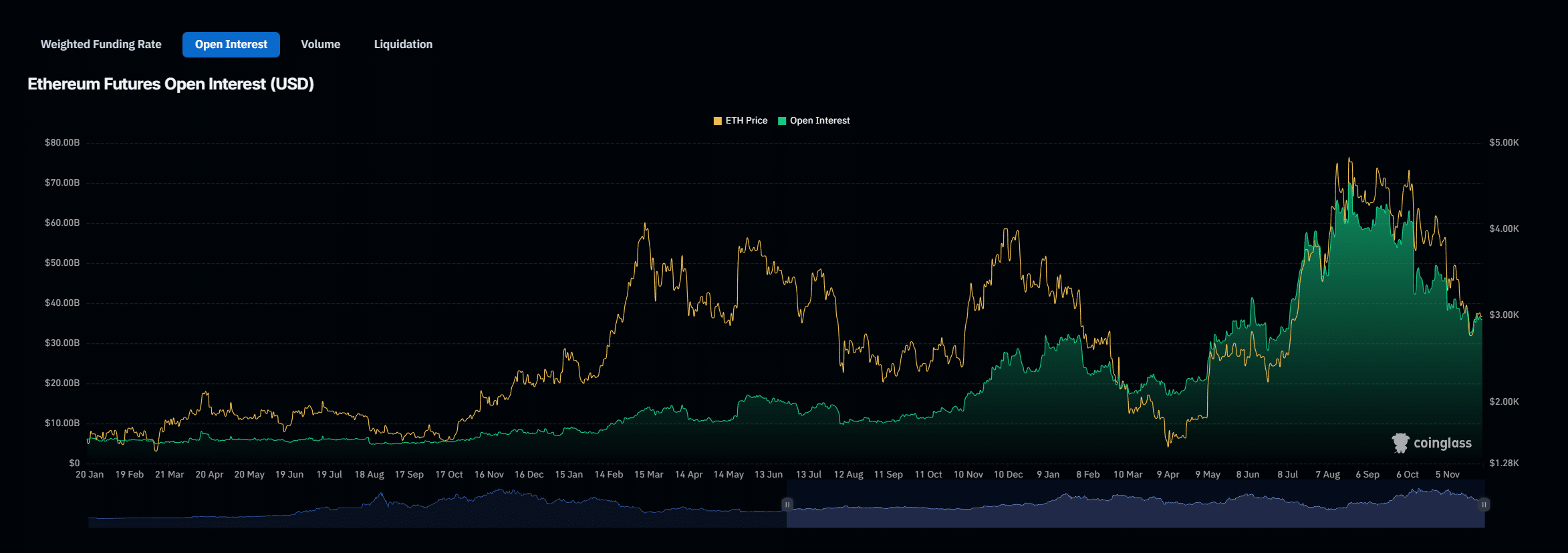

Data from CoinGlass shows a sharp increase in open interest on ETH futures through the end of November, followed by a violent surge as traders were forced to exit. Retail investors have accused insiders of being behind the exploit, although there is no evidence to support this claim.

Meanwhile, Taiwanese whale Machi Big Brother once again found itself on the wrong side of volatility. Its partial liquidation left it holding 3,300 ETH with 25x leverage, with a liquidation price of $2,831.58.

Screenshots of his HYPE and ETH perpetual positions show another $1.7 million in forced closes and a -108% ROE. Analyst Wukong: “This is what happens when you treat ETH like a casino token rather than collateral.”

Machi(@machibigbrother) has just been partially liquidated again while the market was falling!

He still has 3,300 left $ETH($9.4 million) long position remaining, with a new liquidation price of $2,831.58. pic.twitter.com/XnigX3im8G

– Lookonchain (@lookonchain) December 1, 2025

Market conditions still favor ETH USD price volatility

From a data perspective, Ethereum remains in a fragile situation.

CoinGecko shows ETH trading volume fading, while Glassnode’s funding rate metrics indicate an unhealthy trend toward high leverage even after this washout. FRED data on global liquidity continues to decline as Japan signals tightening and US real yields remain elevated.

EXPLORE: XRP Price Jumps 11% After SEC Cryptocurrency Unit Announces XRP ETF Progress

Key takeaways

-

Why did Ethereum fall? Well, the fundamentals haven’t changed for ETH, but my net worth has.

-

From a data perspective, Ethereum remains in a fragile situation.

The post Why did Ethereum fall? Crypto Crash Dents’ Ethereum Price Prediction for December appeared first on 99Bitcoins.