Join our Telegram channel to stay up to date with the latest news

The strategy’s CEO, Phong Le, said Michael Saylor’s company has “more flexibility than ever” to continue buying Bitcoin.

Speaking on In the “What Bitcoin Did” podcast, Le said Strategy has a capital structure built on long-term debt and there is no near-term pressure on its ability to raise funds.

The $60 billion Bitcoin bet | @Strategy CEO Phong Le pic.twitter.com/w0WBg42PaD

-Michael Saylor (@saylor) November 28, 2025

Capital Markets The Reason Why Strategy Can Buy Bitcoin in Different Market Cycles

Strategy is the largest Bitcoin holding company in the world and began purchasing BTC as part of its treasury in 2020.

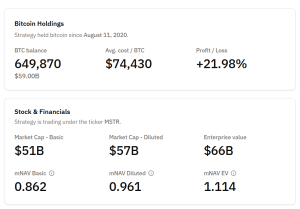

Bitcoin Treasury data shows the company holds 649,870 BTC, valued at approximately $59 billion at current prices.

BTC holdings of the strategy (Source: Bitcoin Treasures)

These securities were acquired through a series of purchases financed by tranches of long-term convertible notes with little risk of short-term dilution.

Le said capital markets are the “magic” that allows Strategy to continue its accumulation of Bitcoin through multiple market cycles, adding that its balance sheet is edesigned to avoid liquidity tensions and leave room for opportunistic issues.

The company’s first debt maturity isn’t until December this year, giving Strategy “a lot of flexibility to be opportunistic,” he said.

He argued that Strategy currently has more flexibility than at any time in its history, citing the company’s ability to raise capital through market programs as well as its track record of issuing zero-coupon or low-coupon convertible notes.

“We have shown that we can do both,” he said, adding that the company can either raise more capital when stock markets are strong or rely on convertible bonds when rates and market conditions favor long-duration issues.

Strategic stock price in a short-term uptrend

The company transitioned from MicroStrategy to Strategy earlier this year and has evolved from a traditional software company to a hybrid business combining business analytics with a Bitcoin buying cash flow plan.

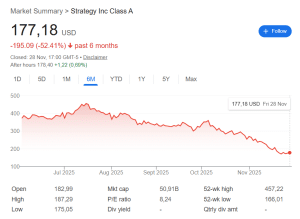

Le acknowledged that some investors are still wondering how to value the strategy, especially given the volatility around the price of Bitcoin. Strategy’s MSTR stock has fallen more than 52% in the past six months.

Performance of the strategy’s stock price over the last 6 months (Source: Google Finance)

That, along with the decline in Bitcoin’s price, caused Strategy’s market net asset value (MNAV), which is the ratio of the company’s market capitalization to the net asset value of its crypto holdings, to plunge. The ratio has since recovered somewhat to reach stay at 1:13 a.m.

MSTR rallied last week, climbing 2.4% after a 0.8% gain over the past 24 hours. The rally coincided with a 5% rise in the price of Bitcoin over the past week.

Related articles:

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news