Bitcoin is entering a watershed moment as selling pressure intensifies and uncertainty continues to grip the market. The bulls are struggling to regain higher levels, and each failed bounce reinforces the prevailing downtrend. With momentum in spot and derivatives markets weakening, investors are increasingly questioning whether BTC can stabilize before more serious structural damage occurs.

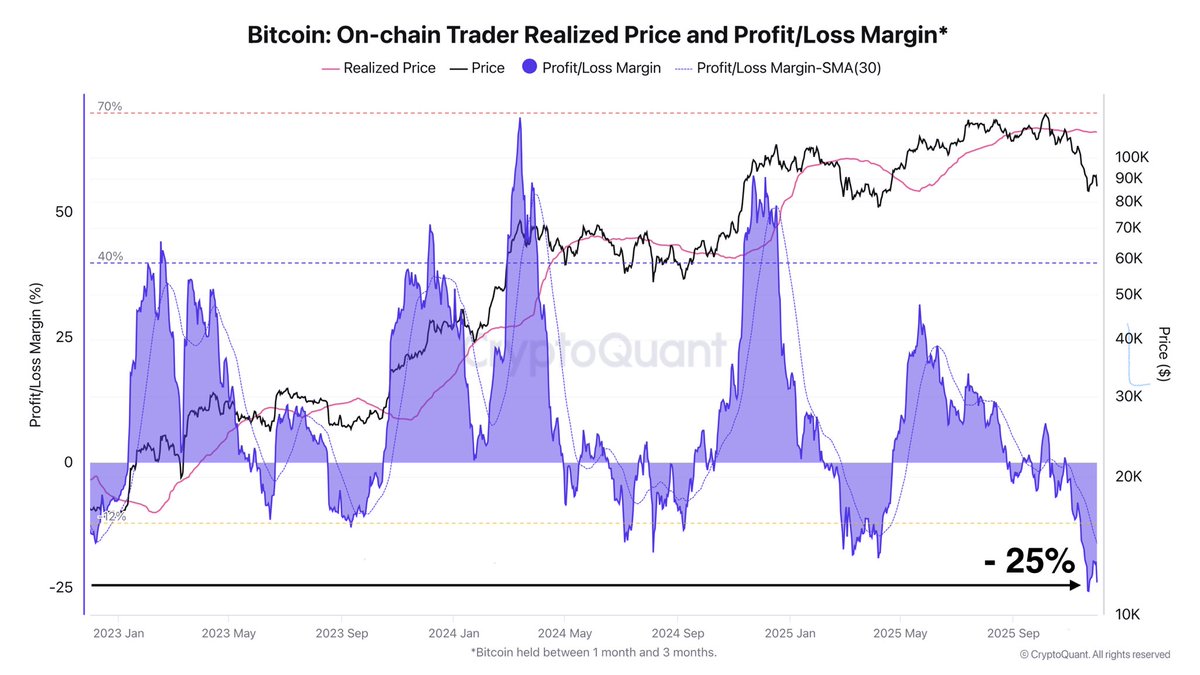

According to a report from Darkfost, the situation is particularly difficult for short-term participants. With a realized price of $113,692, the 1-3 month BTC cohort is now experiencing the largest percentage loss of this entire cycle.

This analysis focuses exclusively on the cash market, isolating a group of investors known for more speculative behavior and faster reaction times. Since these holders typically enter phases of strong momentum, their capitulation or continued holding often signals decisive changes in market structure.

The significant losses within this cohort reveal how aggressively the market has reversed and highlight the growing pressure on players in the near term. As Bitcoin approaches critical support levels, the behavior of these investors may determine whether the current correction stabilizes – or accelerates into a broader downturn.

Capitulation of short-term holders often signals bottoming

Darkfost points out that the cohort of 1-3 month Bitcoin holders has now gone almost two weeks with average unrealized losses of between 20% and 25%. Historically, this type of decline among short-term participants has tended to occur close to the formation of the cyclical bottom.

These traders typically react quickly to volatility, and when their losses reach this magnitude, they are pushed toward a critical decision point: sell and exit the market, or hold and endure further decline.

Throughout this cycle, similar phases of high losses preceded major inflection points. Once a large portion of these speculative holders capitulate – a process that appears to have been unfolding in recent weeks – the selling pressure usually begins to wear off. This change often creates an environment in which accumulation becomes much more attractive to patient investors who follow realized price dynamics.

However, Darkfost points out that this trend only holds if the long-term uptrend remains intact. On-chain structural indicators, broader demand trends, and long-term holder behavior continue to support the idea that Bitcoin’s macro trend has not been invalidated.

Although volatility may persist in the short term, the alignment of capitulation signals with a still-intact long-term structure suggests that current levels could become an opportunity for strategic accumulation.

Bitcoin tests weekly level as market seeks longer-term support

Bitcoin’s weekly chart shows the most significant corrective phase since the early stages of the cycle, with the price falling sharply from the $120,000 region and now trying to stabilize around the 100 SMA between $84,000 and $85,000. This moving average has historically acted as major structural support during bull markets, and BTC’s current interaction with it marks a critical turning point for the broader trend.

The break below 50 SMA was a clear sign of weakening momentum, signaling that sellers have taken control of the longer-term structure. However, the wick formed below the 100 SMA suggests that buyers are starting to step in, attempting to defend this crucial area. The reaction so far is constructive but not yet decisive: BTC needs a stronger weekly close above $90,000 to confirm stability.

Volume increased during the decline, indicating forced selling and capitulation rather than an organic trend reversal. Historically, pullbacks toward the 100 SMA often precede mid-term lows within a long-term bull market, but continuation depends on BTC’s ability to avoid a sustained weekly close below this level.

Featured image from ChatGPT, chart from TradingView.com

Editorial process as Bitcoinist focuses on providing thoroughly researched, accurate and unbiased content. We follow strict sourcing standards and every page undergoes careful review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance and value of our content to our readers.