The Uniswap community is set to approve one of the most important governance decisions in the protocol’s history, with a vote to enable the long-debated fee change and burn a large portion of UNI tokens expected to be adopted later this week.

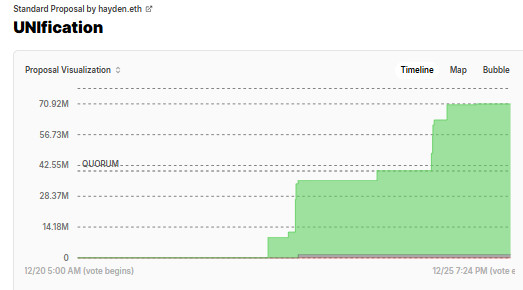

The proposal, known as “UNification,” has already reached the required quorum, has overwhelming support and is expected to go live after a short blocking period.

Notably, this will pave the way for changes that would directly tie Uniswap’s protocol activity to the supply dynamics of the UNI token for the first time since its launch.

Uniswap vote comes to an end with overwhelming support

As of Monday morning, more than 69 million UNI tokens had been used to vote in favor of the proposal, well above the 40 million required for approval.

Voting began on December 20 and will continue until Christmas Day, although opposition has been negligible. Only around 740 votes, or around 0.001% of the votes cast, came against the proposal, while around 1.5 million UNI were marked as abstentions.

More than 6,000 addresses participated, with near 100% support among active voters.

Hayden Adams, CEO of Uniswap Labs, said that once voting is officially closed, changes will be subject to a two-day delay before implementation.

The proposal also authorizes the immediate burning of 100 million UNI from the Uniswap Foundation treasury.

The governance package also introduces a protocol fee reduction auction system designed to improve returns for liquidity providers while aligning Uniswap Labs, the Uniswap Foundation and on-chain governance under a single legal structure using Wyoming’s DUNA framework.

Several influential figures in decentralized finance have supported UNification’s proposal, including Variant founder Jesse Waldren, Synthetix and Infinex founder Kain Warwick, and former Uniswap Labs engineer Ian Lapham, all of whom hold substantial voting power.

Can the fee change finally give UNI holders a direct gain?

The vote comes amid a broader debate within DeFi over sustainable token economics and long-term value capture.

Many protocols have struggled to translate heavy usage into tangible benefits for token holders, a criticism that has followed Uniswap for years despite its dominant position in the market.

Uniswap remains the largest decentralized exchange by volume, having processed over $4 trillion in transactions since its launch in 2018, but UNI holders have historically had limited direct exposure to the protocol’s revenue.

Proponents of the fee change argue that tying protocol revenue more directly to UNI supply dynamics could reshape this narrative.

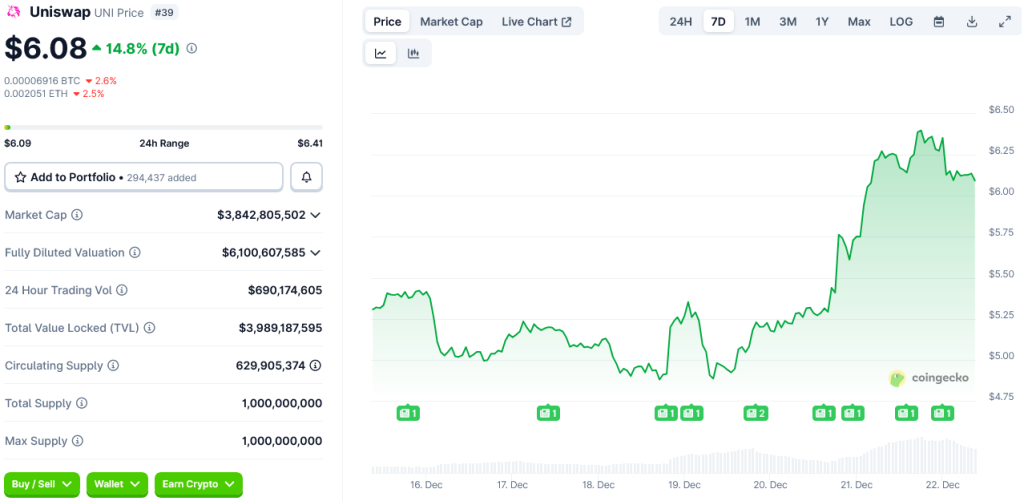

The market reaction was rapid. UNI has gained about 25% since voting began, trading near $6.08 after recovering from a month-long slump that pushed the token to a seven-month low of $4.88.

Early signs of the proposal in November triggered an even sharper move, with UNI climbing nearly 40% in a matter of days and briefly reaching $9.70 on November 11 before broader market weakness took hold.

Can UNI reach $10 before the end of the year?

According to CoinGecko data, UNI is currently the 38th largest cryptocurrency by market capitalization, valued at approximately $3.8 billion.

From a technical perspective, UNI’s price action has attracted renewed attention as the governance process draws to a close.

The token recently rebounded from the lower boundary of a multi-year ascending channel that has guided its recovery since the post-2021 pullback.

Analysts who track the structure note that this area has historically acted as high demand, with each new test followed by higher reaction spikes.

In the near term, UNI faces resistance around the $6.80 to $7.20 range, with greater supply approaching $9 and above.

Post Uniswap Fee Switch Set to Trigger Historic Token Burns as Voting Passes – Can UNI Hit $10? appeared first on Cryptonews.

Uniswap advances fee change proposal to redirect protocol revenue to

Uniswap advances fee change proposal to redirect protocol revenue to  100 million UNI will be burned

100 million UNI will be burned