Join our Telegram channel to stay up to date with the latest news

Cryptocurrency exchange platform Crypto.com is looking to expand into prediction markets and has begun recruiting an in-house market making team for its platform.

According to Bloomberg on December 23 reportthe exchange is looking for someone who will help buy and sell contracts linked to the results of sporting events on Crypto.com’s predictions market platform.

The report added that the individual would actively trade against client orders to support the liquidity of sports contracts and other derivatives offered on the company’s US platform.

Crypto.com’s market creation team will not have access to proprietary data

The Prediction Markets team will operate in the same way whether these teams operate on crypto exchanges or traditional financial platforms. These market makers actively attempt to match open orders in a platform’s order books to help them execute more quickly.

A spokesperson highlighted the benefits of Crypto.com’s in-house sales team in a recent statement and said it would introduce “more competition and liquidity to the platform,” as well as “create a better overall experience.”

Although the new team may increase liquidity on Crypto.com’s market prediction platform, the structure is starting to resemble a traditional sportsbook that profits from customer losses.

The spokesperson addressed concerns that an internal market-making team would have access to information before the rest of the market. They stated that “no market on Crypto.com is ‘first look,’ and our in-house market maker does not have access to proprietary data or customer order flow before other market makers or participants.”

The spokesperson added that Crypto.com does not rely on proprietary trading as a source of revenue.

“We have a simple business model that allows our retail clients to access digital assets for a fee, while remaining risk neutral,” they said.

Crypto.com is not the first prediction market platform to consider market creation

Other players in the prediction markets industry also use professional trading companies or dedicated liquidity providers to facilitate activity on their platform.

Kalshi, which is one of the largest platforms in the industry and operates a federally regulated event-driven contracts exchange, relies on designated market makers instead of relying solely on a peer-to-peer order book.

It was reported that a quantitative trading company called Susquehanna International Group has been providing market making services to Kalshi since 2024.

At the same time, decentralized prediction markets platform Polymarket has also reportedly started building an internal market creation team. The move raised eyebrows, with critics claiming it was being shipped to the outskirts of Polymarket as a decentralized platform.

Prediction Market Volumes Followed a Strong Uptrend

Prediction markets are platforms that allow users to bet on the outcomes of a variety of real-world events, ranging from politics to sports.

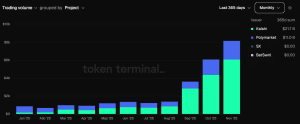

Forecast market volumes (Source: Token terminal)

Over the past few months, volumes on these platforms have skyrocketed, as data from Token Terminal shows.

This rise began in September, when volumes increased from approximately $1.397 billion in August to $3.641 billion in September. This increase in activity continued in the months that followed, with volumes reaching over $8 billion in November.

The growing popularity of prediction markets has prompted several companies to expand into this area. Among them are crypto exchanges Coinbase and Gemini, both of which are working to create their own “everything” apps.

We first announced the prediction markets on Coinbase.

We are now tapping specialist talent to take our projects to the next level.

Welcome to Coinbase, @theclearingco. pic.twitter.com/KfRZSp9w9j

– Coinbase 🛡️ (@coinbase) December 22, 2025

Related articles:

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news