Key notes

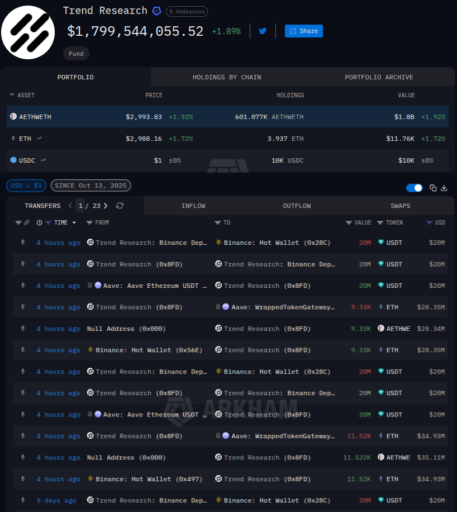

- Trend Research’s ETH position has an average cost of $3,265, after borrowing $958 million in stablecoins on Aave to purchase Ether.

- The company has $1.8 billion in ETH collateral deposited, held in AETHWETH, Aave’s interest-bearing token.

- Recent activity on December 29 involved two 20 million USDT loans on Aave, both deposited to a Binance address, followed by an ETH withdrawal.

Investment firm Trend Research has an open long position on Ethereum

ETH

$2,914

24h volatility:

0.8%

Market capitalization:

$356.52 billion

Flight. 24h:

$23.41 billion

for a nominal value of approximately $1 billion by posting ETH collateral, borrowing stablecoins, purchasing Ether, and redepositing it on Aave

AAVE

$150.4

24h volatility:

2.7%

Market capitalization:

$2.31 billion

Flight. 24h:

$218.66 million

for a high-leverage, high-conviction game.

This long position was spotted and reported by Lookonchain on December 29, with activity dating back to October 2025.

According to its recent article on X, Trend Research borrowed $958 million in stablecoins from Aave to achieve this goal.

Trend search (@Trend_Research_) continues to borrow $USDT buy $ETH.

Trend Research currently holds 601,074 $ETH($1.83 billion) and borrowed a total of $958 million in stablecoins from #Aave.

Channel based $ETH withdrawal price of #Binancethe average purchase price is… pic.twitter.com/MLNVeN8r2l

– Lookonchain (@lookonchain) December 29, 2025

The company leverages Ethereum’s DeFi protocols by depositing ETH as collateral and borrowing stablecoins on Aave.

He then uses the borrowed stablecoins to purchase Ether on Binance, withdraws the purchased ETH to his on-chain address, and redeposits a portion to Aave to increase collateral and borrowing capacity for additional leveraged positions.

Trend Research has an estimated average cost of $3,265 for its ETH purchases, per Lookonchain.

How does Trend Research take a long position on ETH?

At the time of writing, the company holds over 600,000 ETH deposited by Aave, a position worth $1.8 billion at current prices, at $2,993 per Ether.

According to Arkham, this is held in the form of AETHWETH, an interest-bearing token issued by Aave when users make loan deposits and which can then be redeemed by withdrawing collateral.

Its recent activities began on December 29 with a withdrawal of 11,520 ETH from Binance, five days after depositing 20 million USDT on the exchange.

This amount was fully deposited into Aave’s loan agreement and used as collateral for another 20 million USDT purchase that was deposited with Binance.

The pattern repeated with a withdrawal of 9,330 ETH on Binance, deposited again on Aave, followed, again, by borrowing and depositing 20 million USDT on Binance.

Trend Research’s onchain assessment and activity, as of December 29, 2025. | Source: Arkham Intelligence

ETH is struggling to break through $3,000 resistance, a key level that many analysts are eyeing to signal a bullish reversal for the second-largest cryptocurrency by market cap. Analysts believe that sustained momentum could propel Ethereum as high as $8,500.

Meanwhile, Aave, Ethereum’s primary DeFi lending and borrowing protocol, is going through a historic moment in terms of governance.

Aave Labs is pushing “token alignment” proposals in ongoing community discussions, seeing its first related proposal fail with record token-weighted participation.

following

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article is intended to provide accurate and current information, but should not be considered financial or investment advice. Because market conditions can change quickly, we encourage you to verify the information for yourself and consult a professional before making any decisions based on this content.

Vini Barbosa has been covering the crypto industry professionally since 2020, summarizing over 10,000 hours of researching, writing and editing related content for media outlets and major industry players. Vini is an active commentator and avid user of technology, sincerely believing in its revolutionary potential. Topics of interest include blockchain, open source software, decentralized finance, and real-world utilities.

Vini Barbosa on X