Divexa Exchange has released its annual Compliance and Risk Governance white paper, providing a comprehensive overview of the platform’s governance structure, risk management architecture and regulatory alignment efforts across global jurisdictions. The release reflects Divexa Exchange’s continued commitment to transparency, operational discipline and institutional standards in the evolving digital asset landscape.

Focus on governance and risk architecture

The white paper details how Divexa Exchange structures its compliance and risk governance framework across multiple operational layers, including identity management, transaction monitoring, data governance and internal controls. It describes how these components work together to support platform stability, regulatory readiness, and user protection in various market conditions.

Key areas covered in the report include:

Risk identification and escalation process at the company level

Internal audit and supervisory control mechanisms

Asset Segregation and Conservation Governance

Data integrity, access controls and record keeping standards

Planning for incident response and operational resilience

Regulatory milestones 2025

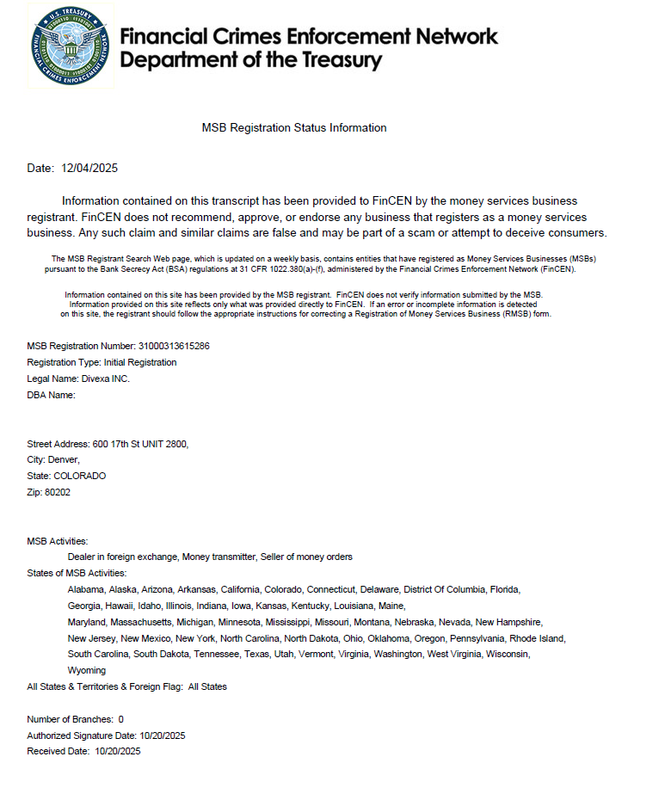

As noted in the white paper, 2025 marked a significant year in the development of Divexa Exchange compliance in the United States. During this period, the platform completed its official Money Services Business (MSB) registration with the U.S. Financial Crimes Enforcement Network (FinCEN), strengthening its compliance foundation for money services operations in the United States.

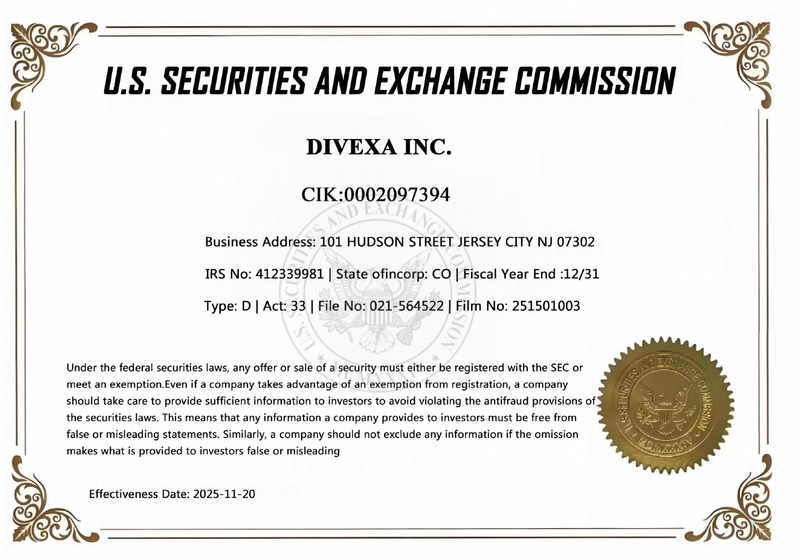

In parallel, Divexa Exchange has further strengthened its internal governance and operational policies to align with regulatory expectations shaped by the United States Securities and Exchange Commission (SEC). These enhancements focused on disclosure discipline, auditability, asset management controls, and supervisory transparency, reflecting best practices commonly observed in U.S. regulatory frameworks.

The white paper highlights that these measures are part of Divexa Exchange’s broader compliance strategy and are designed to support the platform’s responsible operations as regulatory standards continue to evolve.

Risk management as a continuous process

Rather than treating compliance as a one-time step, the report presents risk governance as an ongoing, adaptive process. Divexa Exchange describes how ongoing system reviews, policy updates and technical controls are used to respond to emerging risks, regulatory developments and operational complexity in global markets.

According to Grant Ellison, director of global strategy at Divexa Exchange,

“The release of our annual white paper reflects how we approach compliance and risk governance as a core operational discipline. Our regulatory progress for 2025, including the registration of MSBs and enhanced SEC-aligned governance practices, represents an important step in building long-term institutional trust.”

Support transparency and institutional trust

By publishing its annual Compliance and Risk Governance white paper, Divexa Exchange aims to provide stakeholders, partners and institutional participants with clearer visibility into how the platform manages regulatory responsibilities and operational risks. The initiative supports Divexa Exchange’s long-term goal of contributing to a more transparent, stable and trusted global digital asset ecosystem.

About Divexa Exchange

Divexa Exchange is a global digital asset trading platform offering secure, efficient and intelligent services to users around the world. Its ecosystem includes derivatives and spot trading, new token listings, conservative yield products, and advanced tools for digital asset management. Backed by multi-layer security, real-time monitoring, proof of reserves transparency and strict regulatory alignment, Divexa Exchange is committed to enabling safe and confident participation in digital finance.

Disclaimer:

The information provided in this press release does not constitute an investment solicitation nor is it intended to constitute investment advice, financial advice or trading advice. Investing involves risks, including the potential loss of capital. It is strongly recommended that you perform due diligence, including consulting a professional financial advisor, before investing in or trading cryptocurrencies and securities. Neither the media platform nor the publisher shall be liable for any fraudulent activity, misrepresentation or financial loss arising from the contents of this press release.