Join our Telegram channel to stay up to date with the latest news

The price of Bitcoin edged up more than 1% in the past 24 hours to trade at $88,445 as of 1:27 a.m. EST, on trading volume that fell 8% to $39.3 billion.

This comes as investors bet that rate cuts in January will remain the same, with a probability of reaching 87%. Polymarketa signal that the Federal Reserve might leave them intact.

At the same time, most Fed officials believe additional interest rate cuts are appropriate as long as inflation continues to slow, according to the minutes released Wednesday (Dec. 30).

According to the minutes, policymakers cut interest rates earlier this month to a range of 3.5% to 3.75% in a 9-3 vote.

FOMC Minutes of December 10, 2025 and Key Takeaways for 2026

The Federal Open Market Committee cut the federal funds rate by 25 basis points, bringing it to 3.50-3.75 percent at its December meeting.

The decision passed 9-3, marking an internal division and divergent views on the balance between… pic.twitter.com/Z9ZA0mnloE

– Truflation (@truflation) December 30, 2025

“Several participants highlighted the risk of higher inflation and suggested that a further cut in the policy rate in the context of high inflation could be misinterpreted as implying less commitment from policymakers to the 2% inflation target,” the minutes said.

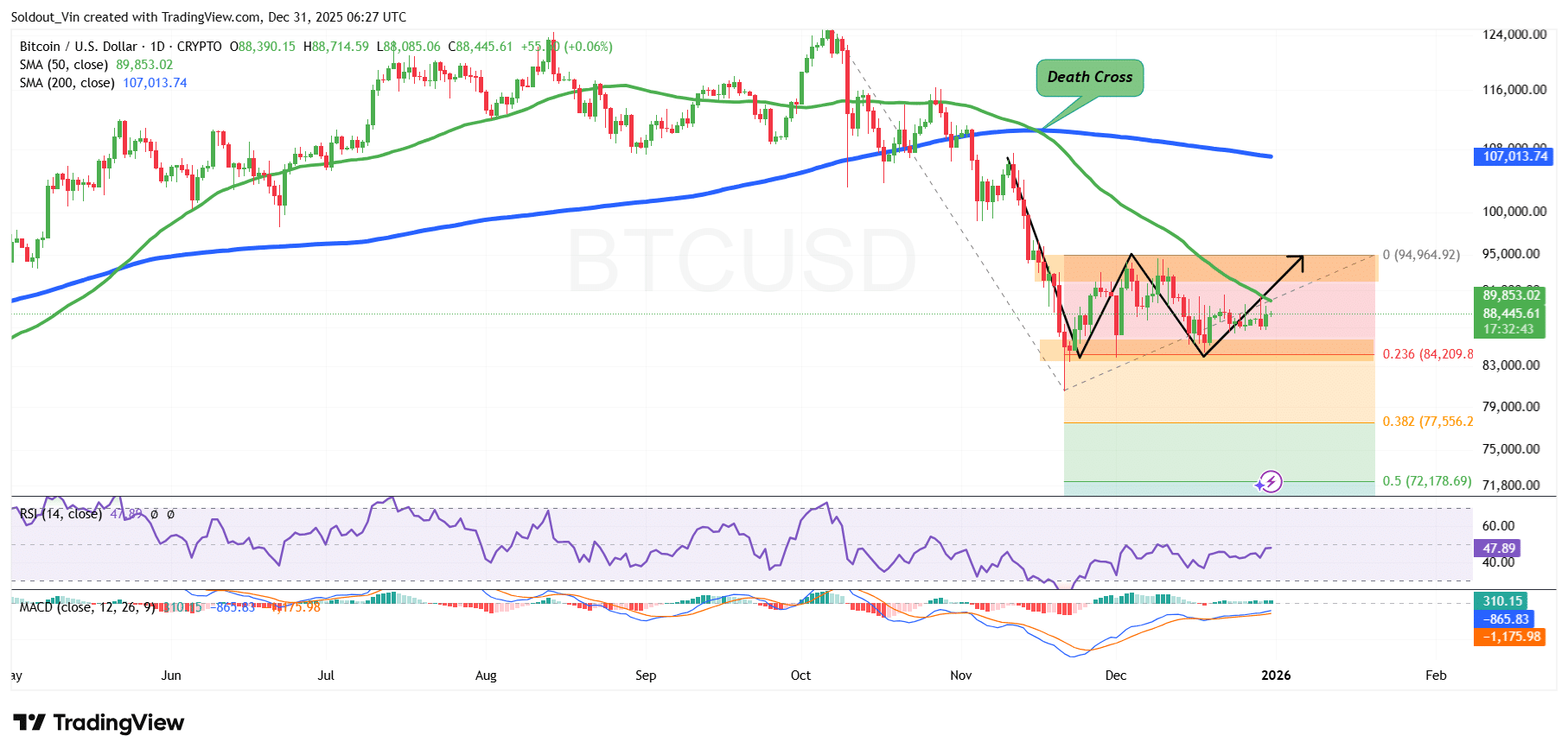

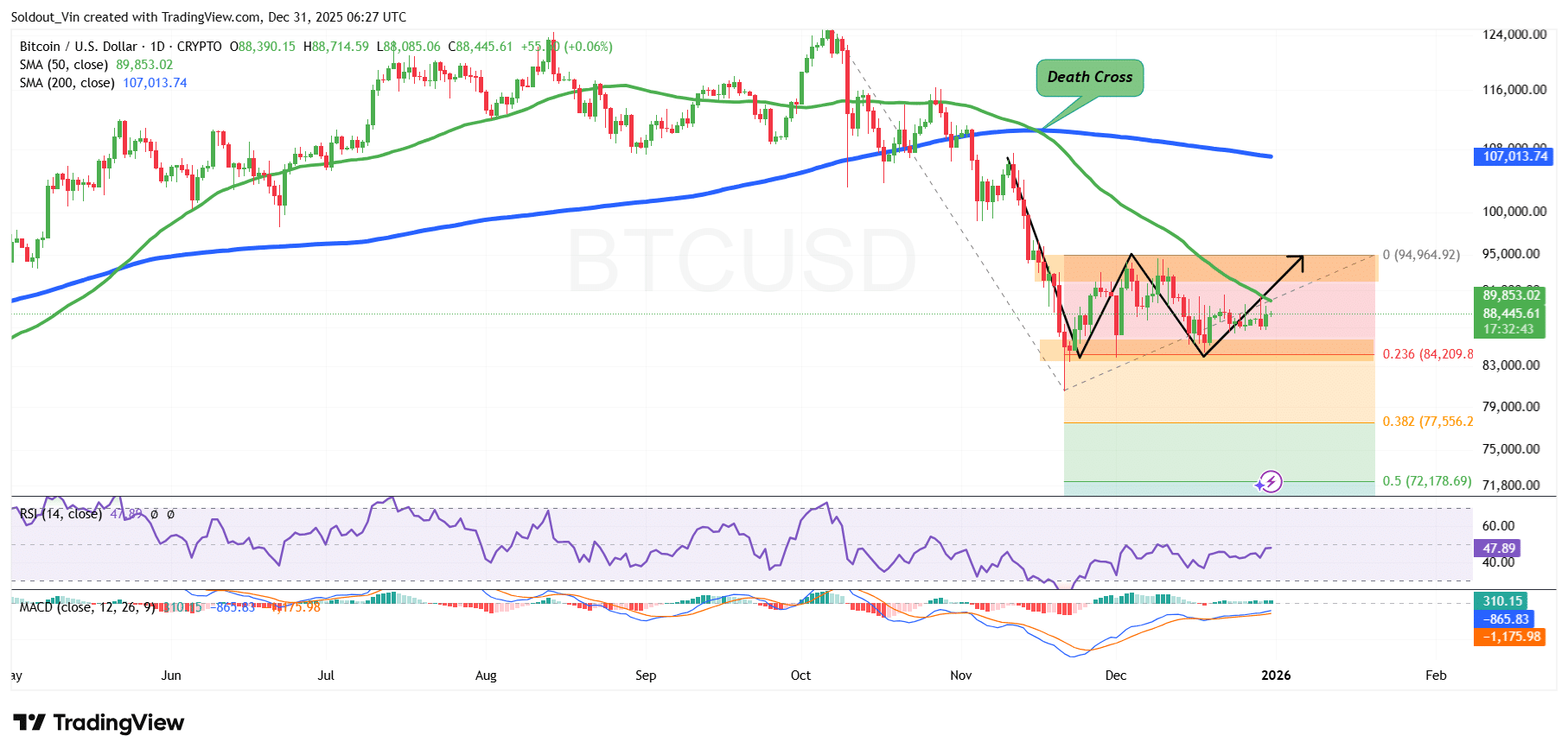

Bitcoin Price Follows Cautious Trend as Bears and Bulls Battle for Dominance

Investors are cautious about BTC Priceas the asset is trading sideways and indicators are signaling indecision in the market.

After rising in April and May, Bitcoin price consolidated above the $100,800 support zone, allowing BTC to reach its all-time high (ATH) around $126,200.

However, the bulls were unable to sustain the uptrend, after which the bears took control, pushing the asset lower and prompting investors to book profits, as shown in the trend-based Fibonacci retracement chart.

This downtrend was also fueled by the simple moving averages (SMA) forming a deadly crossover at $110,404, after the 200-day SMA crossed above the 50-day SMA.

BTC is now trading below both SMAs, indicating that sellers still have some control.

Following the downtrend, BTC price then reached a key support area around the $81,000 area, now acting as a significant demand area. Since reaching this level in late November, Bitcoin has been trading in a consolidation phase, with the $94,964 level at the 0 Fib zone acting as a barrier above.

However, Bitcoin is showing signs of a breakout, with trend indicators suggesting slight bullish pressure.

The Moving Average Convergence Divergence (MACD) turned positive as the blue MACD line moved above the orange signal line on the daily time frame. The green bars on the histogram also rise above the neutral line, confirming increased positive momentum.

Meanwhile, the Relative Strength Index is trading between the 40-50 zone, indicating continued consolidation. The RSI, currently at 47.89, is showing signs of rebound, as buyers move in.

BTC Price Prediction

Based on BTC/USD chart analysis, BTC price is currently in a tug-of-war with bears and bulls fighting for dominance at the 0 and 0.236 Fibonacci retracement levels.

If bulls rally from the last daily candle to maintain their uptrend, and if they push BTC above the 50-day SMA ($89,853), Bitcoin price could rise even further, breaking through the $94,000 barrier as they target $107,100, the previous supply zone, and into the 200-day SMA.

According to Michaël van de Poppe, a crypto analyst on X with over 816,000 subscribers, BTC is currently testing the 21-day MA (around $88,300) on the daily chart. A close above this figure could indicate a sustained bullish rally.

However, on the downside, if the bears take control, BTC price could fall back to the 0.382 Fib zone at $77,556, which now serves as stable support in the event of an extended decline.

Related news

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news