LIT, the newly launched token of decentralized perpetual exchange Lighter, fell sharply in premarket trading on Tuesday as its long-awaited airdrop distribution went live, triggering heavy selling from early recipients and leveraged traders.

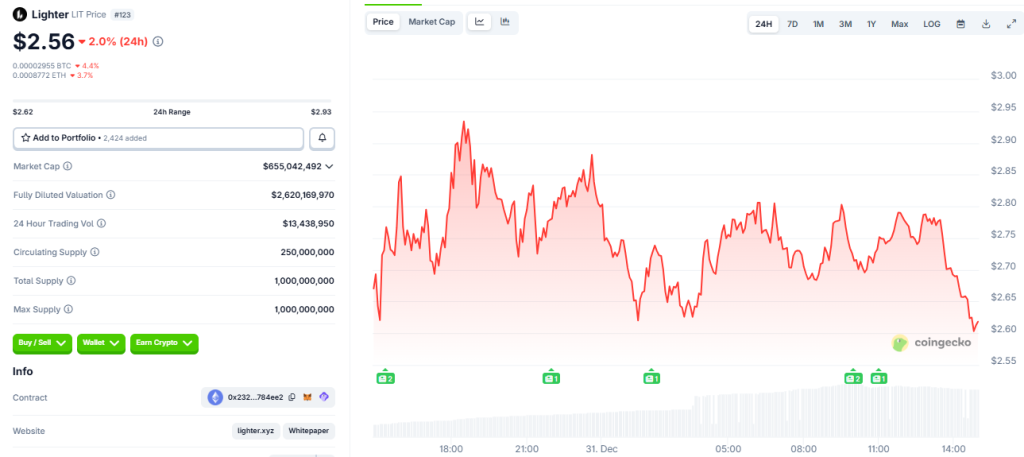

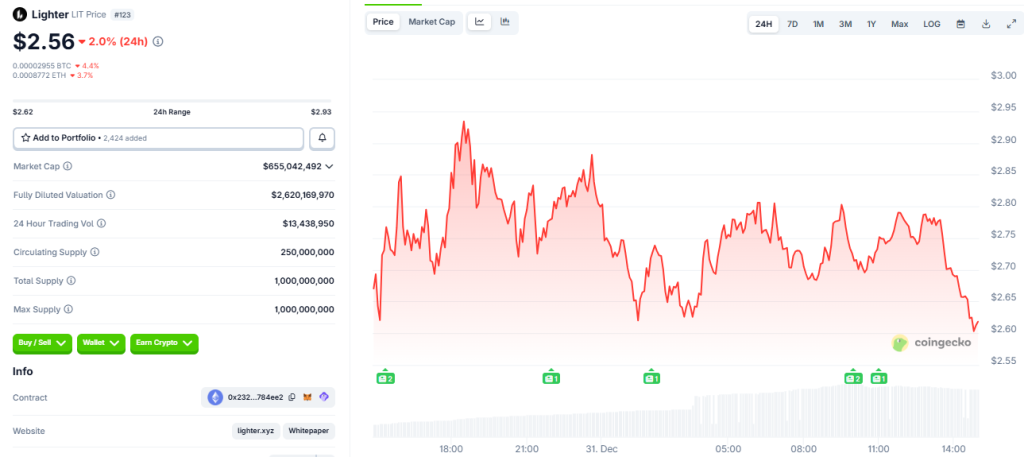

The token initially climbed to a post-launch high of $4.04 shortly after trading began, before changing course and falling to around $2.62, a decline of around 22.2%.

This price also marked LIT’s lowest level since its launch, reflecting sustained downward pressure as the market absorbed the broad distribution of tokens.

LIT sees heavy trading as linked to selling exceeding early accumulation

However, despite this excessive price drop, trading volume increased over the last 24 hours, as LIT recorded a trading volume of 13.43 million, almost three times the amount recorded the previous day.

The increased volume was a sign of greater market participation, driven primarily by volatility, short-term speculation and unwinding of positions, not long-term accumulation.

LIT is trading nearly 35% lower than at its peak, and the token is now squarely in a post-launch correction period, with price discovery still underway.

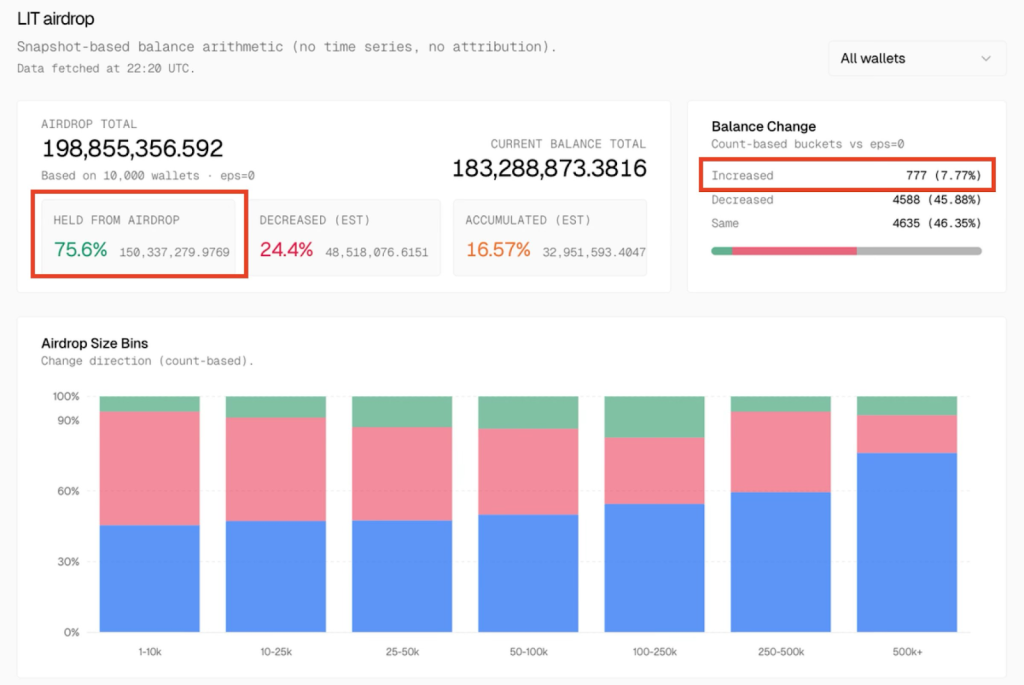

On-chain data based on the airdrop provided additional insight into selling pressure, and analysis of 10,000 wallets conducted immediately after the distribution revealed that approximately 198.86 million LIT tokens were initially received by participants.

The existing balances in all these wallets amount to approximately LIT 183.29 million, meaning that a significant portion of the airdropped supply has already declined.

Only 7.77% of portfolios increased their holdings, while 45.88% reduced their balances and 46.35% made no changes, indicating that selling activity exceeded accumulation.

In absolute terms, approximately 150.34 million LIT, or approximately 75.6% of the airdropped tokens, remain held. Around 48.52 million tokens, or 24.4%, were sold or transferred.

At the same time, only about LIT 32.95 million, or 16.57% of the total, can be classified as accumulated beyond initial allocations.

The imbalance suggests that buy-side conviction lagged behind sell-side activity early in the trading window.

Lighter’s LIT Joins One of Crypto’s Largest Airdrops Even as Tokenomics Comes Under Scrutiny

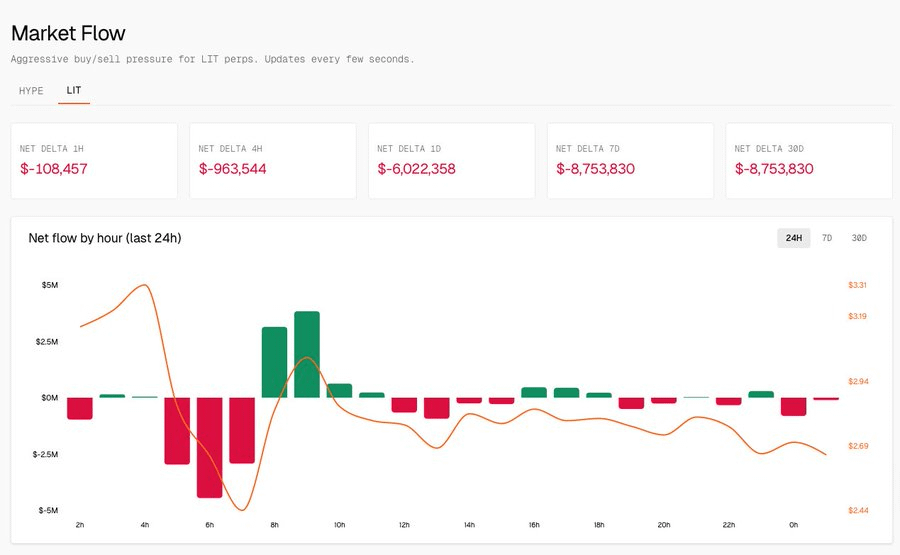

Derivatives market data reinforced this picture, as net flow indicators for LIT perpetual contracts showed consistent aggressive selling over multiple periods.

The net delta was negative around $108,000 over one hour, widened to almost $1 million over four hours, and deteriorated to over $6 million over ten hours.

Hourly net flow data over the past day also showed repeated negative fluctuations, suggesting that price rebounds were accompanied by renewed selling.

The sale follows one of the largest token giveaways in crypto history, as Lighter airdropped approximately $675 million worth of LIT tokens to early adopters, ranking the distribution 10th in dollar value, according to CoinGecko data.

The airdrop surpassed 1inch Network’s 2020 distribution, but remained well below Uniswap’s record airdrop of $6.43 billion.

Some early adopters reported receiving six-figure stipends, underscoring the scale of the distribution.

At the same time, the debate around Lighter’s tokenomics has intensified. Half of LIT’s total supply is allocated to users, partners and growth initiatives, while the remaining 50% is reserved for the team and investors, subject to a one-year vesting period and multi-year vesting.

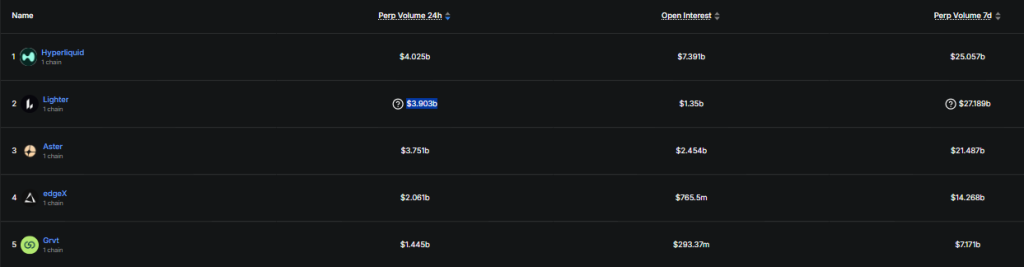

The launch comes as Lighter continues to post strong trading metrics within a rapidly expanding on-chain derivatives market.

The platform processed around $3.90 billion in 24-hour perpetual volume and around $201 billion over 30 days, placing it among the top decentralized venues alongside Hyperliquid and Aster.

The broader perpetual DEX sector has seen explosive growth in 2025, with cumulative volume reaching $12.09 trillion and over $7.9 trillion generated this year alone.

The post LIT Token Plunges 22% as Distribution of Lighter Airdrops Goes Live appeared first on Cryptonews.

The community reacts like

The community reacts like