Join our Telegram channel to stay up to date with the latest news

BlackRock, the world’s largest asset manager, moved significant amounts of Bitcoin and Ethereum to Coinbase, a move that sparked market concerns.

On-chain data shows that the company transferred 1,134 BTC (approximately $101 million) and 7,255 ETH (approximately $22 million). These transfers likely mean BlackRock is preparing to sell, especially after strong outflows from its crypto ETFs late last year.

On December 31, Bitcoin ETFs saw a net outflow of $348.1 million, while Ethereum ETFs saw $72.1 million leave the market. BlackRock’s equity was among the biggest losers, with its Bitcoin ETF seeing $99 million in outflows and its Ethereum ETF losing around $21.5 million.

BlackRock has moved 𝟏,𝟏𝟑𝟒 $BTC ($101.4M) & 𝟕,𝟐𝟓𝟓 $ETH ($22.1 million) to Coinbase Prime 3 hours ago. 😳😳

What is the reason?

Are they quietly 𝐥𝐨𝐚𝐝𝐢𝐧𝐠 or is the 𝐝𝐮𝐦𝐩 coming? pic.twitter.com/pdx7dEncyr

– Open4profit (@open4profit) January 2, 2026

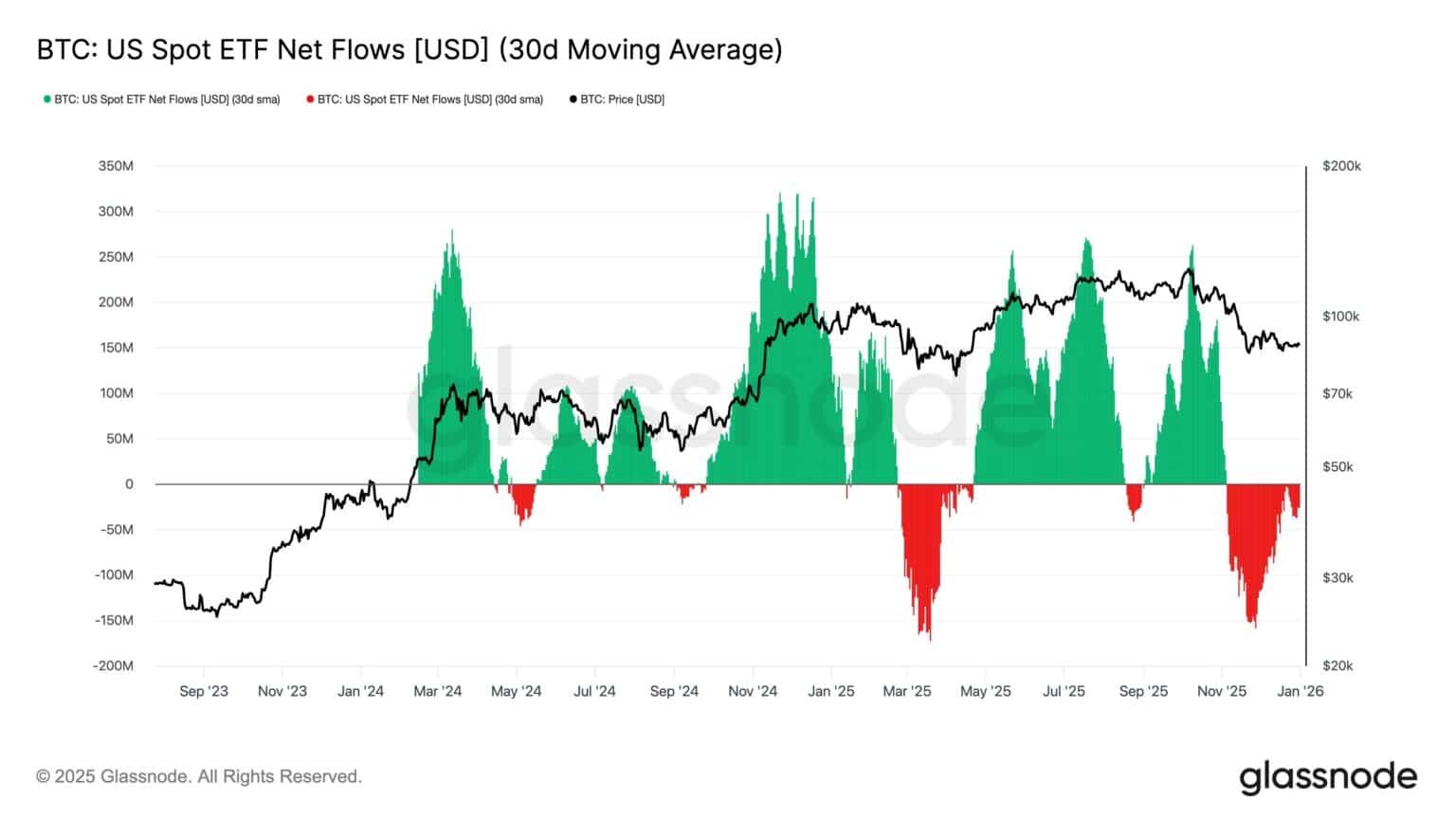

This shows that institutional investors continue to withdraw money from crypto-related funds. Selling pressure has been increasing for some time. Bitcoin ETFs have seen outflows in eight of the last nine trading days, while Ethereum ETFs have seen outflows in five of the last six days.

Analysts warn that if these outflows continue, Bitcoin could fall below the important $90,000 level. A break below this level could open the door to a much deeper correction. Market nerves are also high as $2.2 billion worth of crypto options expire today.

Bitcoin stabilizes near $88,000 as options expiration tests market

These options cover Bitcoin, Ethereum, XRP and Solana. For Bitcoin, the key “maximum pain” level is around $88,000, which traders are watching closely. Despite these negatives, there are some positive signs. Glassnode says there is still no strong new institutional demand as ETF flows remain negative.

However, long-term Bitcoin holders stopped selling. This helped BTC rebound from around $88,300 to over $89,600. The total crypto market value has also climbed back above $3 trillion, with some altcoins posting strong gains.

Related articles:

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news