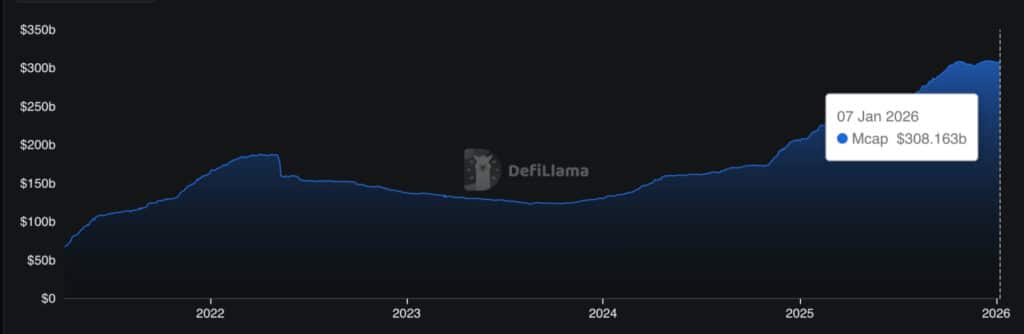

US lawmakers are debating last-minute changes to the GENIUS Act after banking groups urged Congress to block third-party rewards on stablecoins. This surge came as the supply of stablecoins surpassed $316 billion, a sign that everyday users already rely on dollar-pegged tokens for payments and savings. The fight addresses a larger theme: who controls digital dollars as crypto moves closer to the financial mainstream.

Stablecoins like USDC and USDT remained stable at $1, but the political noise affected crypto stocks and DeFi tokens tied to on-chain yield. Traders interpreted the debate as a warning that Washington still holds the steering wheel. Regulations, not price tables, set the tone.

The GENIUS Act already took effect in June 2025, giving the United States its first federal regulation for stablecoins. Banks now want stricter language. The change reignited fears that ordinary users would lose out while large institutions retained their advantage.

JUST IN: Stablecoin volume hits $33 trillion in 2025 as GENIUS Act accelerates adoption. pic.twitter.com/jIYXmIdsnE

— Radar 𝘸 Archie

(@RadarHits) January 8, 2026

DISCOVER: The Best Ethereum Meme Coins to Buy in 2026

What is the GENIUS Act, in plain English?

The GENIUS Act establishes ground rules for stablecoins. Think of a stablecoin as a digital dollar that lives on a blockchain, similar to cash in a control application but without a bank in the middle. The law states that issuers must hold actual dollar reserves and follow strict oversight.

The law prohibits issuers from paying interest directly. Crypto platforms always reward users by sharing trading fees or loan returns. The banks now want Congress to close this route as well.

Why is this important to you? Because stable rewards often beat bank savings accounts that pay close to zero. For beginners, this is one of the safest on-ramps to crypto yield.

Why are crypto executives calling this a big deal?

Industry groups say banks fear competition, not risk. Lawmakers designed the bill to balance safety and innovation.

John Deaton, a pro-crypto lawyer, warned that banning rewards is pushing users toward China’s digital yuan, which already earns interest. He called the idea a national security trap. His point is simple. If U.S. digital dollars can’t compete, users look elsewhere.

The Blockchain Association echoed this view, stating that there is no evidence that stablecoins weaken banks. Instead, rewards help ordinary people, not big incumbents.

DISCOVER: The Best Ethereum Meme Coins to Buy in 2026

How could this change affect your money?

(Source: Stablecoins, an absolute record in 2026 / DefiLlama)

If Congress sides with the banks, stablecoins start to resemble checking accounts without any of the benefits. This slows adoption and hits DeFi applications that rely on stable liquidity. Less liquidity means fewer opportunities and higher fees.

On the other hand, stricter rules may attract cautious users who want clear protections. Stablecoin supply jumped almost 7% after the law was passed. Clarity attracts capital.

For beginners, the trade-off is real. Security increases. Earning power decreases.

What are the risks that everyone ignores?

There have been 98 new major yielding stablecoins launched in 2025. pic.twitter.com/rsBBo0sY0t

– stablewatch (@stablewatchHQ) January 8, 2026

Stablecoin rewards are not free money. Platforms generate revenue through lending or trading. This carries risks in the event of market freezes or borrowers going bankrupt. Regulators worry that users will treat rewards like assured bank interest. They are not the same.

This is where caution is required. Never invest rent money in yield products. Even dollar-pegged tokens can break under extreme stress.

Yet the push to ban rewards tilts the balance entirely in favor of the banks. Crypto executives say choice is shaping the future of digital dollars.

Congress is now deciding whether stablecoins remain competitive or become digital money with the brakes on. This choice proves to be wise as global demand for dollar tokens continues to increase.

DISCOVER: The Best Solana Meme Coins to Buy in 2026

Follow 99Bitcoins on X for the latest market updates and subscribe on YouTube for daily market analysis from experts

The post GENIUS Act Backlash: Banks Push to Kill Stablecoin Rewards appeared first on 99Bitcoins.

(@RadarHits)

(@RadarHits)